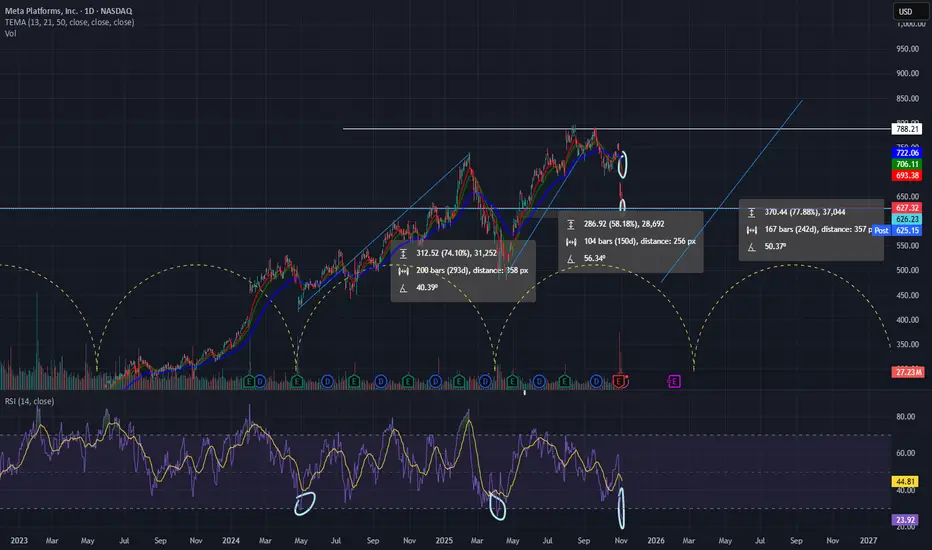

META just hit a major technical confluence zone around $620–625, aligning with previous cycle lows and a deeply oversold RSI (~24).

Every prior RSI flush at this level (2023, early 2024) has marked the start of a new multi-month leg higher.

The current structure mirrors META’s past rhythm — roughly 8–9-month accumulation–expansion cycles.

If this pattern holds, we could be looking at the early phase of the next uptrend targeting the $780–840 zone by mid-2026.

Volume shows heavy post-earnings capitulation, but selling pressure is easing, and buyers are starting to defend support.

Short-term confirmation would come with a close above $650–670, flipping the short-term trend.

📊 Outlook:

Support: $620

Resistance: $670 / $706 / $788

RSI: Oversold, early reversal signals forming

Bias: Neutral → Bullish if $670 reclaims

Cycles, symmetry, and RSI all suggest META might be setting up for its next expansion phase.

Every prior RSI flush at this level (2023, early 2024) has marked the start of a new multi-month leg higher.

The current structure mirrors META’s past rhythm — roughly 8–9-month accumulation–expansion cycles.

If this pattern holds, we could be looking at the early phase of the next uptrend targeting the $780–840 zone by mid-2026.

Volume shows heavy post-earnings capitulation, but selling pressure is easing, and buyers are starting to defend support.

Short-term confirmation would come with a close above $650–670, flipping the short-term trend.

📊 Outlook:

Support: $620

Resistance: $670 / $706 / $788

RSI: Oversold, early reversal signals forming

Bias: Neutral → Bullish if $670 reclaims

Cycles, symmetry, and RSI all suggest META might be setting up for its next expansion phase.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.