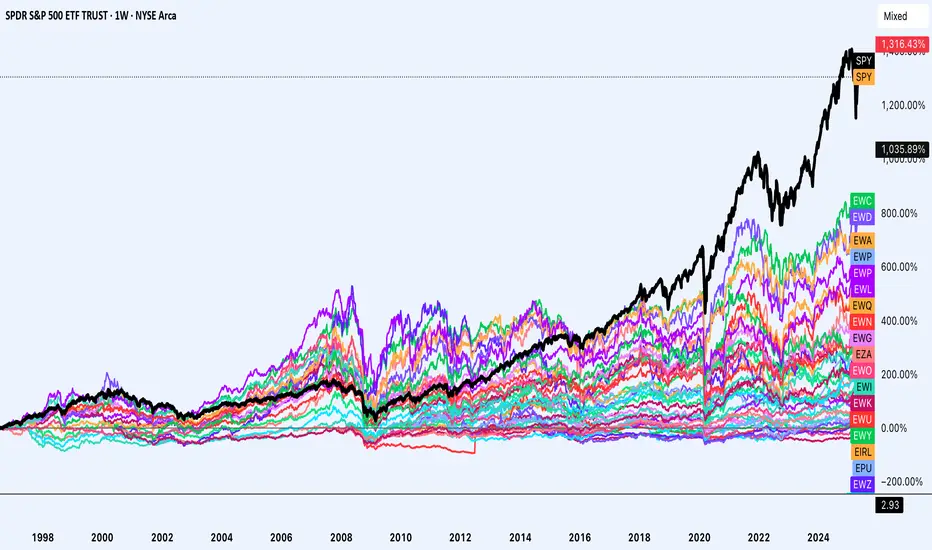

The US market has consistently outperformed global markets since the global financial crisis, it has also outperformed since the tech bubble. A portion of this can be attributed to a strong dollar (many markets outperformed in local currency). However this strong dollar performance may be coming to an end.

In addition there are structural reasons why the US has and may continue to outperform:

1. A larger weighting to higher growth sectors such as technology, communication services and a lower weight to lower growth sectors such as energy and materials.

2. Better rule of law, better focus on shareholder returns, less crowding from the government and state owned enterprises lowering the return of markets. (EM SOEs as an example)

3. US attracting global talent and fostering innovation. "The smartest person in any subject will likely go to the US'

So how can the US consistently underperform given these things?

1. Well for one the dollar may start to be a worse performing currency, it seems the current administration wants that. This not only lowers the performance of the US compared to global markets it also lowers the foreign inflows to US assets and also benefits EMs with dollar denominated debts.

2. The idea that the US attracts the best talent and fosters innovation may be declining with the current cultural attacks on immigration and the federal government spending cuts impacting research projects.

3. Global markets currently have a lower weighting to high growth sectors however this may not continue and instead we may start to see the marginal weight of sectors going to higher growth sectors instead of lower growth sectors.

4. The darling companies in most countries may list in their local markets instead of in the US. (Seeing the UK ease regulations of share classes, Chinese companies not welcomed in the US, European companies redomiciling back to Europe)

5. Valuations, Valuations, Valuations. Gun to your head: Next ten years would the multiple become a headwind or tailwind for the US market? What about for global markets? US trades at roughly 21x forward earnings whereas the UK trades at 12x, Eurozone at 14x, Japan at 13.5x, EM at 12x and China at 11x.

If after 10 years the US trades at an 18x multiple and the UK as an example trades at a 15x valuation that would be an annualized headwind of 1.5% for the US and an annualized tailwind of 2.3% for the UK. Add to that the effect of low starting valuations on yield (US net shareholder yield is close to 2% whereas the UK yields 4%).

Just rough numbers on performance for US vs UK next 10 years.

US: -1.5% multiple change, 2% yield, 10% earnings growth = 10.5%

UK: 2.3% multiple change, 4% yield, 6% earnings growth, 1% currency = 13.3%

Everyone is over allocated to the US and is under allocated outside the US. Currently the US represents around 20% of global GDP however it represents 70% of global market cap. 70 cents of every dollar in the equity market is in and goes to the US. Will this likely increase or decrease as a share? The next question becomes who will take that share if it falls?

Investing outside the US does not mean:

Investing in markets with bad shareholder friendliness

Investing in markets with a history of fraud

Investing in markets with notorious related party transactions

Investing in markets with high starting valuations.

Some markets such as China can have the first 3 issues applied to it, some markets such as India may frankly have all of these issues. Some markets in Europe may have the first and last aspect. And some markets likely have none of these issues. I propose Japan, UK and Northern Europe.

History is only a guide however the history of returns involved one of the single best economic performances of any country coming from the US which resulted in an amazing stock market with great returns, this is not guaranteed.

Historically stocks return nominally 10% and on a real basis 7% which can be decomposed to 3% yield and 7% earnings growth with virtually no multiple change (on long enough time horizons) when you start at a high valuation the yield component is lower and you need higher earnings growth to compensate. And on a much longer time horizon earnings growth is what really matters.

Earnings growth does not exist out of no where, it usually tracks nominal gdp growth + a margin increase from operations and or sector compositions.

Nothing is guaranteed, your next maximum drawdown is in the future, expect the unexpected and keep invested as the global debt bubble will likely be inflated away.

In addition there are structural reasons why the US has and may continue to outperform:

1. A larger weighting to higher growth sectors such as technology, communication services and a lower weight to lower growth sectors such as energy and materials.

2. Better rule of law, better focus on shareholder returns, less crowding from the government and state owned enterprises lowering the return of markets. (EM SOEs as an example)

3. US attracting global talent and fostering innovation. "The smartest person in any subject will likely go to the US'

So how can the US consistently underperform given these things?

1. Well for one the dollar may start to be a worse performing currency, it seems the current administration wants that. This not only lowers the performance of the US compared to global markets it also lowers the foreign inflows to US assets and also benefits EMs with dollar denominated debts.

2. The idea that the US attracts the best talent and fosters innovation may be declining with the current cultural attacks on immigration and the federal government spending cuts impacting research projects.

3. Global markets currently have a lower weighting to high growth sectors however this may not continue and instead we may start to see the marginal weight of sectors going to higher growth sectors instead of lower growth sectors.

4. The darling companies in most countries may list in their local markets instead of in the US. (Seeing the UK ease regulations of share classes, Chinese companies not welcomed in the US, European companies redomiciling back to Europe)

5. Valuations, Valuations, Valuations. Gun to your head: Next ten years would the multiple become a headwind or tailwind for the US market? What about for global markets? US trades at roughly 21x forward earnings whereas the UK trades at 12x, Eurozone at 14x, Japan at 13.5x, EM at 12x and China at 11x.

If after 10 years the US trades at an 18x multiple and the UK as an example trades at a 15x valuation that would be an annualized headwind of 1.5% for the US and an annualized tailwind of 2.3% for the UK. Add to that the effect of low starting valuations on yield (US net shareholder yield is close to 2% whereas the UK yields 4%).

Just rough numbers on performance for US vs UK next 10 years.

US: -1.5% multiple change, 2% yield, 10% earnings growth = 10.5%

UK: 2.3% multiple change, 4% yield, 6% earnings growth, 1% currency = 13.3%

Everyone is over allocated to the US and is under allocated outside the US. Currently the US represents around 20% of global GDP however it represents 70% of global market cap. 70 cents of every dollar in the equity market is in and goes to the US. Will this likely increase or decrease as a share? The next question becomes who will take that share if it falls?

Investing outside the US does not mean:

Investing in markets with bad shareholder friendliness

Investing in markets with a history of fraud

Investing in markets with notorious related party transactions

Investing in markets with high starting valuations.

Some markets such as China can have the first 3 issues applied to it, some markets such as India may frankly have all of these issues. Some markets in Europe may have the first and last aspect. And some markets likely have none of these issues. I propose Japan, UK and Northern Europe.

History is only a guide however the history of returns involved one of the single best economic performances of any country coming from the US which resulted in an amazing stock market with great returns, this is not guaranteed.

Historically stocks return nominally 10% and on a real basis 7% which can be decomposed to 3% yield and 7% earnings growth with virtually no multiple change (on long enough time horizons) when you start at a high valuation the yield component is lower and you need higher earnings growth to compensate. And on a much longer time horizon earnings growth is what really matters.

Earnings growth does not exist out of no where, it usually tracks nominal gdp growth + a margin increase from operations and or sector compositions.

Nothing is guaranteed, your next maximum drawdown is in the future, expect the unexpected and keep invested as the global debt bubble will likely be inflated away.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.