Market Preview

* Macro backdrop: U.S. index futures are steady after a strong tech rally last week. Rates and the dollar remain stable, leaving room for growth stocks to extend gains.

* Sector tone: EV and AI-related momentum is strong, with Tesla leading on heavy volume and institutional call buying.

Technical Analysis – TSLA

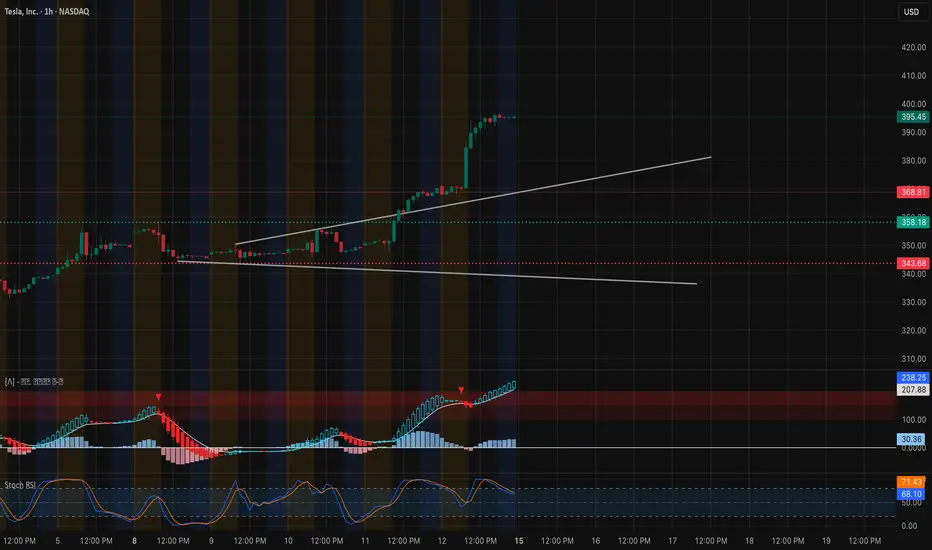

Trend & Structure (1-Hour Chart)

* Price surged to $395–396 and is consolidating near the highs.

* Structure remains firmly bullish with higher highs/lows and a well-defined rising channel.

Key Levels

* Resistance: $396.6 (highest positive NETGEX / CALL Resistance), $405, and $420 as next upside targets.

* Support: $389.9 (near-term pivot), $368.8 (major breakout base), $347.5 (HVL zone).

Momentum & Indicators

* MACD on 1H is bullish and expanding, supporting continuation.

* Stoch RSI is near overbought, signaling possible brief consolidation or a minor pullback before another leg higher.

* Volume remains strong, showing solid institutional demand.

Options/GEX Insight

* Massive call positioning (≈98% call bias) with positive GEX layers up to $420 suggests market makers may support higher prices.

* IVR 17.4 and IVx avg 61.5 indicate elevated but manageable volatility.

Trade Scenarios for Sept 15

* Bullish Plan:

* Entry: Break/hold above $396.6 with volume.

* Targets: $405 → $420.

* Stop: Below $389.9.

* Defensive Plan (if rejection occurs):

* Entry: Loss of $389.9 with momentum shift.

* Targets: $368.8 → $347.5.

* Stop: Above $396.6.

Summary

Tesla heads into Monday with a strong bullish setup. Holding above $389.9 keeps momentum intact, while a breakout over $396.6 could trigger a run toward $405–420.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

* Macro backdrop: U.S. index futures are steady after a strong tech rally last week. Rates and the dollar remain stable, leaving room for growth stocks to extend gains.

* Sector tone: EV and AI-related momentum is strong, with Tesla leading on heavy volume and institutional call buying.

Technical Analysis – TSLA

Trend & Structure (1-Hour Chart)

* Price surged to $395–396 and is consolidating near the highs.

* Structure remains firmly bullish with higher highs/lows and a well-defined rising channel.

Key Levels

* Resistance: $396.6 (highest positive NETGEX / CALL Resistance), $405, and $420 as next upside targets.

* Support: $389.9 (near-term pivot), $368.8 (major breakout base), $347.5 (HVL zone).

Momentum & Indicators

* MACD on 1H is bullish and expanding, supporting continuation.

* Stoch RSI is near overbought, signaling possible brief consolidation or a minor pullback before another leg higher.

* Volume remains strong, showing solid institutional demand.

Options/GEX Insight

* Massive call positioning (≈98% call bias) with positive GEX layers up to $420 suggests market makers may support higher prices.

* IVR 17.4 and IVx avg 61.5 indicate elevated but manageable volatility.

Trade Scenarios for Sept 15

* Bullish Plan:

* Entry: Break/hold above $396.6 with volume.

* Targets: $405 → $420.

* Stop: Below $389.9.

* Defensive Plan (if rejection occurs):

* Entry: Loss of $389.9 with momentum shift.

* Targets: $368.8 → $347.5.

* Stop: Above $396.6.

Summary

Tesla heads into Monday with a strong bullish setup. Holding above $389.9 keeps momentum intact, while a breakout over $396.6 could trigger a run toward $405–420.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.