\📊 NIFTY TRADING PLAN – 25-Jun-2025\

📍 \Previous Close:\ 25,071.55

📏 \Gap Opening Consideration:\ ±100 Points

🕒 \Time Frame Analyzed:\ 5-Min Chart

📦 \Volume Check:\ 9.16M (aiding intraday trend confirmation)

---

\

📍 \Previous Close:\ 25,071.55

📏 \Gap Opening Consideration:\ ±100 Points

🕒 \Time Frame Analyzed:\ 5-Min Chart

📦 \Volume Check:\ 9.16M (aiding intraday trend confirmation)

---

\

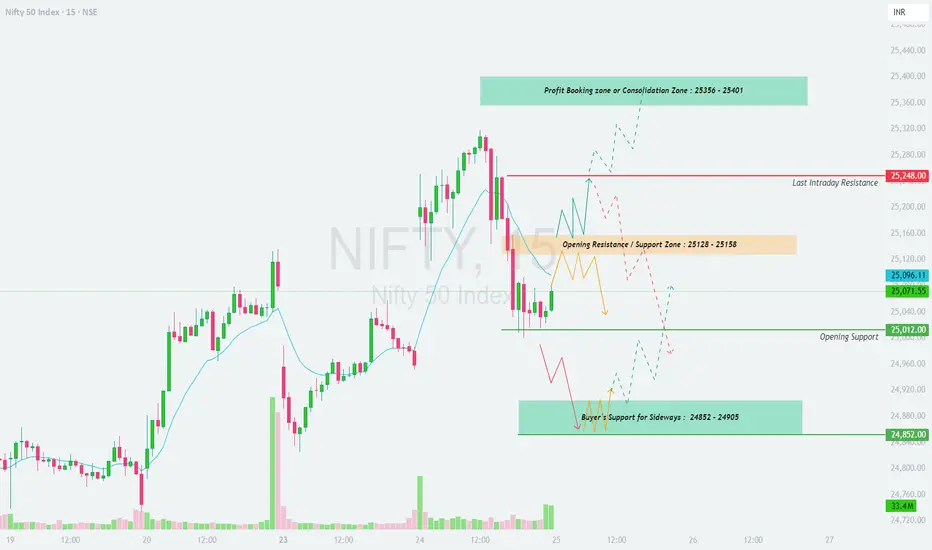

\[\*]\🚀 GAP-UP OPENING (Above 25,148):\

If Nifty opens above the \Opening Resistance Zone (25,128 – 25,158)\, it immediately faces \Last Intraday Resistance\ at \25,248\. Sustained buying above this level may push prices toward the \Profit Booking / Consolidation Zone (25,356 – 25,401)\.

✅ \Plan of Action:\

• Avoid jumping in at open — let first 15–30 minutes settle the tone

• Breakout above 25,248 = clear bullish structure

• Watch for profit booking at 25,356–25,401

🎯 \Trade Setup:\

– Long above 25,248 with volume confirmation

– Target: 25,356 → 25,401

– SL: Below 25,158

– Short only if rejection seen near 25,248–25,356

📘 \Pro Tip:\ Book partial profits at 1st target and trail rest.

\[\*]\⚖️ FLAT OPENING (Between 25,012 – 25,128):\

This is a reaction zone where Nifty may oscillate inside the \Opening Resistance/Support Band\. Directional clarity may only come post breakout from this zone.

✅ \Plan of Action:\

• Avoid early trades inside 25,012–25,128 zone

• Break above 25,128 = upside momentum

• Breakdown below 25,012 = weakness

🎯 \Trade Setup:\

– Long above 25,128 (strong bullish candle)

– Short below 25,012 (bearish breakdown confirmation)

– SL: 30–40 pts from entry depending on volatility

– Prefer confirmation candle with decent volume

📘 \Pro Tip:\ Stay flexible — it may be a sideways trap if no breakout happens in the first 45 mins.

\[\*]\📉 GAP-DOWN OPENING (Below 24,912):\

Gap-downs below \Opening Support (25,012)\ could test the critical \Buyer’s Support for Sideways Zone – 24,852 to 24,905\. This is a make-or-break area for the bulls.

✅ \Plan of Action:\

• Observe price behavior near 24,852

• Reversal from here offers intraday long opportunity

• Breakdown confirms bearish pressure

🎯 \Trade Setup:\

– Long near 24,852 (if bullish candle forms)

– Short below 24,852 (breakdown scenario)

– Target: 24,780 / 24,720

– SL: Above 25,012 for shorts, below 24,830 for longs

📘 \Pro Tip:\ This is where "smart money" often plays — watch candle structure, not emotions.

---

\💡 OPTIONS TRADING – RISK MANAGEMENT TIPS:\

✅ \1. Avoid buying options near expiry without confirmation; theta will eat premiums fast.\

✅ \2. Use spreads (like bull call or bear put) in choppy markets.\

✅ \3. Always use Stop Loss based on structure — not emotions or PnL.\

✅ \4. Keep risk per trade below 2% of capital.\

✅ \5. Use 15-min chart candle closing to exit on SL breach.\

---

\📌 SUMMARY – LEVELS TO MONITOR:\

🟥 \Last Intraday Resistance:\ 25,248

🟧 \Opening Resistance/Support:\ 25,128 – 25,158

🟩 \Opening Support:\ 25,012

🟦 \Sideways Support Zone:\ 24,852 – 24,905

🟫 \Breakdown Confirmation Target:\ Below 24,852 → 24,780

---

\🎯 CONCLUSION:\

• 🔼 \Bullish Bias:\ Only above 25,248 with strength

• ⏸️ \Sideways Bias:\ 25,012–25,128 — avoid unless breakout confirmed

• 🔽 \Bearish Bias:\ Below 25,012 → Eyes on 24,852

\⚖️ Discipline + Risk Management > Prediction!\ Stay aligned with price structure and manage your capital smartly. 💰🧠📉

---

\⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This analysis is purely educational and intended to assist in structured thinking. Please consult your financial advisor before acting on any trading decisions. Always apply strict stop-loss and position sizing.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.