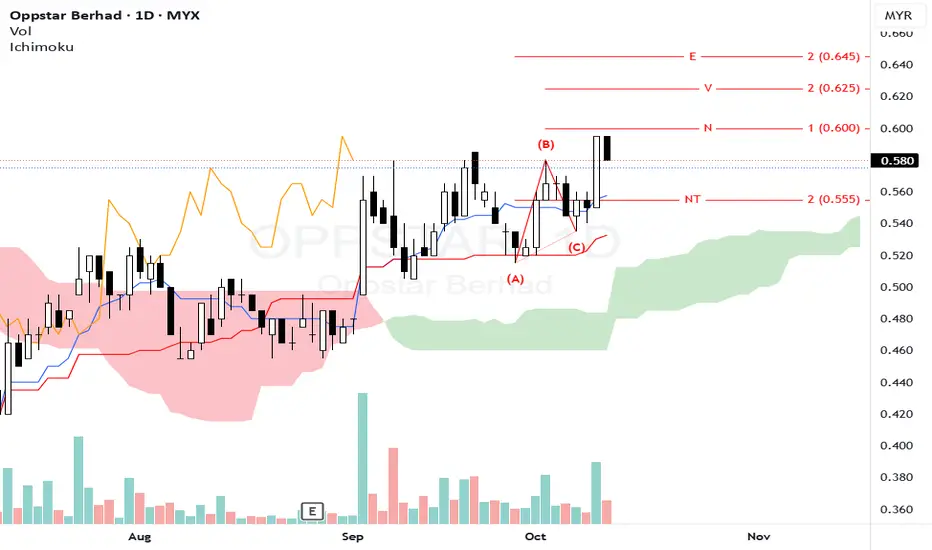

The stock is in an uptrend after a consolidation, with price around 0.58.

Price is testing the NT zone (0.555–0.565) with recent higher highs, indicating a potential setup for continuation if breakout occurs.

Kumo sits below and offers support; price is trading above the Kumo boundary in a favorable context.

Volume has shown spikes on rallies; confirm breakout with sustained volume.

The N-wave suggests a corrective pullback followed by continuation. A break above NT would suggest progression toward N, then V, and possibly E.

Key levels:

Resistance: NT at ~0.555-0.565, then N at ~0.600, V at ~0.625, E at ~0.645

Support: Near-term support near 0.540-0.550 and the Kumo lower edge.

Signals to watch:

Bullish confirmation if there is a daily close above 0.565 with higher volume

Failure to clear NT or a drop back under 0.550 would weaken the setup.

Entry: Enter long on a decisive breakout above 0.565-0.570 with strong volume and bullish candlestick price action.

Stop Loss: Place SL below the NT level, around 0.545-0.550 (or below the Kumo lower boundary for tighter risk).

If price fails to stay above 0.565 or volume does not pick up, consider waiting for a pullback and a safer entry near 0.550.

Notes:

1. Analysis for education purpose only.

2. Trade at your own risk.

Price is testing the NT zone (0.555–0.565) with recent higher highs, indicating a potential setup for continuation if breakout occurs.

Kumo sits below and offers support; price is trading above the Kumo boundary in a favorable context.

Volume has shown spikes on rallies; confirm breakout with sustained volume.

The N-wave suggests a corrective pullback followed by continuation. A break above NT would suggest progression toward N, then V, and possibly E.

Key levels:

Resistance: NT at ~0.555-0.565, then N at ~0.600, V at ~0.625, E at ~0.645

Support: Near-term support near 0.540-0.550 and the Kumo lower edge.

Signals to watch:

Bullish confirmation if there is a daily close above 0.565 with higher volume

Failure to clear NT or a drop back under 0.550 would weaken the setup.

Entry: Enter long on a decisive breakout above 0.565-0.570 with strong volume and bullish candlestick price action.

Stop Loss: Place SL below the NT level, around 0.545-0.550 (or below the Kumo lower boundary for tighter risk).

If price fails to stay above 0.565 or volume does not pick up, consider waiting for a pullback and a safer entry near 0.550.

Notes:

1. Analysis for education purpose only.

2. Trade at your own risk.

Trade chiuso: stop raggiunto

Hit SLDeclinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.