Market context and key levels

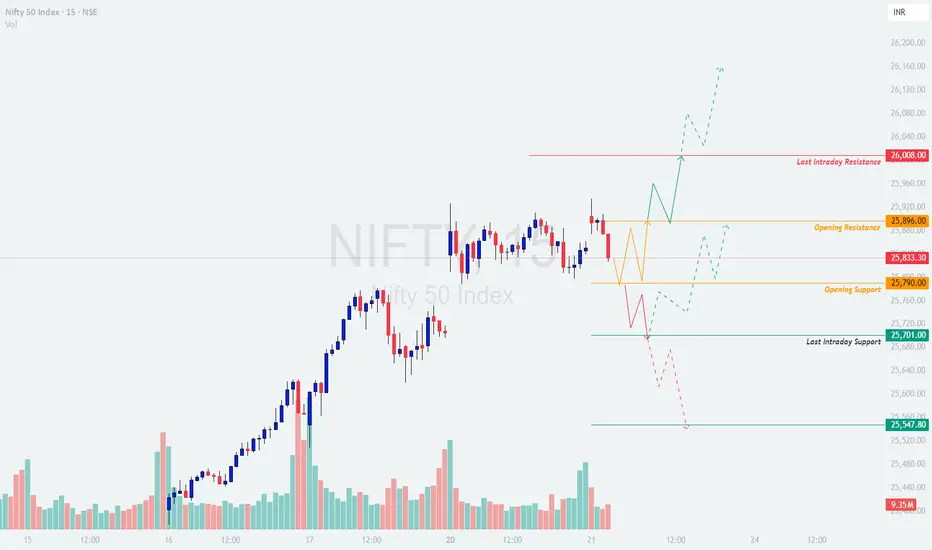

Reference from your map: Opening Resistance 25,896; Opening Support 25,790; Last Intraday Support 25,701 and deeper support 25,548; overhead resistance 26,008. Bias is neutral-to-positive while above 25,790; momentum unlocks only on acceptance above 25,896, whereas sustained loss of 25,701 flips control to bears. 🚦

GAP UP OPEN (≥ +100 pts)

Educational logic: Positive gaps can trap shorts; the edge is to wait for acceptance above resistance (time + volume) before riding continuation. 📈

If open lands around 25,890–25,920 and first 5–15 min hold above VWAP/first high, consider a momentum long toward 25,960–25,980; partials there, then trail for 26,008. Stop below the retest low near 25,880.

If open jumps near 25,980–26,008, avoid chasing into resistance. Prefer a pullback to 25,920–25,900; go long only on a higher low and reclaim of 25,940 with a tight stop under the pullback low; targets 25,980 → 26,008 and extension if breadth expands.

Failure short: Rejection wicks from 25,960–26,008 followed by a 15‑min close back below 25,900. Tactical short to 25,896 → 25,840–25,790; cover if 25,940 is reclaimed decisively.

[/list=1]

FLAT OPEN (±0–50 pts)

Educational logic: Neutral opens favor range trades around nearby pivots until a breakout confirms with acceptance. ⚖️

Range buy: Look for reversal signals near 25,810–25,790 with risk below the session swing; targets 25,850 → 25,896.

Breakout buy: A 15‑min close and successful retest above 25,896 opens 25,940–25,960; scale out into 25,980–26,008 if momentum broadens.

Breakdown short: Acceptance below 25,790 on retest targets 25,735–25,710; if sellers maintain control, extend to 25,701 then 25,650–25,548. Trail using successive lower highs.

[/list=1]

GAP DOWN OPEN (≤ −100 pts)

Educational logic: Negative gaps near support often lead to “gap‑and‑go” trends if acceptance stays below, or fast reversals if buyers defend key zones. 📉

Gap‑and‑go short: Open around 25,720–25,700 and failure to reclaim 25,790 on retest → short to 25,701; book partials, then trail for 25,650–25,600 and 25,548 if momentum persists.

Reversal long: Strong rejection from 25,701 with bullish engulfing/hammer and volume → long back to 25,760 then 25,790; move stop to breakeven once 25,790 holds.

Bias flip: If price re-enters above 25,896 after a weak open and sustains, abandon shorts and prepare for rotation to 25,960–26,008; avoid fighting a reclaim day.

[/list=1]

Execution checklist

Predefine the scenario, trigger (acceptance or clean retest), invalidation (where the idea is wrong), and first target.

Key decision areas: 25,790 pivot, 25,896 resistance to beat, 26,008 resistance, 25,701 and 25,548 supports. Trade reactions to zones, not exact ticks.

Use structure-based stops beyond the far side of the zone; scale out at the next pivot and trail to protect gains.

Options risk management tips- Define risk: Prefer debit spreads near zones (bull call above 25,896; bear put below 25,790/25,701) to cap tail risk on volatile gap opens.

Size by volatility: Wider expected range → smaller size; avoid oversizing because options “look cheap.”

Liquidity first: Use near‑ATM, current‑week Nifty options with tight spreads; avoid illiquid deep OTMs that decay rapidly in chop.

Confirm before entry: Wait for 5–15 min acceptance or a clean retest hold; be cautious in the first 1–3 minutes unless trading a planned opening drive.

Manage winners: Take partials at first pivot; if IV expands, consider converting naked calls/puts into verticals to lock risk while keeping upside.

Avoid overlap: If structure flips (e.g., reclaim above 25,896 after breakdown), exit losers decisively instead of hedging passively.

[/list=1]

Summary

Core map: 25,790 is the intraday pivot; 25,896 is the gate to upside continuation; 26,008 is upper resistance; 25,701 then 25,548 are key supports. Upside opens on acceptance above 25,896 toward 25,960–26,008, while downside strengthens below 25,790/25,701 toward 25,650–25,548. 🙂

Conclusion

Prepare three plays: continuation long above 25,896, responsive range trades around 25,790/25,896 with clear triggers, and momentum shorts below 25,790/25,701 targeting 25,650–25,548. Execute with strict invalidations, scale responsibly, and adapt quickly if pivots are reclaimed. 📊

Disclaimer: This is an educational plan, not investment advice or a trade recommendation; I am not a SEBI registered analyst.

- Define risk: Prefer debit spreads near zones (bull call above 25,896; bear put below 25,790/25,701) to cap tail risk on volatile gap opens.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.