📊 NIFTY TRADING PLAN – 28-Aug-2025

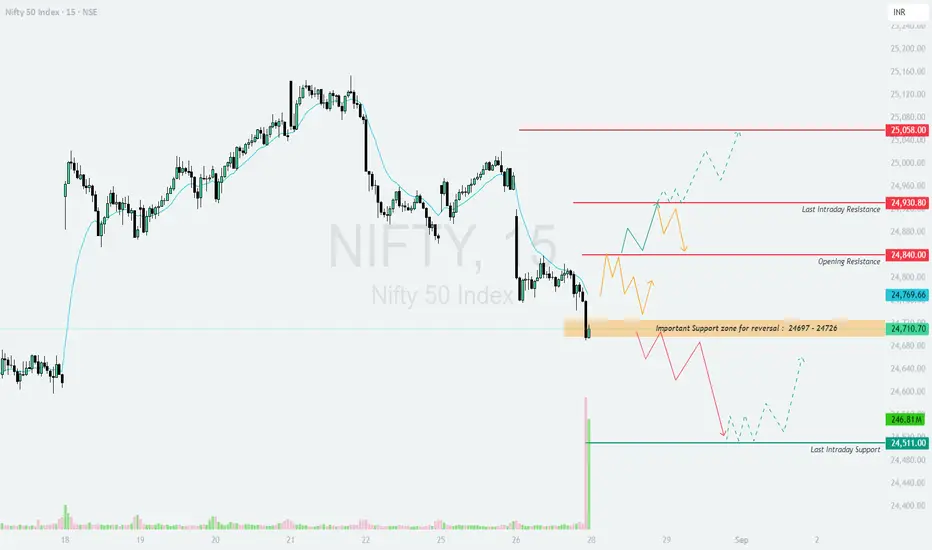

📌 Key Levels to Watch:

Opening Resistance: 24,840

Last Intraday Resistance: 24,930

Major Resistance Above: 25,058

Important Support Zone for Reversal: 24,697 – 24,726

Last Intraday Support: 24,511

These levels will guide our decision-making depending on the type of opening.

🔼 1. Gap-Up Opening (100+ points above 24,840)

If Nifty opens above 24,840, bullish momentum will be active.

📌 Plan of Action:

👉 Educational Note: Gap-ups often trigger early volatility due to overnight positions. Avoid chasing at the open; wait for confirmation candles before entering.

➖ 2. Flat Opening (Around 24,710 – 24,769)

A flat start around the immediate support/resistance range will decide short-term direction.

📌 Plan of Action:

👉 Educational Note: Flat openings are best suited for range traders in the first half, later moving into breakout mode once levels are breached.

🔽 3. Gap-Down Opening (100+ points below 24,697)

If Nifty opens below 24,697, it will show clear bearish pressure.

📌 Plan of Action:

👉 Educational Note: On gap-down days, follow the trend instead of trying to catch falling knives. Look for retests of broken supports before initiating shorts.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 24,930 → Possible upside to 25,058.

🟧 Flat near 24,769 → Wait for breakout/breakdown.

🔴 Below 24,697 → Downside towards 24,511.

🎯 Key Zone: 24,697 – 24,726 (Reversal Zone) will act as a pivot for the day.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult your financial advisor before making trading/investment decisions.

📌 Key Levels to Watch:

Opening Resistance: 24,840

Last Intraday Resistance: 24,930

Major Resistance Above: 25,058

Important Support Zone for Reversal: 24,697 – 24,726

Last Intraday Support: 24,511

These levels will guide our decision-making depending on the type of opening.

🔼 1. Gap-Up Opening (100+ points above 24,840)

If Nifty opens above 24,840, bullish momentum will be active.

📌 Plan of Action:

- [] Sustaining above 24,930 will likely attract buyers towards 25,058, which is the major resistance zone.

[] If Nifty fails to hold above 24,930, profit booking may drag it back to 24,840 support zone. - A breakout above 25,058 can extend the rally further, but this should be traded cautiously, as upside may face profit booking.

👉 Educational Note: Gap-ups often trigger early volatility due to overnight positions. Avoid chasing at the open; wait for confirmation candles before entering.

➖ 2. Flat Opening (Around 24,710 – 24,769)

A flat start around the immediate support/resistance range will decide short-term direction.

📌 Plan of Action:

- [] If Nifty sustains above 24,769, it may gradually climb towards 24,840 → 24,930.

[] If it breaks below 24,697–24,726 (Reversal Zone), weakness may drag it down towards 24,511 (Last Intraday Support). - In flat openings, allow the first 30 minutes to define direction before committing capital.

👉 Educational Note: Flat openings are best suited for range traders in the first half, later moving into breakout mode once levels are breached.

🔽 3. Gap-Down Opening (100+ points below 24,697)

If Nifty opens below 24,697, it will show clear bearish pressure.

📌 Plan of Action:

- [] Below 24,697, the index can slip quickly towards 24,511 (Last Intraday Support).

[] Any bounce from this zone should be treated as an opportunity to re-test resistances, not fresh bullish entry, unless sustained. - If 24,511 is broken with volume, a deeper fall may continue with more downside levels opening up.

👉 Educational Note: On gap-down days, follow the trend instead of trying to catch falling knives. Look for retests of broken supports before initiating shorts.

🛡️ Risk Management Tips for Options Traders

- [] Risk only 1–2% of capital per trade.

[] Use hourly closing basis stop-loss for directional trades.

[] On gap-up/gap-down days, avoid naked options; prefer spreads to manage risk.

[] Do not overtrade if levels remain choppy between 24,769 – 24,840 (no-trade zone). - Track India VIX; high VIX = wider stop-loss needed, low VIX = tight stop-loss.

📌 Summary & Conclusion

🟢 Above 24,930 → Possible upside to 25,058.

🟧 Flat near 24,769 → Wait for breakout/breakdown.

🔴 Below 24,697 → Downside towards 24,511.

🎯 Key Zone: 24,697 – 24,726 (Reversal Zone) will act as a pivot for the day.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult your financial advisor before making trading/investment decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.