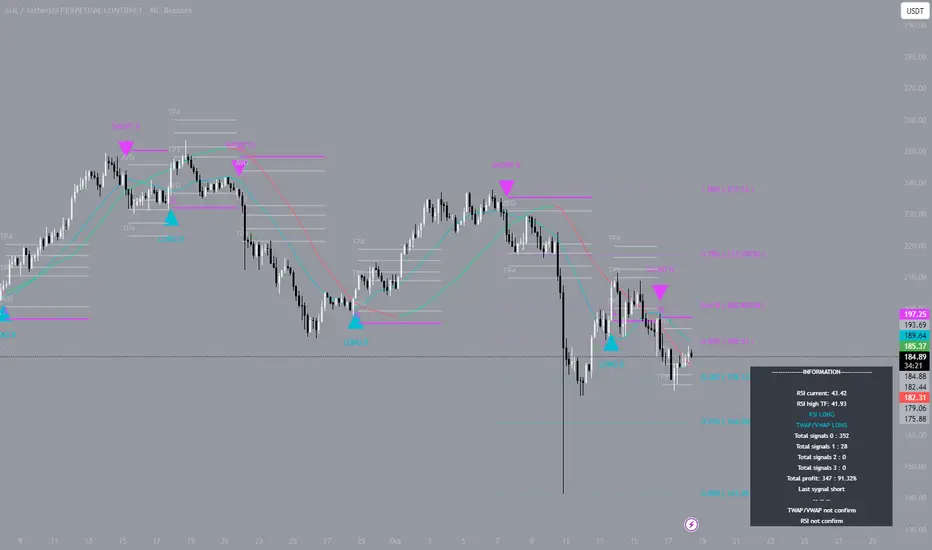

Since October 7, the Solana market has been in turbulence, with drawdowns, sharp reversals, and liquidity spikes. But it’s in periods like these that a systematic approach proves its strength. I opened the first entry on October 7 and closed it at the second take-profit level with modest 1.5x leverage. Then came a pause, and on October 13 I entered again without leverage, cautiously, locking in about 1.5% profit. It was already clear the strategy works even in a turbulent phase. When the next move began on October 16, I followed my proprietary system. The trade unfolded cleanly along the structure: four consecutive take-profit levels, about 7% profit with 2x leverage. Discipline and visual control of levels is what prevented losses.

On TradingView, over 90% of successful traders use multiple indicators at the same time, but the key is always the same: the ability to spot patterns and ignore noise. This systematization makes trading deliberate rather than an emotional chase.

On TradingView, over 90% of successful traders use multiple indicators at the same time, but the key is always the same: the ability to spot patterns and ignore noise. This systematization makes trading deliberate rather than an emotional chase.

🟣indicator: t.me/CryptoVisionPro_news

🟣Forum: t.me/CryptoVision_Forum

🟣Forum: t.me/CryptoVision_Forum

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

🟣indicator: t.me/CryptoVisionPro_news

🟣Forum: t.me/CryptoVision_Forum

🟣Forum: t.me/CryptoVision_Forum

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.