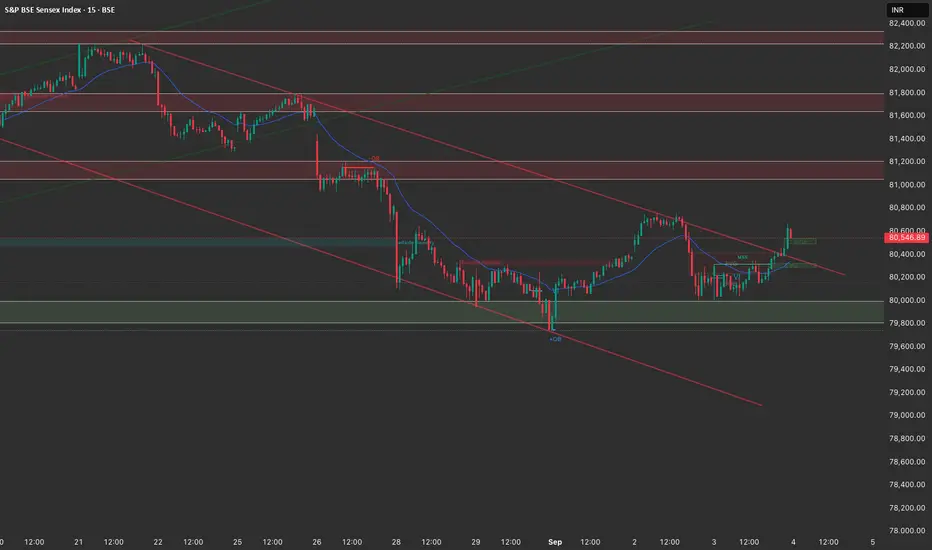

🔎 Higher Timeframe (4H) Outlook

Price rebounded from the 79,800–80,000 demand zone (green box) with multiple wicks showing liquidity grab.

A descending channel breakout attempt is visible → short-term momentum turning bullish.

Overhead supply zones:

80,800–81,000 (immediate)

81,600–81,800 (major resistance + FVG)

Clean Fair Value Gap (FVG) left behind near 80,200–80,350, which may get retested before continuation.

✅ Bias (4H): Mild bullish → until 79,800 holds, upside targets are 80,800 and 81,600.

⏱ Intraday (1H) Structure

Price has broken the short-term downtrend line and reclaimed above 80,500.

Multiple FVGs:

Below current price: 80,300–80,400 → acts as intraday demand.

Above price: 80,800–81,000 → likely first magnet.

Liquidity pools visible above 81,200–81,400 (previous order block).

✅ Bias (1H): Bullish intraday → unless we break below 80,200.

🎯 Scalping / Execution (15M)

Market structure shift (MSS) confirmed after breaking the previous swing high.

Current consolidation around 80,500 after a sharp move.

OB + FVG support: 80,300–80,400 → potential re-entry area.

Next liquidity targets:

80,800 (first test/sell zone)

81,200+ if momentum continues.

📌 Trade Plan for Sensex

Long Setup

Entry: Around 80,300–80,400 (FVG / demand retest)

SL: Below 79,950 (demand invalidation)

Targets:

T1: 80,800

T2: 81,200

T3: 81,600–81,800

Short Setup (countertrend / if rejection seen)

Entry: 80,800–81,000 zone

SL: Above 81,250

Targets:

T1: 80,400

T2: 80,000

⚖️ Summary

Bias: Short-term bullish (demand at 79,800 held).

Key Support: 79,800–80,000.

Key Resistance: 80,800–81,000 → major decision point.

Strategy: Buy dips above 80,200; fade rallies only if rejection at supply.

Price rebounded from the 79,800–80,000 demand zone (green box) with multiple wicks showing liquidity grab.

A descending channel breakout attempt is visible → short-term momentum turning bullish.

Overhead supply zones:

80,800–81,000 (immediate)

81,600–81,800 (major resistance + FVG)

Clean Fair Value Gap (FVG) left behind near 80,200–80,350, which may get retested before continuation.

✅ Bias (4H): Mild bullish → until 79,800 holds, upside targets are 80,800 and 81,600.

⏱ Intraday (1H) Structure

Price has broken the short-term downtrend line and reclaimed above 80,500.

Multiple FVGs:

Below current price: 80,300–80,400 → acts as intraday demand.

Above price: 80,800–81,000 → likely first magnet.

Liquidity pools visible above 81,200–81,400 (previous order block).

✅ Bias (1H): Bullish intraday → unless we break below 80,200.

🎯 Scalping / Execution (15M)

Market structure shift (MSS) confirmed after breaking the previous swing high.

Current consolidation around 80,500 after a sharp move.

OB + FVG support: 80,300–80,400 → potential re-entry area.

Next liquidity targets:

80,800 (first test/sell zone)

81,200+ if momentum continues.

📌 Trade Plan for Sensex

Long Setup

Entry: Around 80,300–80,400 (FVG / demand retest)

SL: Below 79,950 (demand invalidation)

Targets:

T1: 80,800

T2: 81,200

T3: 81,600–81,800

Short Setup (countertrend / if rejection seen)

Entry: 80,800–81,000 zone

SL: Above 81,250

Targets:

T1: 80,400

T2: 80,000

⚖️ Summary

Bias: Short-term bullish (demand at 79,800 held).

Key Support: 79,800–80,000.

Key Resistance: 80,800–81,000 → major decision point.

Strategy: Buy dips above 80,200; fade rallies only if rejection at supply.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.