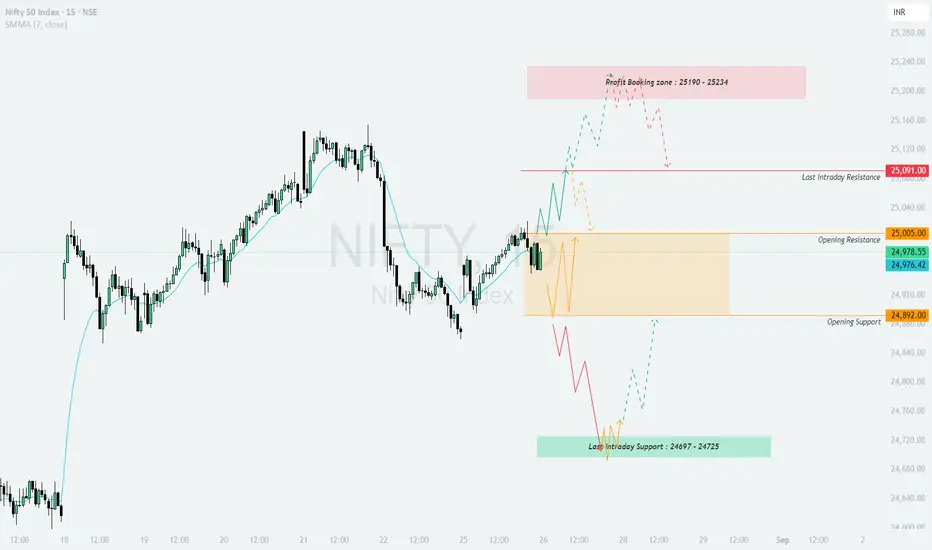

📊 NIFTY TRADING PLAN – 26-Aug-2025

On 25-Aug-2025, Nifty closed at 24,978, positioned between critical levels. The key support and resistance zones for tomorrow are:

Opening Support: 24,892

Opening Resistance: 25,005

Last Intraday Resistance: 25,091

Profit Booking Zone: 25,190 – 25,234

Last Intraday Support: 24,697 – 24,725

Now let’s go through possible scenarios.

🔼 1. Gap-Up Opening (100+ points above 25,091)

If Nifty opens above 25,091, it directly enters the bullish zone.

📌 Plan of Action:

👉 Tip: On gap-ups, avoid aggressive buying at open. Wait for retracements near support to enter for better risk–reward.

➖ 2. Flat Opening (Around 24,892 – 25,005)

A flat start around the opening support–resistance zone will be a deciding factor for intraday trend.

📌 Plan of Action:

👉 Tip: For options traders, flat openings are best for straddle/strangle adjustments. Capture volatility once direction confirms.

🔽 3. Gap-Down Opening (100+ points below 24,892)

If Nifty opens below 24,892, it will show bearish pressure right from the start.

📌 Plan of Action:

👉 Tip: After a gap-down, use put spreads instead of naked puts to manage risk in case of sharp reversals.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 25,091 → 25,190–25,234 (Profit Booking Zone).

🟧 Flat around 24,892–25,005 = Wait for breakout/breakdown confirmation.

🔴 Below 24,892 → 24,725–24,697 (Buyer’s defense zone).

Key Pivot: 24,892 – 25,005 zone for intraday trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading/investment decisions.

On 25-Aug-2025, Nifty closed at 24,978, positioned between critical levels. The key support and resistance zones for tomorrow are:

Opening Support: 24,892

Opening Resistance: 25,005

Last Intraday Resistance: 25,091

Profit Booking Zone: 25,190 – 25,234

Last Intraday Support: 24,697 – 24,725

Now let’s go through possible scenarios.

🔼 1. Gap-Up Opening (100+ points above 25,091)

If Nifty opens above 25,091, it directly enters the bullish zone.

📌 Plan of Action:

- [] Watch for sustainability above 25,091 in the first 15–30 minutes. If sustained, the index can march towards the Profit Booking Zone 25,190 – 25,234.

[] In this zone, expect some consolidation or profit booking. Fresh long positions should be cautious here.

[] If 25,234 is taken out convincingly, it may lead to another strong rally, but chasing at higher levels 🚫 is risky.

[] Failure to sustain above 25,091 may result in a pullback toward the 25,005 – 24,892 zone.

👉 Tip: On gap-ups, avoid aggressive buying at open. Wait for retracements near support to enter for better risk–reward.

➖ 2. Flat Opening (Around 24,892 – 25,005)

A flat start around the opening support–resistance zone will be a deciding factor for intraday trend.

📌 Plan of Action:

- [] If Nifty sustains above 25,005, it will likely attempt a breakout towards 25,091 → 25,190–25,234 zone.

[] Failure to hold 24,892 will open downside towards 24,725 – 24,697 (Last Intraday Support). - In flat openings, the first 30 minutes are crucial. Let the index pick direction before entering.

👉 Tip: For options traders, flat openings are best for straddle/strangle adjustments. Capture volatility once direction confirms.

🔽 3. Gap-Down Opening (100+ points below 24,892)

If Nifty opens below 24,892, it will show bearish pressure right from the start.

📌 Plan of Action:

- [] Below 24,892, the index can test the Last Intraday Support Zone: 24,725 – 24,697.

[] Buyers may attempt to defend this support, so expect a bounce opportunity here (good for scalpers).

[] If 24,697 is broken with volume, further downside continuation may occur.

[] Avoid panic shorts at the open — wait for a retest of resistance before entering for safer trades.

👉 Tip: After a gap-down, use put spreads instead of naked puts to manage risk in case of sharp reversals.

🛡️ Risk Management Tips for Options Traders

- [] Risk only 1–2% of your capital per trade.

[] Always trade with a defined stop-loss. Do not average losing positions.

[] Avoid over-leveraging, especially in weekly expiry sessions ⚡.

[] Prefer spreads (Bull Call, Bear Put, Iron Condors) to reduce premium decay impact. - Track India VIX 📉 before entering — high VIX means bigger moves, low VIX means range-bound.

📌 Summary & Conclusion

🟢 Above 25,091 → 25,190–25,234 (Profit Booking Zone).

🟧 Flat around 24,892–25,005 = Wait for breakout/breakdown confirmation.

🔴 Below 24,892 → 24,725–24,697 (Buyer’s defense zone).

Key Pivot: 24,892 – 25,005 zone for intraday trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading/investment decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.