Using the new impulse base of $0.0079 and the confirmed 4.65× multiplier, the recalculated high is:

- $0.0079 × 4.65 = $0.036735

All technical zones are now recalibrated off this updated anchor structure.

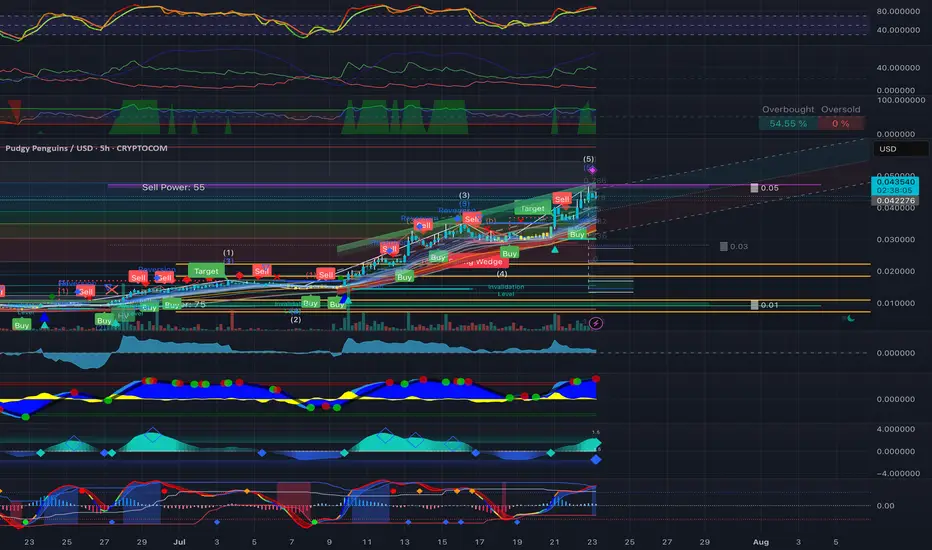

PENGU Technical Breakdown – 4.65x Anchor at $0.0079

🔹 Price Anchors

• Impulse Base (Confirmed): $0.0079

• Target High (Multiplier 4.65x): $0.036735

• Current Price: Refer to real-time chart

• Last Known Local Low: $0.0079 (confirmed base)

📐 Fibonacci Retracement ($0.036735 → $0.0079)

• 0.236: $0.030218

• 0.382: $0.026242

• 0.500: $0.022318

• 0.618: $0.018394

• 0.786: $0.013693

• 1.000: $0.0079

🎯 Fibonacci Extensions (if $0.036735 is reclaimed and exceeded)

• 1.618: $0.060973

• 2.618: $0.096211

• 3.618: $0.131449

📊 Indicators (1D)

• RSI: Monitor reclaim of 50–55 zone for upside unlock

• MACD: Bullish confirmation pending crossover and histogram slope

• Volume: Accumulation baseline rising; breakout requires >20-day average spike

🔑 Critical Price Zones

• Hard Support: $0.0079 (macro base)

• Reversal Trigger: $0.013693 (0.786 reclaim)

• Initial Momentum Zone: $0.018394 (0.618 zone)

• Full Breakout Confirmation: $0.022318 (0.5 reclaim with volume)

⏱ Time Projections (Post-Zone Breach)

• $0.018394 Zone: 6–9 days post $0.0136 reclaim

• $0.022318 Flip: 2–3 weeks under strength

• $0.036735 Retest: 5–6 weeks

• $0.060973 Extension: 7–9 weeks

❌ Invalidation Criteria

• Daily close < $0.0079 invalidates upside structure

• Momentum structure broken below this base

✅ Execution Model – Fibonacci Format

1. Entry Zone: Daily close > $0.013693 with volume acceleration

2. Stop Level: $0.0077 (beneath impulse floor)

3. TP Levels:

• TP1: $0.018394

• TP2: $0.022318

• TP3: $0.036735

• TP4: $0.060973

Recalibrated using $0.0079 impulse anchor and 4.65 multiplier. All Fibonacci zones structurally aligned.

- $0.0079 × 4.65 = $0.036735

All technical zones are now recalibrated off this updated anchor structure.

PENGU Technical Breakdown – 4.65x Anchor at $0.0079

🔹 Price Anchors

• Impulse Base (Confirmed): $0.0079

• Target High (Multiplier 4.65x): $0.036735

• Current Price: Refer to real-time chart

• Last Known Local Low: $0.0079 (confirmed base)

📐 Fibonacci Retracement ($0.036735 → $0.0079)

• 0.236: $0.030218

• 0.382: $0.026242

• 0.500: $0.022318

• 0.618: $0.018394

• 0.786: $0.013693

• 1.000: $0.0079

🎯 Fibonacci Extensions (if $0.036735 is reclaimed and exceeded)

• 1.618: $0.060973

• 2.618: $0.096211

• 3.618: $0.131449

📊 Indicators (1D)

• RSI: Monitor reclaim of 50–55 zone for upside unlock

• MACD: Bullish confirmation pending crossover and histogram slope

• Volume: Accumulation baseline rising; breakout requires >20-day average spike

🔑 Critical Price Zones

• Hard Support: $0.0079 (macro base)

• Reversal Trigger: $0.013693 (0.786 reclaim)

• Initial Momentum Zone: $0.018394 (0.618 zone)

• Full Breakout Confirmation: $0.022318 (0.5 reclaim with volume)

⏱ Time Projections (Post-Zone Breach)

• $0.018394 Zone: 6–9 days post $0.0136 reclaim

• $0.022318 Flip: 2–3 weeks under strength

• $0.036735 Retest: 5–6 weeks

• $0.060973 Extension: 7–9 weeks

❌ Invalidation Criteria

• Daily close < $0.0079 invalidates upside structure

• Momentum structure broken below this base

✅ Execution Model – Fibonacci Format

1. Entry Zone: Daily close > $0.013693 with volume acceleration

2. Stop Level: $0.0077 (beneath impulse floor)

3. TP Levels:

• TP1: $0.018394

• TP2: $0.022318

• TP3: $0.036735

• TP4: $0.060973

Recalibrated using $0.0079 impulse anchor and 4.65 multiplier. All Fibonacci zones structurally aligned.

Avange-Lina

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Avange-Lina

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.