📊 SENSEX TRADING PLAN — 03 DEC 2025

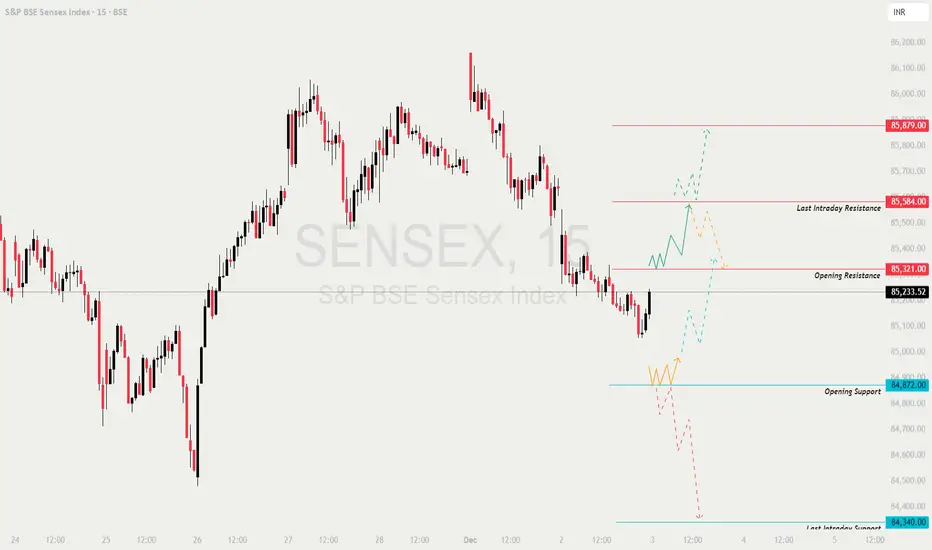

Sensex closed near 85,233, right below the Opening Resistance (85,321).

The structure shows a base at 84,872 and intraday resistance at 85,584, with clear upside and downside liquidity zones.

The opening trend will depend on how the index behaves around 85,321 and 84,872.

🔍 KEY MARKET LEVELS

🟥 Opening Resistance: 85,321

🟥 Last Intraday Resistance: 85,584

🟥 Major Bull Target: 85,879

🟩 Opening Support: 84,872

🟩 Last Intraday Support: 84,340

🟩 Major Bear Target: 84,150 – 84,050

🟢 SCENARIO 1 — GAP-UP OPENING (300+ POINTS)

Expected opening: 85,500–85,600 region (inside or near last intraday resistance)

📘 Educational Insight:

Gap-ups into major resistance are high-risk for longs.

Always wait for either a clean breakout or a clear rejection before acting.

🟧 SCENARIO 2 — FLAT OPENING (Around 85,200–85,300)

Price will open exactly near the Opening Resistance (85,321) — a decision zone.

💡 Educational Note:

Flat openings require patience.

Trend becomes clear after the first 3–4 candles—avoid impulse trades.

🔻 SCENARIO 3 — GAP-DOWN OPENING (300+ POINTS)

Expected opening: 84,800–84,900 zone (near Opening Support)

📘 Educational Note:

Gap-downs into strong support often generate false breakdowns.

Let the retest after the first breakdown decide the direction.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS 📘⚠️

💡 Pro Tip:

When market enters a “No Trade Zone”, shift focus from trading to observing liquidity behaviour.

📌 SUMMARY

Bullish Above:

✔️ 85,321 → 85,420 → 85,500 → 85,584 → 85,879

Bearish Below:

✔️ 85,150 → 84,990 → 84,872 → 84,600 → 84,340 → 84,150

Critical Zones:

🟥 Major Resistance → 85,584

🟩 Major Support → 84,872, 84,340

Trend Deciders:

🔑 Above 85,321 → Bullish day

🔑 Below 84,872 → Intraday weakness

🔑 Below 84,340 → Trend breakdown

🧾 CONCLUSION

Sensex is at a crucial turning point.

The market tone for 03-Dec will be set by how price behaves around:

✔️ 85,321 on the upside

✔️ 84,872 on the downside

Follow levels, not emotions.

Avoid trades in indecisive ranges and strike only on confirmed breakouts or clean retests.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is for educational and study purposes only.

Consult a certified financial advisor before investing or trading.

Sensex closed near 85,233, right below the Opening Resistance (85,321).

The structure shows a base at 84,872 and intraday resistance at 85,584, with clear upside and downside liquidity zones.

The opening trend will depend on how the index behaves around 85,321 and 84,872.

🔍 KEY MARKET LEVELS

🟥 Opening Resistance: 85,321

🟥 Last Intraday Resistance: 85,584

🟥 Major Bull Target: 85,879

🟩 Opening Support: 84,872

🟩 Last Intraday Support: 84,340

🟩 Major Bear Target: 84,150 – 84,050

🟢 SCENARIO 1 — GAP-UP OPENING (300+ POINTS)

Expected opening: 85,500–85,600 region (inside or near last intraday resistance)

- []If the market opens above 85,500, it will directly test the 85,584 resistance (supply zone).

[]For long continuation:

✔️ Break above 85,584

✔️ Retest candle with a strong lower wick

🎯 Targets → 85,720 → 85,879

[]If candles show rejection at 85,584 (upper wicks, volume drop):

Expect profit-booking toward:

➡️ 85,450 → 85,321

[]Aggressive short traders may fade the rejection from 85,584, but only with confirmation such as lower highs on 3–5 min charts.

📘 Educational Insight:

Gap-ups into major resistance are high-risk for longs.

Always wait for either a clean breakout or a clear rejection before acting.

🟧 SCENARIO 2 — FLAT OPENING (Around 85,200–85,300)

Price will open exactly near the Opening Resistance (85,321) — a decision zone.

- []Upside trigger for long trades:

✔️ Break + sustain above 85,321

🎯 Targets → 85,420 → 85,500 → 85,584

[]Downside trigger for shorts:

✔️ Break below 85,150

🎯 Targets → 84,990 → 84,872

[]Avoid taking positions inside a tight range around 85,200–85,321 until a clear directional candle closes.

[]Most reliable setups:

— Retest of 85,321 for longs

— Retest of 85,150 breakdown for shorts

💡 Educational Note:

Flat openings require patience.

Trend becomes clear after the first 3–4 candles—avoid impulse trades.

🔻 SCENARIO 3 — GAP-DOWN OPENING (300+ POINTS)

Expected opening: 84,800–84,900 zone (near Opening Support)

- []If price holds 84,872, expect a reversal bounce toward:

➡️ 85,050 → 85,150 → 85,321

[]For safe long reversal entries:

✔️ Support respected for 3–4 candles

✔️ Higher low structure

✔️ Bullish reversal wick at support

[]If breakdown occurs below 84,872 with strength:

Sellers will target → 84,600 → 84,480 → 84,340

[]Major breakdown trigger:

✔️ Sustained trade below 84,340

🎯 Targets → 84,150 → 84,050

📘 Educational Note:

Gap-downs into strong support often generate false breakdowns.

Let the retest after the first breakdown decide the direction.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS 📘⚠️

- []Trade only after the first 5–10 minutes to avoid trap candles.

[]Use ITM options for momentum trades to reduce theta decay.

[]Keep stop-loss based on chart levels, not random premium numbers.

[]Do not average losing trades — exit and re-enter on new structure.

[]Trail SL after each target hit (especially in strong trends).

[]Avoid naked selling near event days or high VIX. - Stop trading after 2 consecutive losses.

💡 Pro Tip:

When market enters a “No Trade Zone”, shift focus from trading to observing liquidity behaviour.

📌 SUMMARY

Bullish Above:

✔️ 85,321 → 85,420 → 85,500 → 85,584 → 85,879

Bearish Below:

✔️ 85,150 → 84,990 → 84,872 → 84,600 → 84,340 → 84,150

Critical Zones:

🟥 Major Resistance → 85,584

🟩 Major Support → 84,872, 84,340

Trend Deciders:

🔑 Above 85,321 → Bullish day

🔑 Below 84,872 → Intraday weakness

🔑 Below 84,340 → Trend breakdown

🧾 CONCLUSION

Sensex is at a crucial turning point.

The market tone for 03-Dec will be set by how price behaves around:

✔️ 85,321 on the upside

✔️ 84,872 on the downside

Follow levels, not emotions.

Avoid trades in indecisive ranges and strike only on confirmed breakouts or clean retests.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is for educational and study purposes only.

Consult a certified financial advisor before investing or trading.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.