📌 Nifty Trading Plan for 22-Aug-2025

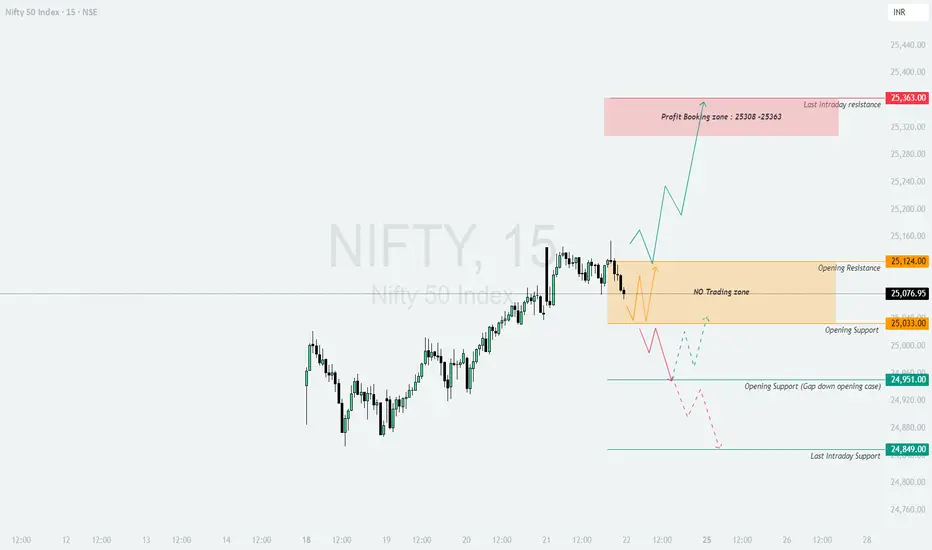

Key Levels from Chart:

Opening Resistance → 25,124

Opening Support → 25,033

Profit Booking Zone (Last Intraday Resistance) → 25,308 – 25,363

Opening Support in Gap Down Case → 24,951

Last Intraday Support → 24,849

Previous Close → 25,076.95

🚀 Scenario 1: Gap Up Opening (100+ points above previous close)

If Nifty opens above 25,175+, bullish sentiment will dominate the early session.

💡 Plan of Action: Look for long trades above 25,124 with confirmation, targeting 25,308–25,363. Trail stop-loss below 25,033. Book partials at resistance and avoid fresh longs if market looks tired near highs.

📊 Scenario 2: Flat Opening (within ±50–80 points of 25,077)

Flat openings often cause range-bound moves until a breakout.

💡 Plan of Action: Stay patient. Go long only above 25,124 or short below 25,033. Inside range, avoid overtrading and save capital for directional clarity.

⚠️ Scenario 3: Gap Down Opening (100+ points below previous close)

If Nifty opens near 24,950 or below, sellers will dominate.

💡 Plan of Action: Go short only if 24,951 breaks with volume, keeping stop-loss above 25,033. For scalpers, a bounce from 24,951 can be used for quick longs with strict SL.

📌 Risk Management Tips for Options Traders 💡

📝 Summary & Conclusion

Above 25,124, momentum can extend toward 25,308 – 25,363, where profit booking is expected 🚀.

Between 25,033 – 25,124, market is in a No Trading Zone ⚖️. Avoid traps.

Below 25,033, weakness toward 24,951, and if broken → 24,849 ⚠️.

👉 The day will be highly level-driven, and patience is key. Trade only at breakouts/breakdowns for clear setups.

⚠️ Disclaimer

I am not a SEBI registered analyst. This analysis is purely for educational purposes. Please consult your financial advisor before making any trading or investment decision.

Key Levels from Chart:

Opening Resistance → 25,124

Opening Support → 25,033

Profit Booking Zone (Last Intraday Resistance) → 25,308 – 25,363

Opening Support in Gap Down Case → 24,951

Last Intraday Support → 24,849

Previous Close → 25,076.95

🚀 Scenario 1: Gap Up Opening (100+ points above previous close)

If Nifty opens above 25,175+, bullish sentiment will dominate the early session.

- [] Immediate hurdle is 25,308 – 25,363 (Profit Booking Zone). Traders should expect selling pressure here as short-term players may book gains.

[] Sustaining above 25,363 can extend momentum further, but risk-reward weakens for fresh longs. - If rejection happens from 25,308–25,363, index could retest 25,124 support.

💡 Plan of Action: Look for long trades above 25,124 with confirmation, targeting 25,308–25,363. Trail stop-loss below 25,033. Book partials at resistance and avoid fresh longs if market looks tired near highs.

📊 Scenario 2: Flat Opening (within ±50–80 points of 25,077)

Flat openings often cause range-bound moves until a breakout.

- [] Price between 25,033 – 25,124 is a No Trading Zone. Avoid entering inside this range to prevent whipsaws.

[] Breakout above 25,124 can trigger a rally toward 25,308 – 25,363 zone. - Breakdown below 25,033 opens weakness toward 24,951.

💡 Plan of Action: Stay patient. Go long only above 25,124 or short below 25,033. Inside range, avoid overtrading and save capital for directional clarity.

⚠️ Scenario 3: Gap Down Opening (100+ points below previous close)

If Nifty opens near 24,950 or below, sellers will dominate.

- [] Support at 24,951 may attract intraday buying or short-covering bounce toward 25,033.

[] If 24,951 breaks decisively, expect further downside toward 24,849 (Last Intraday Support). - Failure to sustain below 24,951 can trap shorts, leading to a recovery back to 25,124 resistance zone.

💡 Plan of Action: Go short only if 24,951 breaks with volume, keeping stop-loss above 25,033. For scalpers, a bounce from 24,951 can be used for quick longs with strict SL.

📌 Risk Management Tips for Options Traders 💡

- [] Never chase option premiums after a big gap — premiums are inflated, wait for retracements.

[] Stick to defined-risk strategies (spreads, butterflies) instead of naked buying.

[] Always use stop-loss on options since time decay works against buyers.

[] Avoid over-leveraging — allocate not more than 2–3% capital per trade. - Book partial profits near key levels 🎯 and trail the rest.

📝 Summary & Conclusion

Above 25,124, momentum can extend toward 25,308 – 25,363, where profit booking is expected 🚀.

Between 25,033 – 25,124, market is in a No Trading Zone ⚖️. Avoid traps.

Below 25,033, weakness toward 24,951, and if broken → 24,849 ⚠️.

👉 The day will be highly level-driven, and patience is key. Trade only at breakouts/breakdowns for clear setups.

⚠️ Disclaimer

I am not a SEBI registered analyst. This analysis is purely for educational purposes. Please consult your financial advisor before making any trading or investment decision.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.