Idea Text:

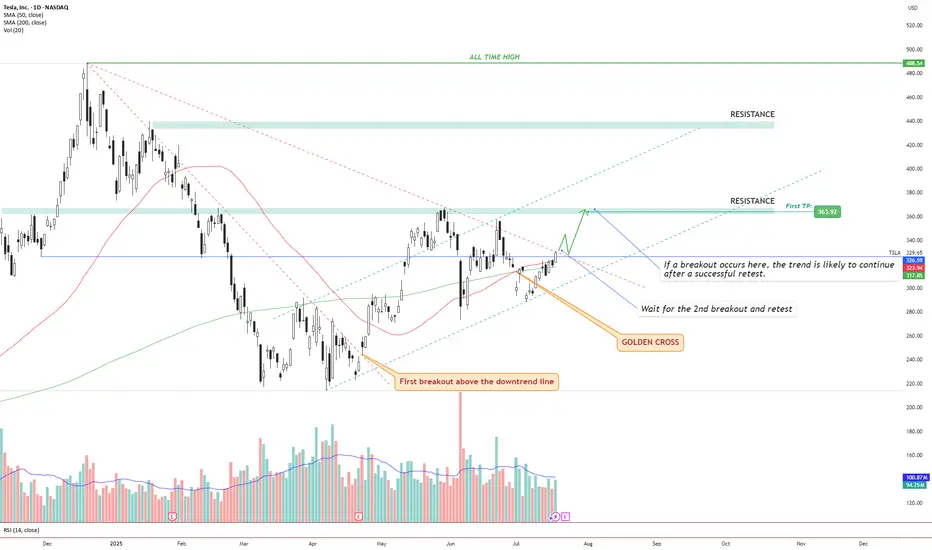

Tesla TSLA has recently printed a powerful Golden Cross, where the 50 SMA has crossed above the 200 SMA — signaling a potential long-term bullish shift in trend.

TSLA has recently printed a powerful Golden Cross, where the 50 SMA has crossed above the 200 SMA — signaling a potential long-term bullish shift in trend.

But price action shows more:

We’re observing a dual-breakout structure, where the first breakout above the long-term downtrend line has already occurred (see orange label), and the price is now approaching a critical horizontal resistance zone.

Let’s break it down step-by-step:

🔸 Step 1: Golden Cross

The 50 SMA crossed above 200 SMA — a classic signal for trend reversal. This often attracts institutional interest, especially if followed by breakout confirmation.

🔸 Step 2: First Breakout (Already Confirmed)

Price broke above the descending trendline, retested it, and maintained higher structure. This breakout initiated a shift in market sentiment from bearish to neutral-bullish.

🔸Step 3: Second Breakout (Setup Forming)

Price is now testing horizontal resistance around $330–$335 zone. This zone also coincides with dynamic resistance from prior failed swing attempts. A successful breakout above this level, followed by a clean retest, can serve as confirmation for a bullish continuation.

🔸 Step 4: Target Setting

🎯 First TP is set at $363.92, a well-defined resistance level. If the breakout holds, next potential targets may develop around key zones such as $395 and $440, depending on price strength and continuation.

🔸 Risk Management

✅ Ideal entry after retest of breakout above ~$335.

❌ Stop-loss below the breakout level or below 50 SMA (~$315 area), depending on entry style.

🔄 Monitor volume: breakout without volume = weak move.

Conclusion:

We are watching a classic price action + moving average confluence setup. Golden Cross, breakout + retest structure, clean resistance level, and defined targets all align.

⚠️ Not financial advice. DYOR.

Tesla

But price action shows more:

We’re observing a dual-breakout structure, where the first breakout above the long-term downtrend line has already occurred (see orange label), and the price is now approaching a critical horizontal resistance zone.

Let’s break it down step-by-step:

🔸 Step 1: Golden Cross

The 50 SMA crossed above 200 SMA — a classic signal for trend reversal. This often attracts institutional interest, especially if followed by breakout confirmation.

🔸 Step 2: First Breakout (Already Confirmed)

Price broke above the descending trendline, retested it, and maintained higher structure. This breakout initiated a shift in market sentiment from bearish to neutral-bullish.

🔸Step 3: Second Breakout (Setup Forming)

Price is now testing horizontal resistance around $330–$335 zone. This zone also coincides with dynamic resistance from prior failed swing attempts. A successful breakout above this level, followed by a clean retest, can serve as confirmation for a bullish continuation.

🔸 Step 4: Target Setting

🎯 First TP is set at $363.92, a well-defined resistance level. If the breakout holds, next potential targets may develop around key zones such as $395 and $440, depending on price strength and continuation.

🔸 Risk Management

✅ Ideal entry after retest of breakout above ~$335.

❌ Stop-loss below the breakout level or below 50 SMA (~$315 area), depending on entry style.

🔄 Monitor volume: breakout without volume = weak move.

Conclusion:

We are watching a classic price action + moving average confluence setup. Golden Cross, breakout + retest structure, clean resistance level, and defined targets all align.

This setup is valid only with confirmation. No breakout = no trade.

⚠️ Not financial advice. DYOR.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.