⚡ OLECTRA – Wave C Completion Zone Hit | Is a Strong Reversal & Wave C Rally Coming?

🧠 Overall Chart Context

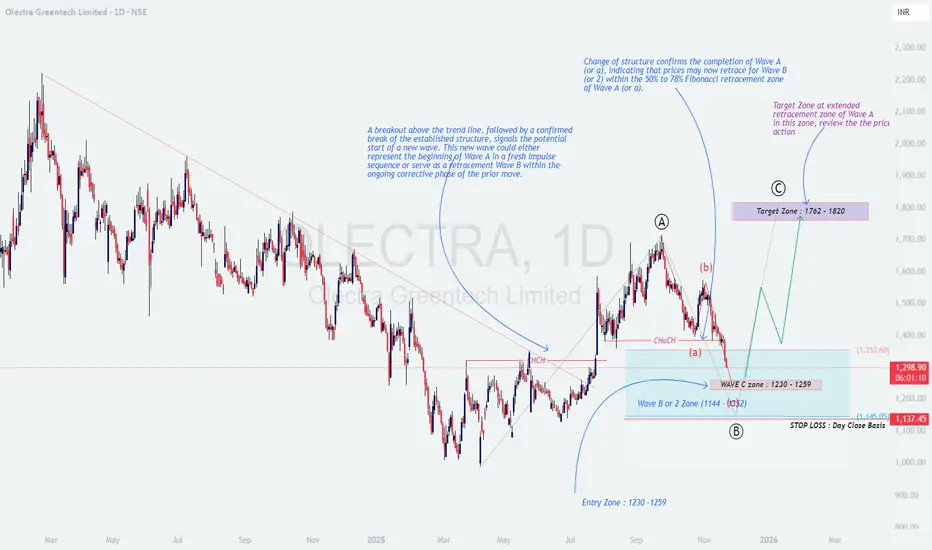

The chart of Olectra Greentech Ltd (1D) shows a well-defined Elliott Wave corrective structure, where price has now entered the expected Wave C completion zone (₹1230–₹1259).

This zone aligns with strong demand + Fibonacci confluence, suggesting a potential end of Wave B/2 and the beginning of a new Wave C impulse.

📌 Price previously made:

A clean Change of Character (ChoCH) → signaling completion of Wave A.

A retracement to the 50–78% retracement zone → forming Wave (b).

A steady fall into Wave C demand zone → now approaching support.

📚 Educational Insights

🎯 Prediction & Targets

If OLECTRA sustains above the ₹1230–₹1259 support zone, a new Wave C rally may unfold.

🎯 First Profit Zone: ₹1,760 – ₹1,820

🎯 Extended Target: ₹1,900+ (if momentum continues)

🛑 Stop Loss: Close below ₹1,137 (invalidates Wave B/2 structure)

💡 Trading Strategy (Educational Purpose Only)

🧩 Summary & Outlook

OLECTRA has entered the crucial Wave C completion zone, which is a high-probability reversal area.

If momentum builds from this demand zone, price may begin a fresh Wave C impulse, aiming for ₹1760–₹1820 in the coming weeks.

A breakout above ₹1353 will act as the early confirmation trigger 🔥.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational purposes only — not investment advice.

🧠 Overall Chart Context

The chart of Olectra Greentech Ltd (1D) shows a well-defined Elliott Wave corrective structure, where price has now entered the expected Wave C completion zone (₹1230–₹1259).

This zone aligns with strong demand + Fibonacci confluence, suggesting a potential end of Wave B/2 and the beginning of a new Wave C impulse.

📌 Price previously made:

A clean Change of Character (ChoCH) → signaling completion of Wave A.

A retracement to the 50–78% retracement zone → forming Wave (b).

A steady fall into Wave C demand zone → now approaching support.

📚 Educational Insights

- 📘 Change of Structure (ChoCH):

A confirmed break of previous swing highs indicates the first shift from bearish to bullish structure — often the start of new wave formation. - ✨ Wave A–B–C Corrections:

Wave B typically retraces 50–78% of Wave A, while Wave C often equals Wave A in size. This structure is playing out perfectly here. - 🌀 Extended Retracement Zones:

When prices fall into strong demand (like ₹1230–₹1260), these zones often create big reversal opportunities in impulsive markets.

🎯 Prediction & Targets

If OLECTRA sustains above the ₹1230–₹1259 support zone, a new Wave C rally may unfold.

🎯 First Profit Zone: ₹1,760 – ₹1,820

🎯 Extended Target: ₹1,900+ (if momentum continues)

🛑 Stop Loss: Close below ₹1,137 (invalidates Wave B/2 structure)

💡 Trading Strategy (Educational Purpose Only)

- 🟢 Entry Zone: ₹1230–₹1259

Wait for reversal candles (hammer, engulfing) or a bullish ChoCH on lower timeframes. - 📈 Confirmation:

A break above ₹1,353 strengthens the probability of Wave C starting. - 🎯 Targets:

• First Target → ₹1762–₹1820

• Extended Target → ₹1900+ - ⚖️ Risk Plan:

Risk only 1–2% of capital.

Stick to closing-basis SL at ₹1,137.

🧩 Summary & Outlook

OLECTRA has entered the crucial Wave C completion zone, which is a high-probability reversal area.

If momentum builds from this demand zone, price may begin a fresh Wave C impulse, aiming for ₹1760–₹1820 in the coming weeks.

A breakout above ₹1353 will act as the early confirmation trigger 🔥.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational purposes only — not investment advice.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.