📊 NIFTY TRADING PLAN — 18 NOV 2025

(Timeframe Reference: 15-Min Chart)

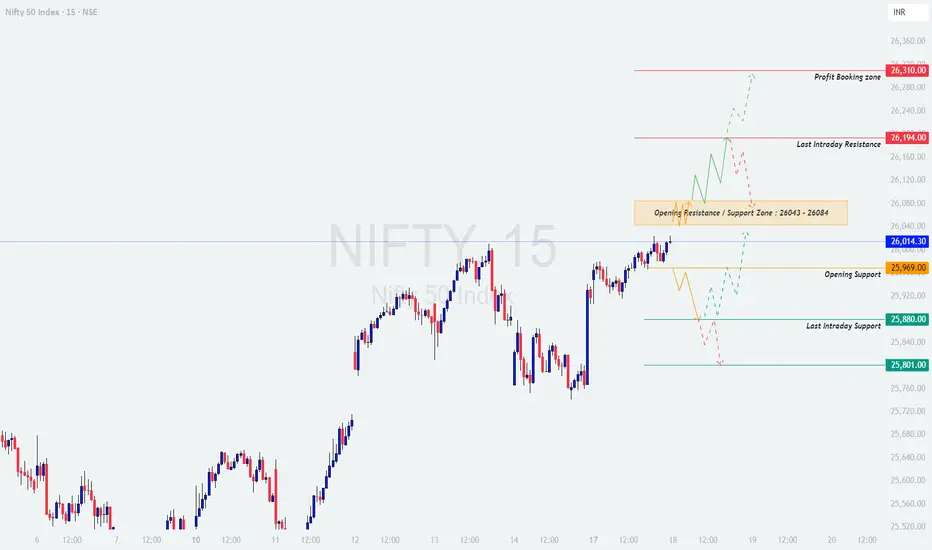

Chart Summary:

Nifty closed near 26,014, maintaining a strong recovery momentum with higher highs formation. The index is currently hovering just below the Opening Resistance / Support Zone (26,043 – 26,084), suggesting that 18th November could be a pivotal session for short-term trend continuation or reversal.

Immediate resistance is visible at 26,194 (Last Intraday Resistance) and a Profit Booking Zone near 26,310. On the downside, the nearest supports are located at 25,969 (Opening Support) and 25,880 – 25,801 (Last Intraday Support Zone).

The structure favors a bullish bias as long as price sustains above 25,969, but traders should remain cautious around higher resistances where profit-taking may emerge.

Key Zones to Watch:

🟩 Supports: 25,969 / 25,880 / 25,801

🟥 Resistances: 26,084 / 26,194 / 26,310

⚖️ Bias: Bullish above 26,084 | Bearish below 25,969

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens around 26,120 – 26,180, it will start near the Last Intraday Resistance (26,194). Such openings near resistance often cause early hesitation or consolidation before direction becomes clear.

💡 Educational Insight:

Gap-up openings near resistance zones test trader psychology. Retail traders often buy impulsively at highs — professionals wait for confirmation of sustained strength. Always let price action validate breakout continuation before committing capital.

🟧 Scenario 2: FLAT Opening (Around 26,000 – 26,040 Zone)

A flat opening near 26,014 keeps Nifty right within the Opening Resistance / Support Zone (26,043 – 26,084). This zone acts as a decision point — a breakout could continue bullish momentum, while rejection could trigger short-term correction.

🧠 Educational Tip:

Flat openings are common near key inflection zones. Avoid being the first to act — let the first 15 minutes set the tone. Volume-backed breakouts from such zones often lead to sustained moves.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens around 25,900 – 25,850, it will open below the Opening Support (25,969) and closer to the Last Intraday Support Zone (25,880 – 25,801). This area will be critical to watch for either a quick reversal or extended weakness.

📘 Educational Note:

Gap-down openings are emotional traps for retail participants. Professionals focus on reaction, not the gap itself. A strong bounce from support zones often provides safer and more rewarding opportunities than chasing fear-driven momentum.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

⚠️ Golden Rule:

Focus on capital protection over profit chasing. Consistency builds wealth — not aggression.

📈 SUMMARY:

📚 CONCLUSION:

Nifty stands at a critical juncture, oscillating just below major resistance. A breakout above 26,084 can open the path toward 26,310, while a breakdown below 25,969 may trigger intraday profit booking toward 25,880 – 25,801.

For 18th November, the key lies in the opening reaction — whether the market builds on momentum or witnesses short-term exhaustion. Stay disciplined, trade only post-confirmation, and align your direction with trend and volume.

📊 Trading success lies not in predicting the move, but in reacting wisely to what unfolds.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The views shared here are purely for educational and informational purposes. Please conduct your own analysis or consult a certified financial advisor before making any trading or investment decisions.

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Nifty closed near 26,014, maintaining a strong recovery momentum with higher highs formation. The index is currently hovering just below the Opening Resistance / Support Zone (26,043 – 26,084), suggesting that 18th November could be a pivotal session for short-term trend continuation or reversal.

Immediate resistance is visible at 26,194 (Last Intraday Resistance) and a Profit Booking Zone near 26,310. On the downside, the nearest supports are located at 25,969 (Opening Support) and 25,880 – 25,801 (Last Intraday Support Zone).

The structure favors a bullish bias as long as price sustains above 25,969, but traders should remain cautious around higher resistances where profit-taking may emerge.

Key Zones to Watch:

🟩 Supports: 25,969 / 25,880 / 25,801

🟥 Resistances: 26,084 / 26,194 / 26,310

⚖️ Bias: Bullish above 26,084 | Bearish below 25,969

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens around 26,120 – 26,180, it will start near the Last Intraday Resistance (26,194). Such openings near resistance often cause early hesitation or consolidation before direction becomes clear.

- []If price sustains above 26,194 for 15–20 minutes with strong volume, expect a quick move toward the Profit Booking Zone (26,310).

[]A breakout above 26,194 followed by a successful retest offers a low-risk buying opportunity for 26,270–26,310 targets.

[]If rejection candles (like upper wicks or bearish engulfing) appear near 26,194 – 26,310, expect a short-term pullback toward 26,084 – 26,000.

[]Avoid chasing the initial gap-up rally; instead, wait for price to confirm strength or provide a retest entry.

💡 Educational Insight:

Gap-up openings near resistance zones test trader psychology. Retail traders often buy impulsively at highs — professionals wait for confirmation of sustained strength. Always let price action validate breakout continuation before committing capital.

🟧 Scenario 2: FLAT Opening (Around 26,000 – 26,040 Zone)

A flat opening near 26,014 keeps Nifty right within the Opening Resistance / Support Zone (26,043 – 26,084). This zone acts as a decision point — a breakout could continue bullish momentum, while rejection could trigger short-term correction.

- []If the index sustains above 26,084, expect bullish continuation toward 26,194 – 26,310.

[]If the index faces rejection and falls below 25,969, a short-term retracement toward 25,880 – 25,801 is likely.

[]Avoid taking trades inside 26,000 – 26,080 initially — this zone may witness indecision.

[]Wait for a strong directional candle close outside the range for trade confirmation.

🧠 Educational Tip:

Flat openings are common near key inflection zones. Avoid being the first to act — let the first 15 minutes set the tone. Volume-backed breakouts from such zones often lead to sustained moves.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens around 25,900 – 25,850, it will open below the Opening Support (25,969) and closer to the Last Intraday Support Zone (25,880 – 25,801). This area will be critical to watch for either a quick reversal or extended weakness.

- []If reversal candles (hammer or bullish engulfing) appear near 25,880 – 25,801, expect a recovery toward 26,000 – 26,043.

[]If the price fails to sustain above 25,880, bearish momentum may drag Nifty toward 25,700 – 25,600.

[]Avoid panic shorting after gap-downs — let the market test supports first.

[]Watch for volume divergence: if selling volume declines near support, it signals exhaustion and possible intraday reversal.

📘 Educational Note:

Gap-down openings are emotional traps for retail participants. Professionals focus on reaction, not the gap itself. A strong bounce from support zones often provides safer and more rewarding opportunities than chasing fear-driven momentum.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

- []Avoid trading during the first 15 minutes of market open — volatility is highest and direction unclear.

[]Never risk more than 1–2% of your capital per trade.

[]Use ATM or slightly ITM options for directional trades — they move more effectively with price.

[]Trail stop-loss once the position gains 30–40 points in your favor — protect profits.

[]Book partial profits at intermediate zones (like 26,084 / 26,194) and hold the rest with SL.

[]Avoid averaging losing trades — discipline is key. - When in doubt or volatility spikes unexpectedly, step aside; missing a trade is better than forcing one.

⚠️ Golden Rule:

Focus on capital protection over profit chasing. Consistency builds wealth — not aggression.

📈 SUMMARY:

- []🟩 Key Supports: 25,969 / 25,880 / 25,801[]🟥 Key Resistances: 26,084 / 26,194 / 26,310[]⚖️ Bias: Bullish above 26,084 | Bearish below 25,969[]🎯 Intraday Levels to Watch:

- Breakout above 26,084 → Target 26,194 → 26,310

- Breakdown below 25,969 → Target 25,880 → 25,801

📚 CONCLUSION:

Nifty stands at a critical juncture, oscillating just below major resistance. A breakout above 26,084 can open the path toward 26,310, while a breakdown below 25,969 may trigger intraday profit booking toward 25,880 – 25,801.

For 18th November, the key lies in the opening reaction — whether the market builds on momentum or witnesses short-term exhaustion. Stay disciplined, trade only post-confirmation, and align your direction with trend and volume.

📊 Trading success lies not in predicting the move, but in reacting wisely to what unfolds.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The views shared here are purely for educational and informational purposes. Please conduct your own analysis or consult a certified financial advisor before making any trading or investment decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.