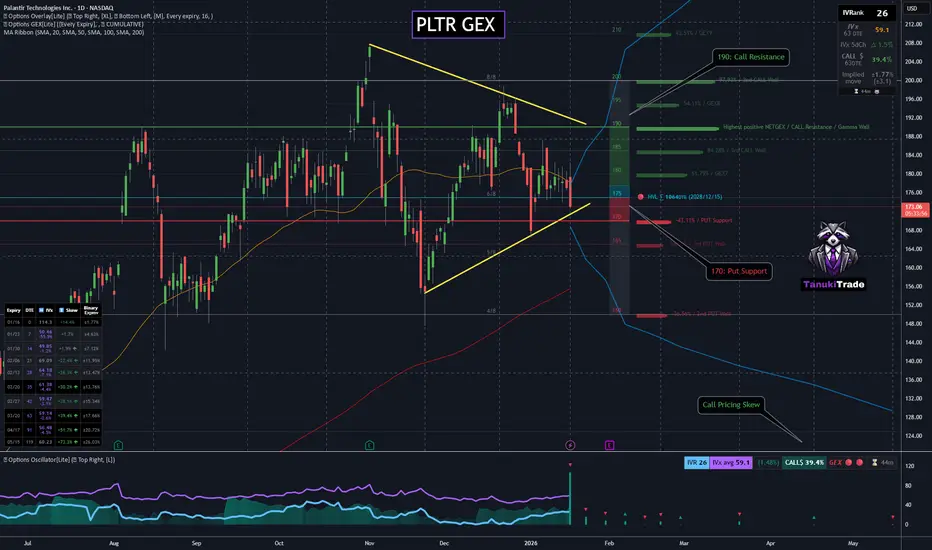

PLTR has entered a tight volatility compression phase, both on price and in the GEX profile, which is now clearly squeezed between well-defined option levels. 🔵

🔶 Current Structure 🔶

This type of GEX compression + price compression rarely persists for long, especially in a high-beta tech name like PLTR. Historically, these regimes resolve via sharp directional expansion, not slow grind.

From a regime perspective, PLTR is currently trading below the HVL, which keeps downside sensitivity elevated. A clean break below 170 would likely trigger 🔴 negative gamma dynamics, opening the door for accelerated downside.

🔶 Options Sentiment 🔶

🔶 Key Structure to Watch 🔶

With price, GEX, and volatility all compressing simultaneously, PLTR is setting up for a near-term breakout, with earnings acting as a potential catalyst. Direction will be determined by which side of the GEX range resolves first.

🔶 Current Structure 🔶

- Call resistance sits at 190

- Put support is defined at 170

- Price has been trading in a narrow range for over a week, confirming balance rather than trend 🔵

This type of GEX compression + price compression rarely persists for long, especially in a high-beta tech name like PLTR. Historically, these regimes resolve via sharp directional expansion, not slow grind.

From a regime perspective, PLTR is currently trading below the HVL, which keeps downside sensitivity elevated. A clean break below 170 would likely trigger 🔴 negative gamma dynamics, opening the door for accelerated downside.

🔶 Options Sentiment 🔶

- Call pricing skew is elevated near 40%, signaling stronger call demand despite range-bound price 🟢

- Implied volatility has been rising steadily over the past 5 sessions, confirming positioning ahead of a catalyst

- Earnings are scheduled for 02/02, adding fuel to an already compressed structure

🔶 Key Structure to Watch 🔶

- 170 – put support / downside trigger 🔴

- 190 – call resistance / upside breakout level 🟢

- HVL – regime pivot 🔵

- Compressed GEX profile – volatility expansion risk 🔵

With price, GEX, and volatility all compressing simultaneously, PLTR is setting up for a near-term breakout, with earnings acting as a potential catalyst. Direction will be determined by which side of the GEX range resolves first.

Boost up your charts with Options PRO!

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Boost up your charts with Options PRO!

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.