🔥

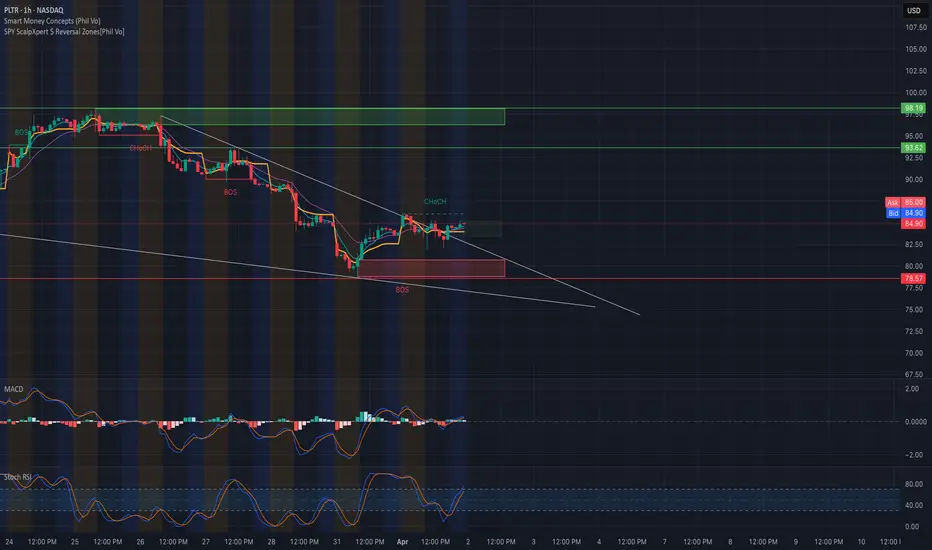

1. Market Structure & Price Action PLTR is compressing inside a descending wedge while forming a small CHoCH near $85, attempting to flip structure. We saw a BOS from the $80 region, pushing toward the $85 liquidity zone. Price is consolidating under a key resistance band around $86, just below the GEX HVL level.

2. SMC & Supply/Demand Zones

* Demand Zone: $78–$80 range acted as a BOS origin with high buyer reaction.

* Supply Zone: $85–$86 now tested multiple times.

* Downward trendline resistance is holding; a break above could invite a run toward the $90 zone.

3. Indicators Analysis

* MACD: Slightly bullish crossover, histogram fading — suggesting early momentum but caution.

* Stoch RSI: Rebounding from oversold, trending upward toward 80 — suggests bullish follow-through if resistance breaks.

4. Options Sentiment & GEX

* GEX Chart shows a thick CALL Resistance / Gamma Wall at $90, aligned with the second call wall (29.31%).

* HVL at $86: Major short-term magnet — breakout above could initiate a gamma squeeze.

* Put support: Strongest level sits at $80, where downside is well-hedged.

* Options Oscillator:

* IVR: 72.4

* IVx Avg: 85.2

* Call$: 26.1%

* GEX Sentiment: 🟢🟢🔴 — still slightly conflicted, but flipping green.

5. Bullish Scenario 🟢

* Entry: Break and retest of $86 with volume

* Target 1: $90 (Gamma Wall)

* Target 2: $93.5–$95

* Stop-loss: Below $83

6. Bearish Scenario 🔴

* Entry: Rejection from $86 + drop under $83

* Target 1: $80

* Target 2: $78–$77 PUT wall

* Stop-loss: Above $86.5

Conclusion PLTR is sitting at a critical inflection point. Compression inside a wedge, early CHoCH + GEX alignment suggests breakout potential, but the $86 HVL must be cleared first. Watch volume and MACD confirmation for the next move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

1. Market Structure & Price Action PLTR is compressing inside a descending wedge while forming a small CHoCH near $85, attempting to flip structure. We saw a BOS from the $80 region, pushing toward the $85 liquidity zone. Price is consolidating under a key resistance band around $86, just below the GEX HVL level.

2. SMC & Supply/Demand Zones

* Demand Zone: $78–$80 range acted as a BOS origin with high buyer reaction.

* Supply Zone: $85–$86 now tested multiple times.

* Downward trendline resistance is holding; a break above could invite a run toward the $90 zone.

3. Indicators Analysis

* MACD: Slightly bullish crossover, histogram fading — suggesting early momentum but caution.

* Stoch RSI: Rebounding from oversold, trending upward toward 80 — suggests bullish follow-through if resistance breaks.

4. Options Sentiment & GEX

* GEX Chart shows a thick CALL Resistance / Gamma Wall at $90, aligned with the second call wall (29.31%).

* HVL at $86: Major short-term magnet — breakout above could initiate a gamma squeeze.

* Put support: Strongest level sits at $80, where downside is well-hedged.

* Options Oscillator:

* IVR: 72.4

* IVx Avg: 85.2

* Call$: 26.1%

* GEX Sentiment: 🟢🟢🔴 — still slightly conflicted, but flipping green.

5. Bullish Scenario 🟢

* Entry: Break and retest of $86 with volume

* Target 1: $90 (Gamma Wall)

* Target 2: $93.5–$95

* Stop-loss: Below $83

6. Bearish Scenario 🔴

* Entry: Rejection from $86 + drop under $83

* Target 1: $80

* Target 2: $78–$77 PUT wall

* Stop-loss: Above $86.5

Conclusion PLTR is sitting at a critical inflection point. Compression inside a wedge, early CHoCH + GEX alignment suggests breakout potential, but the $86 HVL must be cleared first. Watch volume and MACD confirmation for the next move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.