📊 NIFTY TRADING PLAN — 14 NOV 2025

(Timeframe Reference: 15-Min Chart)

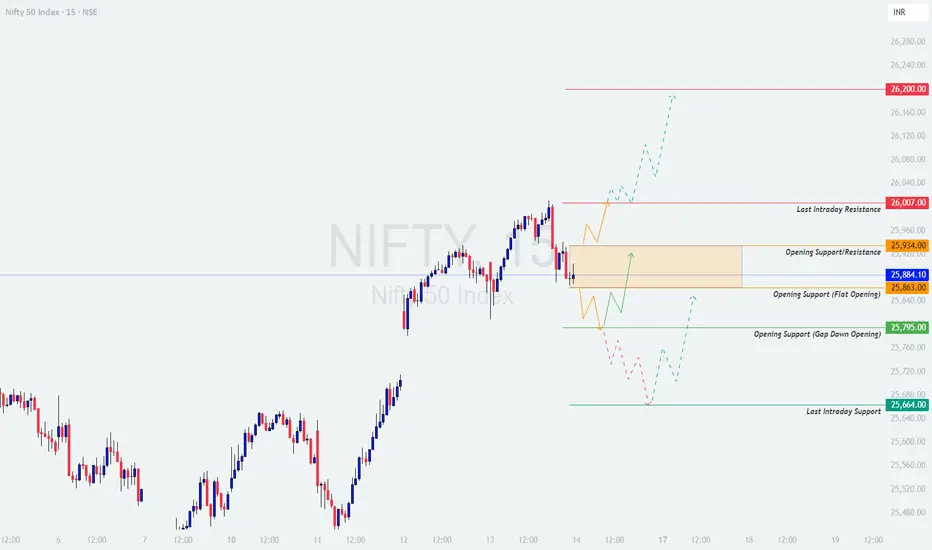

Chart Summary:

Nifty closed near 25,884, forming a balanced structure after recent upside momentum. The index is currently positioned within the Opening Support / Resistance Zone (25,863 – 25,934), suggesting indecision as participants await directional clarity.

Above this range, key resistance levels lie at 26,007 (Last Intraday Resistance) and 26,200. On the downside, supports exist near 25,795 (Gap-down Support) and 25,664 (Last Intraday Support).

The index remains in a neutral-to-bullish bias as long as it holds above 25,795. Sustaining above 25,934 may trigger renewed upward movement toward 26,200.

Key Levels to Watch:

🟩 Supports: 25,795 / 25,664

🟥 Resistances: 25,934 / 26,007 / 26,200

⚖️ Bias Zone: 25,863 – 25,934 (No-Trade Zone – Wait for breakout confirmation)

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens above 26,000 – 26,050, it will open directly near or above the Last Intraday Resistance (26,007). Such a gap-up could trigger excitement at the open, but traders must wait for confirmation of strength.

💡 Educational Note:

Gap-ups near resistance zones often create emotional entry traps. Always let the price establish strength through retests and volume confirmation. A breakout sustained by strong candles signals genuine trend continuation, while sharp reversals at resistance suggest false breakouts.

🟧 Scenario 2: FLAT Opening (Around 25,860 – 25,900 Zone)

A flat opening near the Opening Support / Resistance Zone (25,863 – 25,934) indicates early indecision. Price may spend time consolidating before choosing direction.

🧠 Educational Tip:

Flat openings test trader discipline. Most false breakouts occur when traders predict rather than wait. Breakouts that occur after a consolidation period with strong volume tend to have better follow-through. The key is patience and confirmation, not prediction.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens near 25,770 – 25,800, it will enter the Opening Support Zone. This area will be critical for bulls to defend.

📘 Educational Insight:

Gap-downs attract panic sellers early in the session. Experienced traders wait for signs of stabilization at support levels. Sharp reversals with strong volume often mark the beginning of intraday recoveries. Patience pays more than impulse in such setups.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

📈 SUMMARY:

📚 CONCLUSION:

Nifty is at a decisive point, trading within a narrow consolidation zone between 25,863 – 25,934. A breakout above this zone could drive momentum toward 26,200, while a breakdown below 25,863 could lead to a retest of 25,795 – 25,664.

Patience and observation will be the most valuable tools for traders on 14 Nov. Let price confirm direction with volume support before executing trades. Avoid emotional entries — precision and timing matter more than frequency.

📊 In trading, waiting for confirmation isn’t missing out — it’s aligning with probability and discipline.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The above analysis and levels are shared purely for educational and informational purposes. Please conduct your own research or consult a certified financial advisor before making trading or investment decisions.

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Nifty closed near 25,884, forming a balanced structure after recent upside momentum. The index is currently positioned within the Opening Support / Resistance Zone (25,863 – 25,934), suggesting indecision as participants await directional clarity.

Above this range, key resistance levels lie at 26,007 (Last Intraday Resistance) and 26,200. On the downside, supports exist near 25,795 (Gap-down Support) and 25,664 (Last Intraday Support).

The index remains in a neutral-to-bullish bias as long as it holds above 25,795. Sustaining above 25,934 may trigger renewed upward movement toward 26,200.

Key Levels to Watch:

🟩 Supports: 25,795 / 25,664

🟥 Resistances: 25,934 / 26,007 / 26,200

⚖️ Bias Zone: 25,863 – 25,934 (No-Trade Zone – Wait for breakout confirmation)

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens above 26,000 – 26,050, it will open directly near or above the Last Intraday Resistance (26,007). Such a gap-up could trigger excitement at the open, but traders must wait for confirmation of strength.

- []If price sustains above 26,007 for 15–20 minutes with strong bullish candles, the next upside targets could be 26,120 – 26,200.

[]If price fails to sustain above 26,007 and forms rejection wicks, expect a pullback toward 25,934 – 25,884.

[]Avoid chasing a gap-up immediately — wait for a retest near 26,000 for better entry confirmation.

[]If price reclaims 26,000 after a pullback with rising volume, it could confirm continuation momentum.

💡 Educational Note:

Gap-ups near resistance zones often create emotional entry traps. Always let the price establish strength through retests and volume confirmation. A breakout sustained by strong candles signals genuine trend continuation, while sharp reversals at resistance suggest false breakouts.

🟧 Scenario 2: FLAT Opening (Around 25,860 – 25,900 Zone)

A flat opening near the Opening Support / Resistance Zone (25,863 – 25,934) indicates early indecision. Price may spend time consolidating before choosing direction.

- []Avoid entering within this zone in the first 15 minutes — volatility may remain erratic.

[]If Nifty sustains above 25,934 with strong green candles, upside targets open toward 26,007 – 26,200.

[]If it breaks below 25,863, weakness may push the index toward 25,795 – 25,664.

[]Trade breakout confirmation only — fakeouts are common in flat openings. Wait for candle closure and volume support.

🧠 Educational Tip:

Flat openings test trader discipline. Most false breakouts occur when traders predict rather than wait. Breakouts that occur after a consolidation period with strong volume tend to have better follow-through. The key is patience and confirmation, not prediction.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens near 25,770 – 25,800, it will enter the Opening Support Zone. This area will be critical for bulls to defend.

- []If price forms reversal candles (hammer, bullish engulfing) near 25,795, expect a rebound toward 25,863 – 25,934.

[]If the index fails to hold above 25,795, further weakness could extend toward 25,664 (Last Intraday Support).

[]Avoid panic shorting after a large gap-down — instead, wait for pullbacks toward 25,860 – 25,880 for better entry risk-reward.

[]Watch for volume behavior — decreasing volume near support often indicates exhaustion, hinting at a short-covering rally.

📘 Educational Insight:

Gap-downs attract panic sellers early in the session. Experienced traders wait for signs of stabilization at support levels. Sharp reversals with strong volume often mark the beginning of intraday recoveries. Patience pays more than impulse in such setups.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

- []Avoid option entries during the first 15–20 minutes — IV (Implied Volatility) spikes inflate premium values, leading to quick time decay afterward.

[]Limit exposure to 1–2% of total capital per trade. Consistency in risk control is key to longevity.

[]Prefer ATM or ITM options for directional plays; avoid deep OTM options unless trading clear breakout momentum.

[]Always use stop-losses — trail them once the position moves 30–40 points in your favor.

[]Book partial profits at strong support/resistance zones to lock in gains.

[]If the day turns choppy or non-trending, step back — capital preservation > forced trading.

📈 SUMMARY:

- []🟧 Neutral Zone: 25,863 – 25,934[]🟥 Resistance Zones: 26,007 / 26,200[]🟩 Support Zones: 25,795 / 25,664[]⚖️ Bias: Bullish above 25,934 | Bearish below 25,863

📚 CONCLUSION:

Nifty is at a decisive point, trading within a narrow consolidation zone between 25,863 – 25,934. A breakout above this zone could drive momentum toward 26,200, while a breakdown below 25,863 could lead to a retest of 25,795 – 25,664.

Patience and observation will be the most valuable tools for traders on 14 Nov. Let price confirm direction with volume support before executing trades. Avoid emotional entries — precision and timing matter more than frequency.

📊 In trading, waiting for confirmation isn’t missing out — it’s aligning with probability and discipline.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The above analysis and levels are shared purely for educational and informational purposes. Please conduct your own research or consult a certified financial advisor before making trading or investment decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.