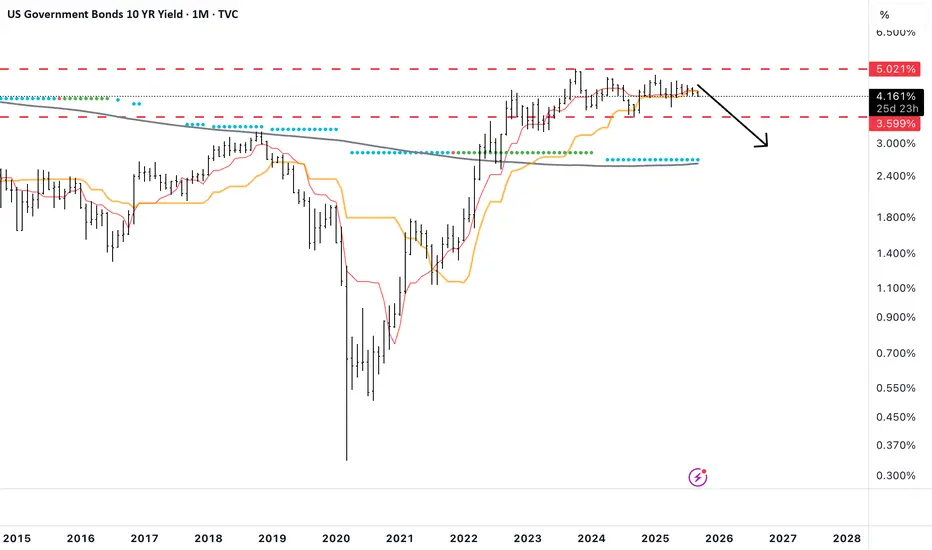

Yields are sniffing out the recession that is already in motion

Everyone keeps talking about how rates cuts are going to push long term yields higher because that is what happened last September, etc, etc.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.