Technical Analysis Summary:

1. Pattern Breakdown:

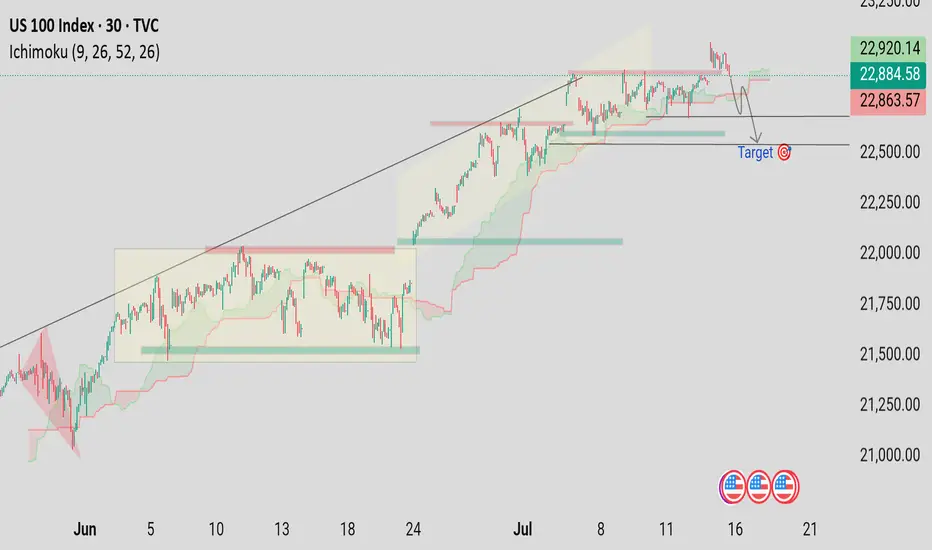

Price has broken below an ascending trendline, signaling weakness after a strong bullish move.

A double-top or distribution phase can be inferred at the recent highs (around 23,100–23,200), confirming buyer exhaustion.

2. Ichimoku Cloud:

The price has dipped into the Ichimoku cloud, indicating indecision or early bearishness.

If it breaks below the cloud, it would confirm a bearish trend continuation.

3. Key Levels:

Resistance: Around 22,920 – 23,200 (recent highs)

Support: Multiple levels observed, but the major target is marked near 22,400.

This aligns with a prior consolidation zone, making it a likely demand area.

4. Price Action:

The projected path (gray line) suggests a potential retest of broken support, followed by a drop toward the 22,400 target.

Current price at 22,884 still offers room to the downside.

5. Volume/Events:

Economic events icons at the bottom (likely U.S. economic news releases) may trigger volatility and either confirm or reject this bearish setup.

---

🔍 Conclusion:

Bias: Bearish short-term

Target: 22,400

Invalidation: A strong move back above 23,000 with bullish momentum

Strategy Suggestion: Watch for a break and close below the Ichimoku cloud, or a lower high rejection for a short entry confirmation.

1. Pattern Breakdown:

Price has broken below an ascending trendline, signaling weakness after a strong bullish move.

A double-top or distribution phase can be inferred at the recent highs (around 23,100–23,200), confirming buyer exhaustion.

2. Ichimoku Cloud:

The price has dipped into the Ichimoku cloud, indicating indecision or early bearishness.

If it breaks below the cloud, it would confirm a bearish trend continuation.

3. Key Levels:

Resistance: Around 22,920 – 23,200 (recent highs)

Support: Multiple levels observed, but the major target is marked near 22,400.

This aligns with a prior consolidation zone, making it a likely demand area.

4. Price Action:

The projected path (gray line) suggests a potential retest of broken support, followed by a drop toward the 22,400 target.

Current price at 22,884 still offers room to the downside.

5. Volume/Events:

Economic events icons at the bottom (likely U.S. economic news releases) may trigger volatility and either confirm or reject this bearish setup.

---

🔍 Conclusion:

Bias: Bearish short-term

Target: 22,400

Invalidation: A strong move back above 23,000 with bullish momentum

Strategy Suggestion: Watch for a break and close below the Ichimoku cloud, or a lower high rejection for a short entry confirmation.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.