1. Understanding the Concept of Supercycles

Commodities traditionally move in cycles based on supply–demand fluctuations, but a supercycle is different in scale and duration. Price trends in supercycles tend to:

Last for 10–20 years

See sustained upward trajectories

Be driven by massive structural demand

Cause large-scale capital investments and supply expansions

Supercycles usually involve multiple commodities rising together, including crude oil, copper, aluminum, iron ore, wheat, corn, and rare earth metals.

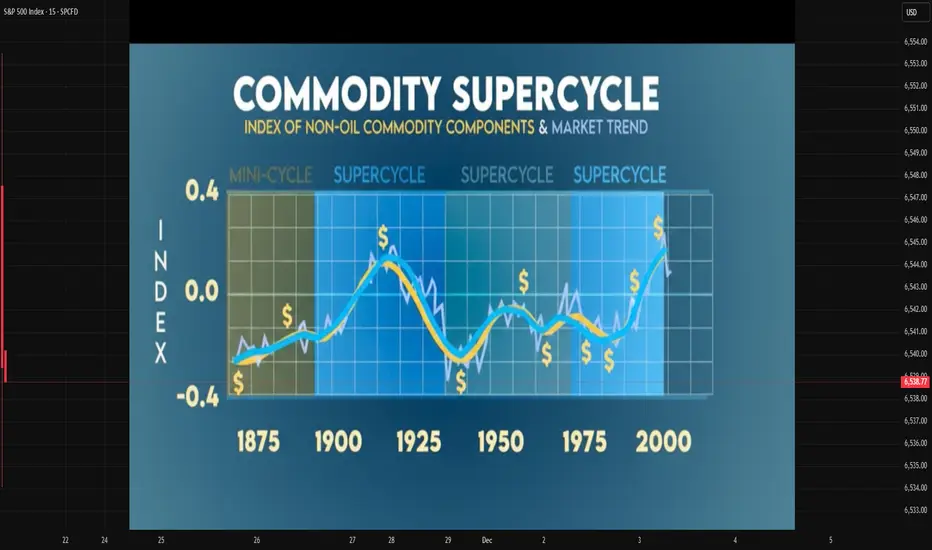

2. Historical Commodity Supercycles

Economists identify four major commodity supercycles in the past 150 years:

a. Late 19th-Century Industrialization Supercycle (1890s–1910s)

This era coincided with the rapid industrial expansion in the US and Europe. Demand surged for coal, metals, and agricultural output to support railway construction, electricity expansion, and manufacturing.

b. Post-WWII Reconstruction Supercycle (1945–1970)

After World War II, Europe and Japan undertook large-scale rebuilding. This sharply increased the demand for energy, steel, and industrial metals. The global population was also rising rapidly, driving agricultural commodity consumption.

c. China-Led Supercycle (2000–2014)

Perhaps the most notable modern supercycle, driven by:

China’s industrialization and urbanization

Massive infrastructure investment

Globalization and trade expansion

Strong energy demand, especially crude oil

Metals like copper, iron ore, and aluminum saw exponential price growth during this period.

d. The “Green Transition” and Renewables Supercycle? (2020s–ongoing)

There is debate over whether the post-2020 environment constitutes a new supercycle. Still, strong demand for battery metals, rare earth elements, lithium, nickel, copper, and silver—essential for clean energy technologies—suggests a potential long-duration upward trend.

3. Drivers Behind Commodity Supercycles

Supercycles are created by mega-trends rather than short-term economic fluctuations. Key drivers include:

a. Industrialization and Urbanization

Emerging economies (e.g., China in the 2000s, India in the 2020s) undergo phases where construction, manufacturing, and infrastructure grow at a rapid pace. This increases demand for:

Steel and iron ore

Cement

Base metals

Energy fuels

b. Technological Shifts

New technologies can reconfigure commodity demand:

Electric vehicles → lithium, nickel, cobalt

Solar energy → silver, polysilicon

Semiconductor demand → rare earths

Technological revolutions often create entirely new commodity markets.

c. Population Growth and Changing Consumption Patterns

Growing populations increase demand for:

Food grains (wheat, rice, corn)

Protein (soybean, livestock feed)

Energy (oil, natural gas)

Urban lifestyles also increase per-capita metal and energy consumption.

d. Underinvestment in Supply

Supercycles often begin after years of:

Low commodity prices

Reduced mining investment

Capacity shrinkage

Supply chain disruptions

When demand picks up suddenly, supply cannot catch up, causing prices to surge.

e. Monetary and Fiscal Stimulus

Loose monetary policy or money supply expansion can raise:

Inflation

Liquidity in markets

Investment in commodity funds

This increases speculative and real demand for commodities.

4. The 2020s: Are We in a New Commodity Supercycle?

Analysts worldwide debate whether the 2020s reflect the start of a new supercycle. Several powerful forces suggest this possibility:

a. Energy Transition and Green Technologies

The transition to a low-carbon global economy hugely increases demand for:

Copper (electric grids, EVs)

Lithium (EV batteries)

Nickel, cobalt (battery chemistry)

Silver (solar panels)

Rare earths (wind turbines, electronics)

Estimates show the energy transition may require 3–10 times more metals compared to the current baseline.

b. Supply Constraints

This decade faces:

Mine depletion

Scarcity of high-grade ores

Stringent environmental rules

Slow permitting processes

Geopolitical resource nationalism (Africa, Latin America)

Supply shortages amplify price pressures.

c. Geopolitical Shifts

Conflicts and tensions between major powers affect commodity flows:

US–China rivalry impacts rare earths

Middle East tensions influence oil

Russia’s sanctions affect natural gas and metals

Realignment of supply chains supports longer-term price elevation.

d. Climate Change Disruptions

Extreme weather affects:

Agricultural output

Mining operations

Shipping routes

More frequent droughts, floods, and storms disrupt supply and raise volatility.

5. Major Commodities Likely to Dominate the Coming Supercycle

1. Copper

Considered the “new oil” of the green economy, copper demand is expected to surge due to:

EVs requiring 2–4 times more copper

Renewable energy grids

Electrification of industries

2. Lithium

A core input for batteries, with demand expected to grow 10–15x by 2035.

3. Nickel and Cobalt

Key metals for high-density battery chemistries.

4. Crude Oil

Despite renewable energy growth, oil demand remains strong due to:

Aviation

Petrochemicals

Industrial use

Slow transition in developing countries

5. Natural Gas and LNG

Seen as a “bridge fuel” in the transition away from coal.

6. Agricultural Commodities

Food prices are rising due to climate volatility and rising global population.

7. Precious Metals (Gold, Silver)

Investors hedge against inflation, currency depreciation, and geopolitical uncertainty.

6. Investment and Trading Implications

a. Long-Term Opportunities

A supercycle supports multi-year rallies in:

Mining stocks

Metal ETFs

Energy companies

Commodity indices

b. Volatility Will Remain High

While long-term trend is upward, short-term fluctuations will be sharp due to:

Interest rate swings

Policy changes

Currency volatility

c. The Role of Emerging Markets

India, Indonesia, Vietnam, and parts of Africa are entering new phases of:

Industrialization

Infrastructure spending

Urbanization

This will add structural demand to the global commodity landscape.

d. ESG and Sustainability Constraints

Environmental regulations limit new mining capacity, pushing prices higher.

7. Conclusion

Commodity supercycles represent long-term, structural shifts in global economic dynamics. They arise when powerful forces—industrialization, population growth, technology transitions, geopolitics, and supply constraints—drive sustained commodity demand. The world today is experiencing pressures that resemble previous supercycle conditions, especially with the rise of green energy, supply chain restructuring, and climate-driven disruptions. Whether or not this evolves into a full-fledged supercycle, commodities like copper, lithium, nickel, crude oil, natural gas, and agricultural products are likely to experience elevated demand and significant price appreciation in the years ahead. Understanding these trends helps investors and policymakers strategize effectively in a resource-constrained and rapidly evolving global economy.

Commodities traditionally move in cycles based on supply–demand fluctuations, but a supercycle is different in scale and duration. Price trends in supercycles tend to:

Last for 10–20 years

See sustained upward trajectories

Be driven by massive structural demand

Cause large-scale capital investments and supply expansions

Supercycles usually involve multiple commodities rising together, including crude oil, copper, aluminum, iron ore, wheat, corn, and rare earth metals.

2. Historical Commodity Supercycles

Economists identify four major commodity supercycles in the past 150 years:

a. Late 19th-Century Industrialization Supercycle (1890s–1910s)

This era coincided with the rapid industrial expansion in the US and Europe. Demand surged for coal, metals, and agricultural output to support railway construction, electricity expansion, and manufacturing.

b. Post-WWII Reconstruction Supercycle (1945–1970)

After World War II, Europe and Japan undertook large-scale rebuilding. This sharply increased the demand for energy, steel, and industrial metals. The global population was also rising rapidly, driving agricultural commodity consumption.

c. China-Led Supercycle (2000–2014)

Perhaps the most notable modern supercycle, driven by:

China’s industrialization and urbanization

Massive infrastructure investment

Globalization and trade expansion

Strong energy demand, especially crude oil

Metals like copper, iron ore, and aluminum saw exponential price growth during this period.

d. The “Green Transition” and Renewables Supercycle? (2020s–ongoing)

There is debate over whether the post-2020 environment constitutes a new supercycle. Still, strong demand for battery metals, rare earth elements, lithium, nickel, copper, and silver—essential for clean energy technologies—suggests a potential long-duration upward trend.

3. Drivers Behind Commodity Supercycles

Supercycles are created by mega-trends rather than short-term economic fluctuations. Key drivers include:

a. Industrialization and Urbanization

Emerging economies (e.g., China in the 2000s, India in the 2020s) undergo phases where construction, manufacturing, and infrastructure grow at a rapid pace. This increases demand for:

Steel and iron ore

Cement

Base metals

Energy fuels

b. Technological Shifts

New technologies can reconfigure commodity demand:

Electric vehicles → lithium, nickel, cobalt

Solar energy → silver, polysilicon

Semiconductor demand → rare earths

Technological revolutions often create entirely new commodity markets.

c. Population Growth and Changing Consumption Patterns

Growing populations increase demand for:

Food grains (wheat, rice, corn)

Protein (soybean, livestock feed)

Energy (oil, natural gas)

Urban lifestyles also increase per-capita metal and energy consumption.

d. Underinvestment in Supply

Supercycles often begin after years of:

Low commodity prices

Reduced mining investment

Capacity shrinkage

Supply chain disruptions

When demand picks up suddenly, supply cannot catch up, causing prices to surge.

e. Monetary and Fiscal Stimulus

Loose monetary policy or money supply expansion can raise:

Inflation

Liquidity in markets

Investment in commodity funds

This increases speculative and real demand for commodities.

4. The 2020s: Are We in a New Commodity Supercycle?

Analysts worldwide debate whether the 2020s reflect the start of a new supercycle. Several powerful forces suggest this possibility:

a. Energy Transition and Green Technologies

The transition to a low-carbon global economy hugely increases demand for:

Copper (electric grids, EVs)

Lithium (EV batteries)

Nickel, cobalt (battery chemistry)

Silver (solar panels)

Rare earths (wind turbines, electronics)

Estimates show the energy transition may require 3–10 times more metals compared to the current baseline.

b. Supply Constraints

This decade faces:

Mine depletion

Scarcity of high-grade ores

Stringent environmental rules

Slow permitting processes

Geopolitical resource nationalism (Africa, Latin America)

Supply shortages amplify price pressures.

c. Geopolitical Shifts

Conflicts and tensions between major powers affect commodity flows:

US–China rivalry impacts rare earths

Middle East tensions influence oil

Russia’s sanctions affect natural gas and metals

Realignment of supply chains supports longer-term price elevation.

d. Climate Change Disruptions

Extreme weather affects:

Agricultural output

Mining operations

Shipping routes

More frequent droughts, floods, and storms disrupt supply and raise volatility.

5. Major Commodities Likely to Dominate the Coming Supercycle

1. Copper

Considered the “new oil” of the green economy, copper demand is expected to surge due to:

EVs requiring 2–4 times more copper

Renewable energy grids

Electrification of industries

2. Lithium

A core input for batteries, with demand expected to grow 10–15x by 2035.

3. Nickel and Cobalt

Key metals for high-density battery chemistries.

4. Crude Oil

Despite renewable energy growth, oil demand remains strong due to:

Aviation

Petrochemicals

Industrial use

Slow transition in developing countries

5. Natural Gas and LNG

Seen as a “bridge fuel” in the transition away from coal.

6. Agricultural Commodities

Food prices are rising due to climate volatility and rising global population.

7. Precious Metals (Gold, Silver)

Investors hedge against inflation, currency depreciation, and geopolitical uncertainty.

6. Investment and Trading Implications

a. Long-Term Opportunities

A supercycle supports multi-year rallies in:

Mining stocks

Metal ETFs

Energy companies

Commodity indices

b. Volatility Will Remain High

While long-term trend is upward, short-term fluctuations will be sharp due to:

Interest rate swings

Policy changes

Currency volatility

c. The Role of Emerging Markets

India, Indonesia, Vietnam, and parts of Africa are entering new phases of:

Industrialization

Infrastructure spending

Urbanization

This will add structural demand to the global commodity landscape.

d. ESG and Sustainability Constraints

Environmental regulations limit new mining capacity, pushing prices higher.

7. Conclusion

Commodity supercycles represent long-term, structural shifts in global economic dynamics. They arise when powerful forces—industrialization, population growth, technology transitions, geopolitics, and supply constraints—drive sustained commodity demand. The world today is experiencing pressures that resemble previous supercycle conditions, especially with the rise of green energy, supply chain restructuring, and climate-driven disruptions. Whether or not this evolves into a full-fledged supercycle, commodities like copper, lithium, nickel, crude oil, natural gas, and agricultural products are likely to experience elevated demand and significant price appreciation in the years ahead. Understanding these trends helps investors and policymakers strategize effectively in a resource-constrained and rapidly evolving global economy.

Hye Guys...

Contact Mail = globalwolfstreet@gmail.com

.. Premium Trading service ...

Contact Mail = globalwolfstreet@gmail.com

.. Premium Trading service ...

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Hye Guys...

Contact Mail = globalwolfstreet@gmail.com

.. Premium Trading service ...

Contact Mail = globalwolfstreet@gmail.com

.. Premium Trading service ...

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.