UST 10Y Technical Outlook for the week Aug 18-22 (updated daily)

UST 10Y Technical Outlook for the week Aug 18-22 (updated daily)

Overnight

The yield on the 10-year US Treasury note stabilized at approximately 4.3% on Friday, following a rebound from 4.2% in the prior session, driven by economic data that tempered expectations for aggressive Federal Reserve rate cuts. Strong July retail sales growth, both in headline and control group figures, alongside an unexpected surge in import prices—the largest in 15 months despite new tariffs—fueled concerns about persistent inflationary pressures. These developments, combined with expansionary fiscal policies and higher deficit spending, have raised doubts about inflation aligning with the Fed’s target, despite earlier subdued CPI data. Market sentiment continues to favor a 25-basis-point rate cut at the Fed’s September meeting, but confidence in three total cuts for 2025 has diminished, as reflected in rate futures. Additionally, the latest 10-year note auction saw reduced participation from indirect bidders, influenced by tariffs and fiscal policy concerns.

Economic Release for the week Aug 18-22 myfxbook.com/forex-economic-calendar

Weekly bias

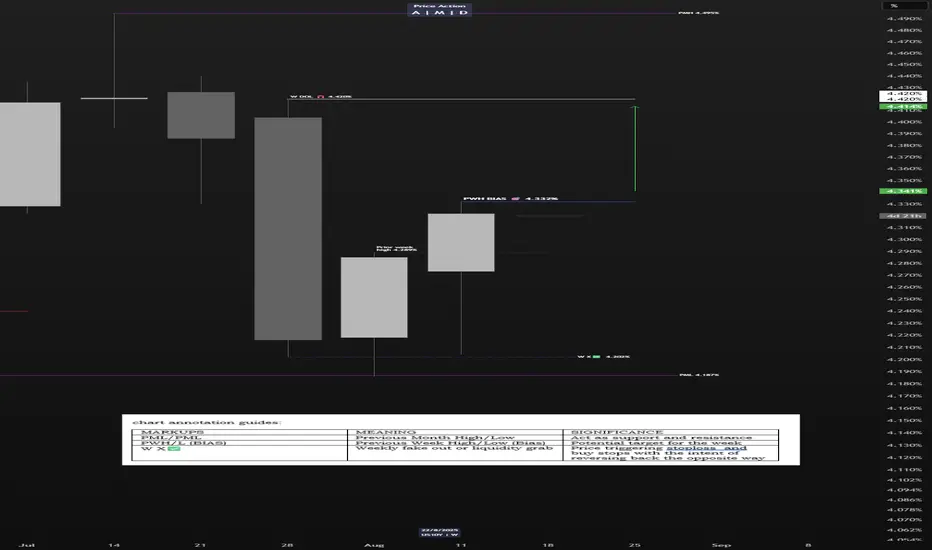

Lets start the week with a long-term look. On the monthly chart (tradingview.com/x/nzXSNjxt/) we can see that we are just trading within the previous month’s range. We almost broke the previous month low of 4.187% but aggressively bounced back up. We need to see an aggressive break above or below to define a new direction otherwise we are sideways within the range. On the weekly chart, ( ) after the market grabbed the liquidity at 4.202% the yield has bounced back and for the week I am anticipating previous week high, 4.332%, as a target.

) after the market grabbed the liquidity at 4.202% the yield has bounced back and for the week I am anticipating previous week high, 4.332%, as a target.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Overnight

The yield on the 10-year US Treasury note stabilized at approximately 4.3% on Friday, following a rebound from 4.2% in the prior session, driven by economic data that tempered expectations for aggressive Federal Reserve rate cuts. Strong July retail sales growth, both in headline and control group figures, alongside an unexpected surge in import prices—the largest in 15 months despite new tariffs—fueled concerns about persistent inflationary pressures. These developments, combined with expansionary fiscal policies and higher deficit spending, have raised doubts about inflation aligning with the Fed’s target, despite earlier subdued CPI data. Market sentiment continues to favor a 25-basis-point rate cut at the Fed’s September meeting, but confidence in three total cuts for 2025 has diminished, as reflected in rate futures. Additionally, the latest 10-year note auction saw reduced participation from indirect bidders, influenced by tariffs and fiscal policy concerns.

Economic Release for the week Aug 18-22 myfxbook.com/forex-economic-calendar

Weekly bias

Lets start the week with a long-term look. On the monthly chart (tradingview.com/x/nzXSNjxt/) we can see that we are just trading within the previous month’s range. We almost broke the previous month low of 4.187% but aggressively bounced back up. We need to see an aggressive break above or below to define a new direction otherwise we are sideways within the range. On the weekly chart, (

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Nota

US 10Y Treasury Daily Bias Aug 19Overnight

On Monday, the yield on the 10-year US Treasury note remained steady above 4.3%, as markets evaluated the implications of a high-profile meeting between US President Donald Trump and Ukrainian President Volodymyr Zelensky in Washington. During the Oval Office discussions, Trump expressed optimism for a swift resolution to ongoing geopolitical tensions, committing to US security support for Ukraine and announcing plans to engage with Russian President Vladimir Putin following talks with Zelensky and European leaders. Despite Friday’s discussions with Putin yielding no ceasefire agreement, Russia signaled openness to US and European security guarantees for Ukraine as part of a potential peace deal. Meanwhile, investors are focused on the upcoming Federal Reserve Jackson Hole symposium, with markets pricing in an 83% probability of a 25 basis point rate cut in September. However, stronger-than-expected producer inflation and retail sales data have reduced expectations for a larger 50 basis point cut.

Economic Release Today myfxbook.com/forex-economic-calendar

Daily Bias

As anticipated yesterday, 4.332% was achieved with a close above which tells me that there’s a momentum of the move. For today, I anticipate that the previous day high of 4.353% is the target with the weekly draw on liquidity in sight 4.20% (W DOL)

Nota

US 10Y Treasury Daily Bias Aug 20Overnight

On Tuesday, the US 10-year Treasury note yield slightly declined toward 4.3% following a 10-basis-point rise over the prior three sessions, as investors evaluated the Federal Reserve’s interest rate outlook. The upcoming release of the FOMC’s latest meeting minutes is expected to clarify the extent of concerns regarding a labor market slowdown, particularly after two policymakers opposed rate cuts last month. Despite recent data showing stronger-than-expected producer inflation and retail sales, which tempered expectations for aggressive rate cuts, weaker earnings from major retailers exerted downward pressure on yields. While markets still anticipate a 25-basis-point rate cut at the Federal Reserve’s September meeting, confidence in three total cuts for 2025 has diminished, as reflected in rate futures.

Economic Release myfxbook.com/forex-economic-calendar

There are no expected high impact news today but Thursday expect FOMC minutes to be released and the start of Jackson Hole Symposium.

Daily Bias

Following three consecutive days of price depreciation, resulting in elevated yields, the market has shifted its focus toward evaluating fundamental factors, with consensus expectations holding for two Federal Reserve interest rate reductions within the current year. Additionally, market participants are closely monitoring potential indications of policy adjustments at the forthcoming Jackson Hole symposium. As a result, yields failed to attain our projected target of 4.353%, instead declining to 4.298%. We anticipate that yields will test this lower threshold in today’s trading session.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Nota

US 10Y Treasury Daily Bias Aug 21Overnight

The yield on the 10-year US Treasury note dipped slightly below 4.3% on Wednesday, continuing a modest retreat from the previous day, as markets evaluated the Federal Reserve’s interest rate trajectory. According to the minutes from the Federal Open Market Committee’s (FOMC) latest meeting, most members viewed inflationary pressures as a greater concern than an abrupt slowdown in labor market conditions, noting that tariffs could further exacerbate inflation with effects materializing at an uncertain pace. These sentiments echoed Federal Reserve Chairman Jerome Powell’s hawkish remarks following the July meeting. Investors are now focused on Powell’s upcoming keynote address at Jackson Hole for further clarity on the FOMC’s approach to balancing inflation and labor market risks, particularly after recent downward revisions to non-farm payrolls and weak ISM PMI data, which have fueled market expectations for multiple rate cuts in 2025. Current rate futures indicate anticipation of two additional rate cuts this year.

Economic Release myfxbook.com/forex-economic-calendar

Daily Bias

As projected yesterday, our target of 4.298% was achieved and successfully closed. Following the release of the FOMC minutes last night, market participants are likely to closely monitor Federal Reserve Chairman Jerome Powell’s remarks during the Jackson Hole keynote address. The FOMC minutes reflect a notably hawkish stance, consistent with the Chairman’s comments after the July meeting. Given this, I would exercise caution in predicting market movements prior to the keynote. From a technical perspective, we may see a retest of the previous day's low at 4.277%; however, volatility is expected in the lead-up to the address.

**Disclaimer:** The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Nota

US 10Y Treasury Daily Bias Aug 21Overnight

The 10-year US Treasury note yield climbed to 4.33% on Thursday, driven by robust economic indicators and persistent inflationary pressures, bolstering expectations for hawkish Federal Open Market Committee (FOMC) policies. Key data points include the S&P PMI reaching its highest level this year, signaling strong business growth, and elevated input costs prompting firms to increase selling prices at the fastest pace in three years. This aligns with the Philly Fed’s three-year high inflation gauge. FOMC minutes from the latest meeting highlighted a consensus among policymakers that inflationary risks outweigh labor market concerns, with fears of unanchored inflation expectations. However, labor market signals were mixed, as rising continuing jobless claims reported by the Department of Labor (DoL) hit a 2021 peak, offsetting stronger labor developments in the S&P report.

Outlook: Attention turns to Federal Reserve Chair Jerome Powell’s upcoming keynote speech on Friday, which may provide further clarity on the Fed’s future interest rate direction.

Source: TradingView News, Trading Economics

Economic Release myfxbook.com/forex-economic-calendar

Daily Bias

Once again, our target was not achieved yesterday due to stronger-than-expected S&P PMI data, which reinforced expectations for a hawkish FOMC policy stance. Today, attention is focused on the Federal Reserve Chair’s keynote address, which is likely to influence the future direction of interest rates. From a technical perspective, I anticipate the previous day’s high of 4.347% and the prior daily swing high of 4.353% as potential targets. However, I recommend exercising caution and awaiting the Fed Chair’s address before initiating any trades.

**Disclaimer:** The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.