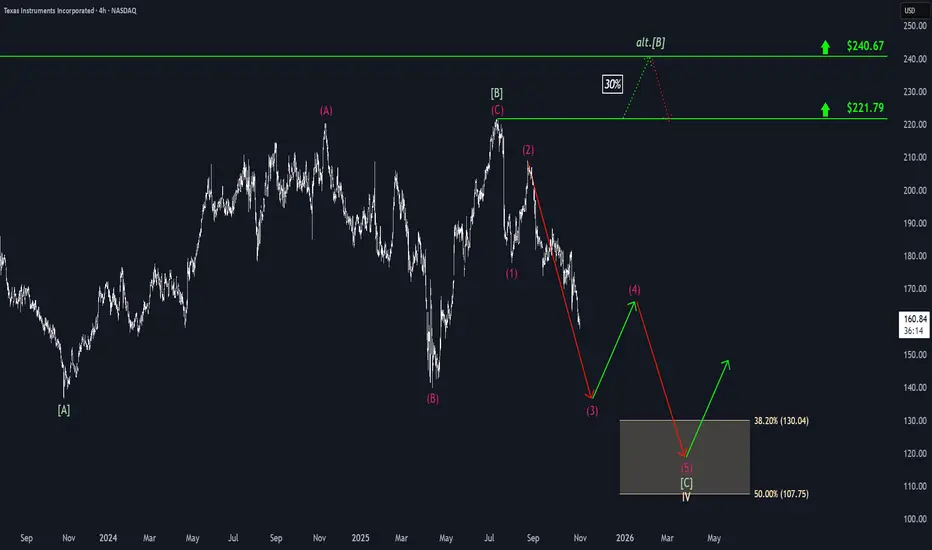

Despite some interim countermoves, Texas Instruments continued to see further sell-offs, advancing our primary scenario. Currently, we still see additional downside potential in magenta wave (3) before expecting a temporary rebound in wave (4). With wave (5), TXN is likely to dip into our beige Target Zone between $130.04 and $107.75, completing the broader correction of beige wave IV. There remains a 30% chance that a new (corrective) high in green wave alt.[B] could still materialize, delaying the end of the correction. In this scenario, price would first move above resistance at $221.79 before reversing at the higher $240.67 level.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.