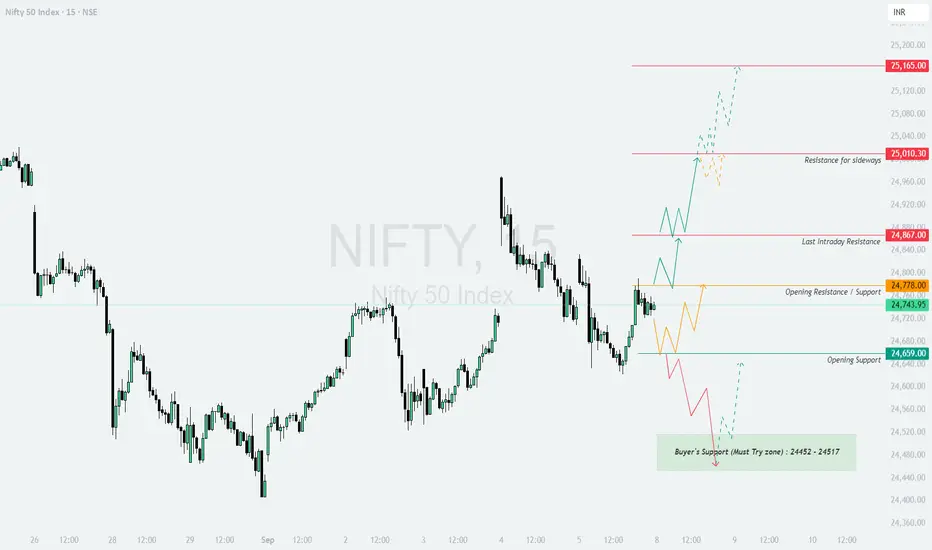

NIFTY TRADING PLAN – 08-Sep-2025

📌 Key Levels to Watch:

Resistance for sideways: 25,010

Major Resistance: 25,165

Last Intraday Resistance: 24,867

Opening Resistance / Support: 24,778

Opening Support: 24,659

Buyer’s Support (Must Try Zone): 24,452 – 24,517

The market is trading near an inflection zone. The price reaction at these levels will guide the intraday trend.

🔼 1. Gap-Up Opening (100+ points above 24,867)

If Nifty opens strongly above 24,867, bulls will attempt to extend gains towards higher resistances.

📌 Plan of Action:

👉 Educational Note: Gap-ups near major resistances require confirmation. Always wait for a retest or sustained move before entering long positions.

➖ 2. Flat Opening (Around 24,720 – 24,780)

A flat start near 24,743 – 24,778 indicates indecision, with equal chances for bulls and bears.

📌 Plan of Action:

👉 Educational Note: Flat openings provide clarity after the first 30 minutes. Observe how price reacts around the opening resistance/support zone before taking trades.

🔽 3. Gap-Down Opening (100+ points below 24,640)

If Nifty opens with weakness below 24,640, sellers will try to dominate.

📌 Plan of Action:

👉 Educational Note: Gap-downs often trigger panic selling. Instead of chasing the fall, wait for a retest of supports to catch a safer entry.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 24,867 → Bullish bias towards 25,010 & 25,165.

🟧 Flat Opening → Watch 24,778 for breakout; above bullish, below weak.

🔴 Below 24,640 → Weakness towards 24,517 & 24,452 buyer’s support zone.

⚠️ Critical Zone: 24,452 – 24,517 (Buyer’s Support). A rebound here is highly probable, but if broken, weakness can accelerate.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only and should not be considered as financial advice. Please consult your financial advisor before trading.

📌 Key Levels to Watch:

Resistance for sideways: 25,010

Major Resistance: 25,165

Last Intraday Resistance: 24,867

Opening Resistance / Support: 24,778

Opening Support: 24,659

Buyer’s Support (Must Try Zone): 24,452 – 24,517

The market is trading near an inflection zone. The price reaction at these levels will guide the intraday trend.

🔼 1. Gap-Up Opening (100+ points above 24,867)

If Nifty opens strongly above 24,867, bulls will attempt to extend gains towards higher resistances.

📌 Plan of Action:

- [] Sustaining above 24,867 will shift momentum towards 25,010.

[] A sideways consolidation can occur near 25,010, as it’s a critical resistance. - If Nifty manages to sustain above 25,010, the next big target is 25,165.

👉 Educational Note: Gap-ups near major resistances require confirmation. Always wait for a retest or sustained move before entering long positions.

➖ 2. Flat Opening (Around 24,720 – 24,780)

A flat start near 24,743 – 24,778 indicates indecision, with equal chances for bulls and bears.

📌 Plan of Action:

- [] If Nifty sustains above 24,778, it can push towards 24,867.

[] A breakout above 24,867 strengthens the bullish momentum towards 25,010. - Failure to hold above 24,743 can drag Nifty back to 24,659 (opening support).

👉 Educational Note: Flat openings provide clarity after the first 30 minutes. Observe how price reacts around the opening resistance/support zone before taking trades.

🔽 3. Gap-Down Opening (100+ points below 24,640)

If Nifty opens with weakness below 24,640, sellers will try to dominate.

📌 Plan of Action:

- [] Immediate test will be at 24,659; if broken, price may fall towards the buyer’s support zone 24,452 – 24,517.

[] A strong rebound is likely from this buyer’s support zone, as it is marked as a “must-try” level for bulls. - Sustaining below 24,452 will open deeper downside possibilities, turning the sentiment weak.

👉 Educational Note: Gap-downs often trigger panic selling. Instead of chasing the fall, wait for a retest of supports to catch a safer entry.

🛡️ Risk Management Tips for Options Traders

- [] Always define a stop-loss based on hourly close to avoid getting trapped in volatility.

[] Keep position sizing small (1–2% of capital) in uncertain zones.

[] For gap-up/gap-down days, prefer directional option buying only after confirmation.

[] Use hedged strategies (like spreads) if trading near major support/resistance zones. - Book partial profits at intermediate levels to lock in gains.

📌 Summary & Conclusion

🟢 Above 24,867 → Bullish bias towards 25,010 & 25,165.

🟧 Flat Opening → Watch 24,778 for breakout; above bullish, below weak.

🔴 Below 24,640 → Weakness towards 24,517 & 24,452 buyer’s support zone.

⚠️ Critical Zone: 24,452 – 24,517 (Buyer’s Support). A rebound here is highly probable, but if broken, weakness can accelerate.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only and should not be considered as financial advice. Please consult your financial advisor before trading.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.