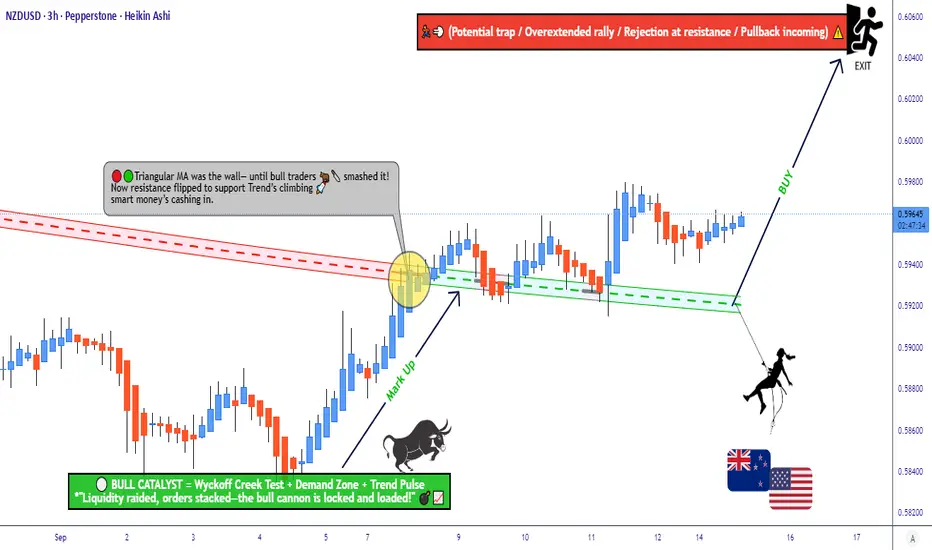

NZD/USD Technical Setup – Demand Retest + Bullish Structure

📈 NZD/USD "THE KIWI" Forex Money Looting Plan (Swing/Day Trade) 🥝💵

🛠️ Plan Overview

Bias: Bullish ✅

Reasoning: Demand Re-Test + Wyckoff Accumulation Phase (buyers confirmed their presence).

🎯 Entry Strategy (Thief Layer Style)

Our Thief Strategy = layered limit orders 🔑

Example buy layers:

0.59200

0.59300

0.59400

0.59500

(You can expand layers based on your risk appetite & market liquidity 📊).

⚡ This layered entry approach helps capture price dips while managing risk — OG Thief style!

🛡️ Stop Loss

Suggested SL: 0.59000 (below breakout structure).

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this SL is not a hard rule. Adjust it to match your own strategy & risk management.

🎯 Take Profit

Target zone: 0.60400 (strong resistance area).

Rationale: Price approaching overbought conditions + potential trap zone.

⚠️ Note: Exit is flexible — take profits on your own terms and protect your gains.

🔗 Related Pairs to Watch (Correlation Radar)

AUDUSD → Highly correlated (both AUD & NZD are commodity currencies 📦).

AUDUSD → Highly correlated (both AUD & NZD are commodity currencies 📦).

NZDJPY → Tracks Kiwi strength vs safe-haven flows 💴.

NZDJPY → Tracks Kiwi strength vs safe-haven flows 💴.

DXY (US Dollar Index) → Inverse correlation driver 💵.

DXY (US Dollar Index) → Inverse correlation driver 💵.

GBPNZD → Cross-check for Kiwi strength in broader FX spectrum.

GBPNZD → Cross-check for Kiwi strength in broader FX spectrum.

Watching these helps confirm if Kiwi momentum is real or just a false breakout!

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDUSD #Forex #Kiwi #SwingTrade #DayTrade #Wyckoff #FXTrading #TradingPlan #LayeringStrategy #AUDUSD #DXY

🛠️ Plan Overview

Bias: Bullish ✅

Reasoning: Demand Re-Test + Wyckoff Accumulation Phase (buyers confirmed their presence).

🎯 Entry Strategy (Thief Layer Style)

Our Thief Strategy = layered limit orders 🔑

Example buy layers:

0.59200

0.59300

0.59400

0.59500

(You can expand layers based on your risk appetite & market liquidity 📊).

⚡ This layered entry approach helps capture price dips while managing risk — OG Thief style!

🛡️ Stop Loss

Suggested SL: 0.59000 (below breakout structure).

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this SL is not a hard rule. Adjust it to match your own strategy & risk management.

🎯 Take Profit

Target zone: 0.60400 (strong resistance area).

Rationale: Price approaching overbought conditions + potential trap zone.

⚠️ Note: Exit is flexible — take profits on your own terms and protect your gains.

🔗 Related Pairs to Watch (Correlation Radar)

Watching these helps confirm if Kiwi momentum is real or just a false breakout!

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDUSD #Forex #Kiwi #SwingTrade #DayTrade #Wyckoff #FXTrading #TradingPlan #LayeringStrategy #AUDUSD #DXY

Trade attivo

Nota

📊 NZD/USD Market Report - 18 September 2025💵 Real-Time Exchange Rate

NZD/USD: 0.5975 USD per 1 NZD

Daily Change: +0.0021 (+0.35%) 📈

Weekly Change: +0.85% 📈

Monthly Change: -0.52% 📉

😊 Investor Sentiment Outlook

Retail Traders:

Long (Bullish): 62% 😄

Short (Bearish): 38% 😟

Institutional Traders:

Long (Bullish): 45% 😐

Short (Bearish): 55% 😕

🧠 Overall Investor Mood

Mood: Neutral 😐

Retail traders show moderate optimism, driven by recent NZD strength.

Institutional traders lean cautious, reflecting global economic uncertainties.

😨 Fear & Greed Index

Score: 48/100 (Neutral Zone) ⚖️

Balanced sentiment with no extreme fear or greed.

Investors are cautious but not overly pessimistic.

📈 Fundamental & Macro Score Points

Fundamental Score: 52/100 🟡

New Zealand’s economy shows resilience with stable exports.

US Fed rate cut expectations (4.75% rate) pressure USD slightly.

Macro Score: 46/100 🟠

Global risk appetite is mixed due to US economic data and China’s trade slowdown.

NZD benefits from commodity price stability but faces headwinds from global uncertainty.

🐂 Overall Market Outlook

Outlook: Neutral with slight Bearish tilt 🐻

Short-term: Potential for NZD/USD to test lower levels due to institutional caution.

Long-term: Limited upside unless US data weakens further or NZ commodity exports surge.

🔑 Key Takeaways

NZD/USD slightly up today but underperforming monthly. 📉

Retail traders more bullish than institutions. 😄 vs 😕

Neutral investor mood and Fear & Greed Index suggest caution. ⚖️

Fundamentals and macro factors balanced, no strong directional bias. 🟡🟠

Market leans slightly bearish, watch US economic data for cues. 🐻

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.