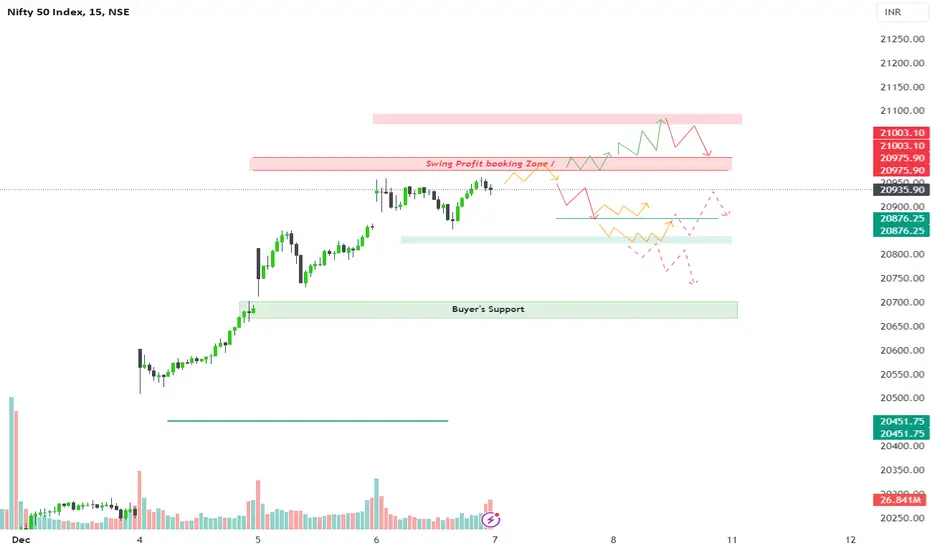

In the Nifty chart, there are indications of a potential double top formation near the swing profit booking zone of 21003-20975. If prices decline from these levels without dwelling for an extended period, it raises the likelihood of exhaustion, potentially leading to profit booking and a descent to around 20875. Subsequently, a consolidation phase between 20875 and 20920 may occur. A breach below 20870 could trigger a further decline to the range of 20820-20800.

If prices open lower and trade beneath 20875, traders are advised to wait for a test of the 20838-20822 range before initiating a buying trade, with a stop loss at 20800. The target for this trade is set at 20900-20930. Should prices dip below 20800 and linger, refraining from trade is recommended until an upward retracement occurs. Look for a short trade near 20850-20875 with a stop loss at 20900 if such a retracement takes place (position trade).

If prices open lower and trade beneath 20875, traders are advised to wait for a test of the 20838-20822 range before initiating a buying trade, with a stop loss at 20800. The target for this trade is set at 20900-20930. Should prices dip below 20800 and linger, refraining from trade is recommended until an upward retracement occurs. Look for a short trade near 20850-20875 with a stop loss at 20900 if such a retracement takes place (position trade).

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.