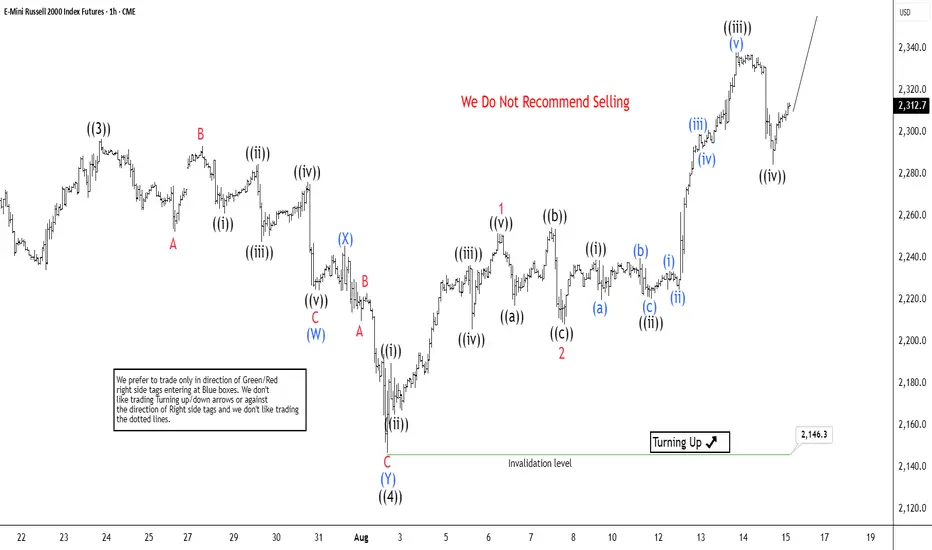

A bullish cycle, launched from the April 9, 2025 low, continues to develop as a five-wave impulse. Starting from that low, wave ((1)) peaked at 1948.6, followed by a wave ((2)) pullback to 1794.3. The Index then rallied in wave ((3)), reaching 2296.5. Wave ((4)) formed a double-three structure, with wave (W) ending at 2224.2, wave (X) at 2245.7, and wave (Y) dropping to 2146.96, completing wave ((4)). The Index has since advanced in wave ((5)), which unfolds as a smaller-scale impulse.

From the wave ((4)) low, wave 1 climbed to 2251.7, and wave 2 corrected to 2208.1, addressing the earlier typo of 22081. The Index then surged in wave 3, also an impulse. Within wave 3, wave ((i)) hit 2238.9, wave ((ii)) dipped to 2220.3, wave ((iii)) rose to 2338.1, and wave ((iv)) pulled back to 2284.2. As long as the 2146.9 pivot low remains intact, the Index should push higher.

In the near term, the bullish structure favors continued upside. Traders must monitor the 2146.9 low, as a break below could indicate a reversal. For now, wave ((5))’s momentum suggests further gains, with the Index likely to test new highs soon. Staying above the pivot reinforces the bullish outlook for the immediate future.

From the wave ((4)) low, wave 1 climbed to 2251.7, and wave 2 corrected to 2208.1, addressing the earlier typo of 22081. The Index then surged in wave 3, also an impulse. Within wave 3, wave ((i)) hit 2238.9, wave ((ii)) dipped to 2220.3, wave ((iii)) rose to 2338.1, and wave ((iv)) pulled back to 2284.2. As long as the 2146.9 pivot low remains intact, the Index should push higher.

In the near term, the bullish structure favors continued upside. Traders must monitor the 2146.9 low, as a break below could indicate a reversal. For now, wave ((5))’s momentum suggests further gains, with the Index likely to test new highs soon. Staying above the pivot reinforces the bullish outlook for the immediate future.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.