No way! This is where we stick the landing and win the gold!

Why is Paul Bunyan often depicted as a smiling, cheerful character? Why is he portrayed as a confident I can do this man? We all know why. It is because he is a man who is good at what he does, a man who can proudly say look at what I have accomplished, not in a braggadocios way but in a way of feeling delight in a job well done. It is his force multiplier - his great size and strength - that enable him to be so. We admire him for his character. We are drawn to him for his character. He realizes his full potential in life using his innate unique abilities and opportunities in a cheerful and humble attitude.

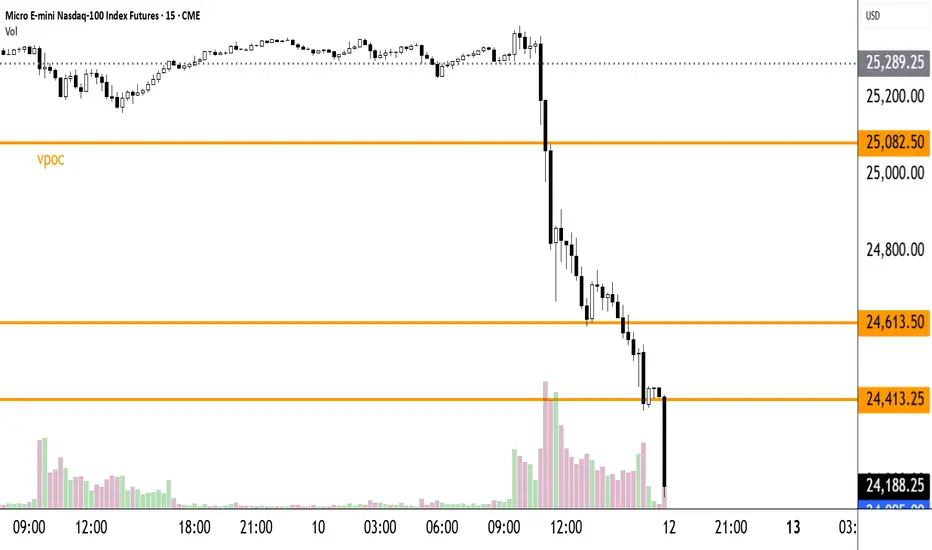

Let us now apply Bunyan's example to further illustrate the benefits of A Pawn for a King trading plan using the price action on Friday, 10.10.2025 as an example of its simplicity and its built-in force multiplier.

Let us pick up with our real-life example where we left off on my prior published idea. Everything is real. Only the names have been changed to protect the innocent.

Let us recall how the trade started. We waited for a good bounce on a strong support. Then we entered the trade by buying 2 MNQ contracts @ 24,994.5 and we sold 1 MNQ contract @ 24,994.

We then added 22 points to each of those entries - we bot 2 contracts @ 24,994.5 + 22 = 25016.5 and we sold 2 contracts @ 24,994 + 22 = 25016. Do NOT miss the subtlety. Our first trade we sold ONE contract. On this second and all subsequent trades, we will sell TWO contracts. This subtlety is the key to this plan. It is the force multiplier. When the pull back happens, and we all know it will, we have a secret weapon that enables us to do away with those awful things called stop losses, I meantersay, who's in this to lose? Instead of that losing proposition we have Paul Bunyan. We are Paul Bunyan!

We left off with $1,247.38 profit and we have just sold 2 contracts @ 25,390 and we bot 2 contracts @ 25,390.5. We are still 1L.

The px plummets. Do we plummet as well? NO WAY! We've got a force multiplier! That initial ONE contract we sold at the outset.

So, what do we do? That is a very simple question to answer. We wait for the next bounce at a strong support. This hasn't happened yet. We have a strong support in the area of 24,100 - 24,000. Whenever and wherever that bounce happens, we start the A Pawn for a King plan again. We sell 1 contract, and we buy 2 contracts $.50 above that. Remember how we were 1L when the px plummeted? Well now we are two long and no stop loss got in our way.

Now the force multiplier comes in. Let's say it bounces at 24,000 and we sell 1 contract @ 24,000 and we buy 2 @ 24,000.50. We add 22 points to each number, and we sell THREE contracts @ 24,000 +22 = 24,022 and we buy THREE contracts @ 24,000.50 + 22 = 24022.50.

The dark orange lines on my charts are vpocs. If you're not familiar with them learn about them and have them as a key part of your strategy. They are very powerful px magnets, places where buyers and sellers have met in the past and therefore very likely to meet again. Think strong support. Watch and wait for a good bounce on a strong support. Be patient. It will happen and you will be locked and loaded.

I hope you can see that rather than getting stopped out of a trade we turned our initial -1 contract into a force multiplier. In essence we just turned that px plummet into a gain of whatever that plummet was.

If we do get in again @ 24,000.5 this is what it will look like: 25,390.5 (our last entry) - 24,000.50 = 1,390 points x $2.00 per point - $1.82 (commission and fees) = $2,778.18. Did we lose that? No way. We made sure our account could handle the margin required for that. The intraday margin requirement for 1 contract is $100.00 with NinjaTrader and the Initial Margin requirement, although it varies, is usually about $3,400.00.

What if the px does not get back up to 25,390.5 before roll-over? That is when you will take a loss. But you will have made so much profit in the meantime, that won't matter much.

What if the px never bounces but just keeps falling? If that is the case, you'll have much greater problems than $$$. It will be time to put your head between your legs and kiss your sweet ass good-bye.

If you conclude that the best time to start this plan with real $$$ is right after roll-over time, you would be right. That is one of the wonders of demo trading. Also, some practice will be most necessary for you to master the subtleties of this plan.

As always, thank-you for your time in reading this. Forgive any typos or math errors. For some strange reason this fellow doesn't always catch them in time. Stay tuned for further notes. Or shall we call them afterthoughts?

Why is Paul Bunyan often depicted as a smiling, cheerful character? Why is he portrayed as a confident I can do this man? We all know why. It is because he is a man who is good at what he does, a man who can proudly say look at what I have accomplished, not in a braggadocios way but in a way of feeling delight in a job well done. It is his force multiplier - his great size and strength - that enable him to be so. We admire him for his character. We are drawn to him for his character. He realizes his full potential in life using his innate unique abilities and opportunities in a cheerful and humble attitude.

Let us now apply Bunyan's example to further illustrate the benefits of A Pawn for a King trading plan using the price action on Friday, 10.10.2025 as an example of its simplicity and its built-in force multiplier.

Let us pick up with our real-life example where we left off on my prior published idea. Everything is real. Only the names have been changed to protect the innocent.

Let us recall how the trade started. We waited for a good bounce on a strong support. Then we entered the trade by buying 2 MNQ contracts @ 24,994.5 and we sold 1 MNQ contract @ 24,994.

We then added 22 points to each of those entries - we bot 2 contracts @ 24,994.5 + 22 = 25016.5 and we sold 2 contracts @ 24,994 + 22 = 25016. Do NOT miss the subtlety. Our first trade we sold ONE contract. On this second and all subsequent trades, we will sell TWO contracts. This subtlety is the key to this plan. It is the force multiplier. When the pull back happens, and we all know it will, we have a secret weapon that enables us to do away with those awful things called stop losses, I meantersay, who's in this to lose? Instead of that losing proposition we have Paul Bunyan. We are Paul Bunyan!

We left off with $1,247.38 profit and we have just sold 2 contracts @ 25,390 and we bot 2 contracts @ 25,390.5. We are still 1L.

The px plummets. Do we plummet as well? NO WAY! We've got a force multiplier! That initial ONE contract we sold at the outset.

So, what do we do? That is a very simple question to answer. We wait for the next bounce at a strong support. This hasn't happened yet. We have a strong support in the area of 24,100 - 24,000. Whenever and wherever that bounce happens, we start the A Pawn for a King plan again. We sell 1 contract, and we buy 2 contracts $.50 above that. Remember how we were 1L when the px plummeted? Well now we are two long and no stop loss got in our way.

Now the force multiplier comes in. Let's say it bounces at 24,000 and we sell 1 contract @ 24,000 and we buy 2 @ 24,000.50. We add 22 points to each number, and we sell THREE contracts @ 24,000 +22 = 24,022 and we buy THREE contracts @ 24,000.50 + 22 = 24022.50.

The dark orange lines on my charts are vpocs. If you're not familiar with them learn about them and have them as a key part of your strategy. They are very powerful px magnets, places where buyers and sellers have met in the past and therefore very likely to meet again. Think strong support. Watch and wait for a good bounce on a strong support. Be patient. It will happen and you will be locked and loaded.

I hope you can see that rather than getting stopped out of a trade we turned our initial -1 contract into a force multiplier. In essence we just turned that px plummet into a gain of whatever that plummet was.

If we do get in again @ 24,000.5 this is what it will look like: 25,390.5 (our last entry) - 24,000.50 = 1,390 points x $2.00 per point - $1.82 (commission and fees) = $2,778.18. Did we lose that? No way. We made sure our account could handle the margin required for that. The intraday margin requirement for 1 contract is $100.00 with NinjaTrader and the Initial Margin requirement, although it varies, is usually about $3,400.00.

What if the px does not get back up to 25,390.5 before roll-over? That is when you will take a loss. But you will have made so much profit in the meantime, that won't matter much.

What if the px never bounces but just keeps falling? If that is the case, you'll have much greater problems than $$$. It will be time to put your head between your legs and kiss your sweet ass good-bye.

If you conclude that the best time to start this plan with real $$$ is right after roll-over time, you would be right. That is one of the wonders of demo trading. Also, some practice will be most necessary for you to master the subtleties of this plan.

As always, thank-you for your time in reading this. Forgive any typos or math errors. For some strange reason this fellow doesn't always catch them in time. Stay tuned for further notes. Or shall we call them afterthoughts?

Nota

Say whattt?You heard me right. This is a bto bull market strategy and yes, we do indeed wait for a strong bounce. Picture it as a ladder. Every rung has both a sto entry and a bto entry. The sto entry is .50 points less than the bto entry. On the first rung only the sto entry quantity is one half the qty of the bto entry. This is important. Don't miss this detail.

Each subsequent entry or rung will be an equal qty of sto and bto contracts. I strongly urge you to start with a ratio of one sto contract coupled with two bto contracts. Each rung thereafter will be two sto contracts and two bto contracts.

So, you're climbing the ladder i.e. the px is going up and you're pocketing some coin. All is fine and dandy. Then the px pulls back. I won't start a new ladder until I get a pullback of about 200 points. Think about it and you will understand why I wait for at least a 200-point pullback.

Using the identical plan outlined above you will start a new ladder. The first rung you will sto 1 contract and buy 2 contracts .50 points higher. However, you will now be long 2 contracts rather than 1L as you were with the first ladder.

Each pullback you will gain an extra contract. So, with the next pullback you will be 3L, then 4L, then 5L etc. This thing gets to be a freight train after a while. Most of your profits will come toward the end of each quarter at roll-over time.

The best time to get your freight train rolling is at the beginning of the new quarter. Now is the time to paper trade it. It is a very simple plan based on very simple mathematical principles. However, when you start doing something new there is always a learning curve. How hard is it to ride a bicycle? Right? I still have scars on my knees from when my training wheels came off many years ago. I bet some of you do as well.

Nota

Aw shucks. I always think of something else.You can space your rungs any distance you wish. I space mine 22 points apart. I do not think the fees and commissions will warrant much less or much more. It's just my gut feeling. I don't have enough advanced math to have a formula to confirm or deny this. Just basic instinct. Maybe there is a mathematician reading this who can come up with the ideal number...

When the rungs are spaced 22 points apart you are getting a 21.5-point profit on each MNQ contract or 21.5 x $2.00 profit per point - $1.82 commission and fees ($.91 per side) = $41.18 per rung. On the first pullback you will be making twice that, $82.36 per rung, on the third pullback you will be making thrice that, $123.54 per rung and so on. You can begin to see what a powerful locomotive this can become.

Nota

Yet, the Golden Thread continues...Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.