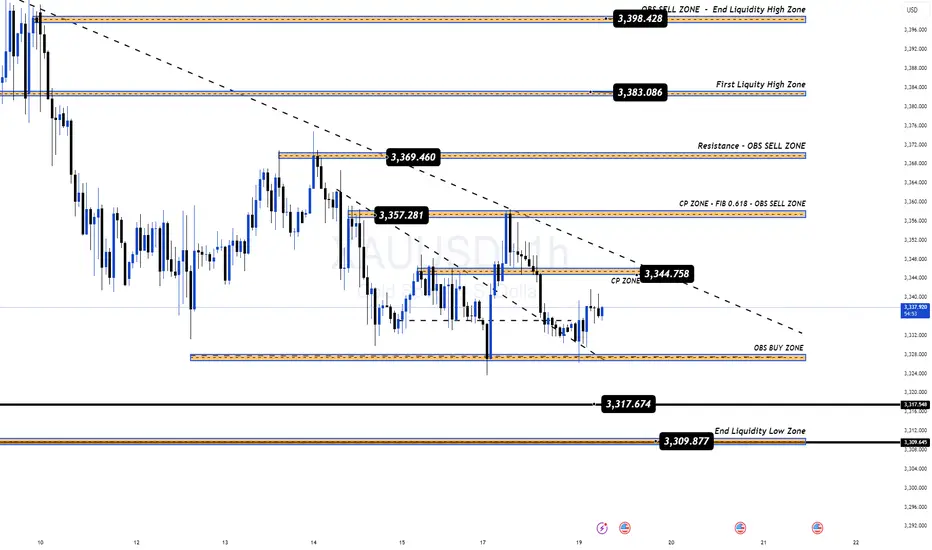

Gold continues to move in line with our weekly outlook. Despite strong rebounds from liquidity zones, the market still faces heavy selling pressure, unable to break out of the 335x – 336x resistance area.

With no major news events scheduled today, price action is expected to remain within range, making KeyLevels the most important zones to trade from.

📌 Trading Bias Today

Priority remains on SELL setups at upper resistance zones. Adjust entries slightly for better risk–reward.

For BUY positions, wait for deeper entries to avoid liquidity sweeps around 333x – 332x, which have been tested multiple times recently.

🔑 Key Market Levels

Resistance: 3346 – 3357 – 3370 – 3383

Support: 3324 – 3316 – 3309

📌 Trading Plan for India Traders

✅ BUY Zone: 3316 – 3314

SL: 3310

TP: 3320 – 3324 – 3328 – 3332 – 3336 – 3340 – 3350 – 3360+

✅ SELL Zone: 3356 – 3358

SL: 3362

TP: 3352 – 3348 – 3344 – 3340 – 3330 – 3320

⚠️ Summary

Gold remains inside a bearish channel, waiting for a clear breakout. Until major news like the FOMC hits, expect sideways price action within today’s KeyLevels.

👉 Watch reactions closely around 333x – 336x for the next potential move.

Stay disciplined, trade the levels, and let the market show its hand.

With no major news events scheduled today, price action is expected to remain within range, making KeyLevels the most important zones to trade from.

📌 Trading Bias Today

Priority remains on SELL setups at upper resistance zones. Adjust entries slightly for better risk–reward.

For BUY positions, wait for deeper entries to avoid liquidity sweeps around 333x – 332x, which have been tested multiple times recently.

🔑 Key Market Levels

Resistance: 3346 – 3357 – 3370 – 3383

Support: 3324 – 3316 – 3309

📌 Trading Plan for India Traders

✅ BUY Zone: 3316 – 3314

SL: 3310

TP: 3320 – 3324 – 3328 – 3332 – 3336 – 3340 – 3350 – 3360+

✅ SELL Zone: 3356 – 3358

SL: 3362

TP: 3352 – 3348 – 3344 – 3340 – 3330 – 3320

⚠️ Summary

Gold remains inside a bearish channel, waiting for a clear breakout. Until major news like the FOMC hits, expect sideways price action within today’s KeyLevels.

👉 Watch reactions closely around 333x – 336x for the next potential move.

Stay disciplined, trade the levels, and let the market show its hand.

Trade attivo

📊 Daily Plan UpdateThe KeyLevels marked in today’s plan once again delivered perfect market reactions:

🔑 CP ZONE: 3344 – 3346 → sharp drop of 200 PIPS.

🔑 OBS BUY ZONE: 3326 – 3324 → strong rebound of 100 PIPS, leaving a clean wick reaction.

📊 Daily Plan Update

The KeyLevels marked in today’s plan once again delivered perfect market reactions:

🔑 CP ZONE: 3344 – 3346 → sharp drop of 200 PIPS.

🔑 OBS BUY ZONE: 3326 – 3324 → strong rebound of 100 PIPS, leaving a clean wick reaction.

👉 Once again, KeyLevels = Profits ✅

Stay tuned and keep watching the chart for the next golden opportunities! 🚀

👉 Once again, KeyLevels = Profits ✅

Stay tuned and keep watching the chart for the next golden opportunities! 🚀

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.