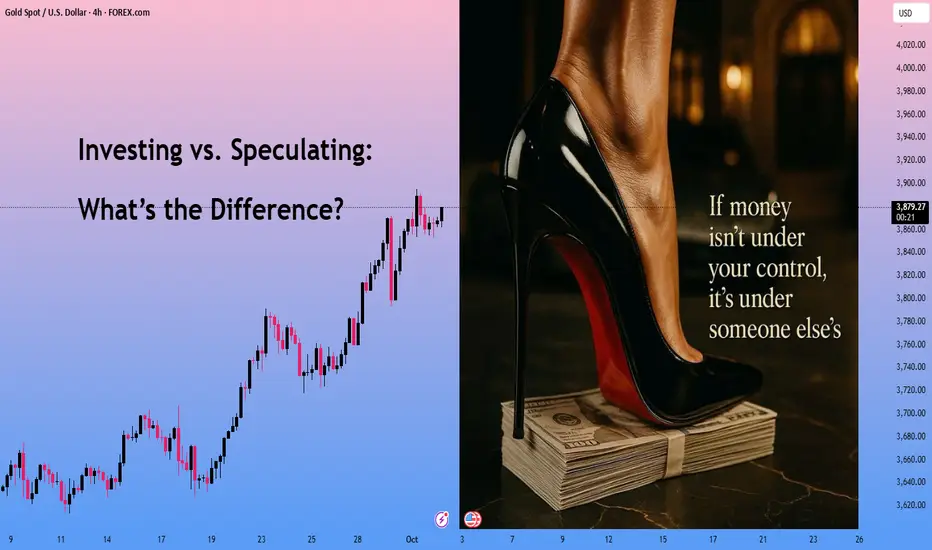

Hey everyone, you’ve probably heard the words “investing” and “speculating,” but do you really know what sets them apart? Both are about putting money in to make more money, but the mindset and approach are Totally different. Let’s break it down super simply:

What’s Investing? (4 Keywords: Long-term, steady, knowledge, patience)

Investing is like a marathon—it’s about the long game, focusing on things that grow in value over time. You’re aiming for steady, lasting profits, not a quick buck.

When you invest, you do your research. You really understand what you’re putting your money into.

You use knowledge—like studying a company’s finances (FA), looking at market trends (TA), or knowing the rules of the game (FM, RM).

You stay cool-headed, not getting swept up by hype or greed.

Investing isn’t about betting everything on one big win. It’s about protecting your money first, then letting profits grow slowly.

Think of it like planting a tree: you care for it, water it, and wait patiently for the fruit.

For example, let’s say you research a solid real estate deal. You believe a piece of land will grow in value over 3–5 years because it’s in a great spot with new roads being built. You buy it, hold on, and later sell it for a profit. Or you keep it, build a house, or rent it out for monthly cash while owning something valuable.

Investing like this isn’t fazed by short-term ups and downs—it’s all about the long-term payoff.

What’s Speculating? (4 Keywords: Short-term, fast, risky, flexible)

Speculating is like surfing—you jump in to catch a quick wave and make money fast by riding short-term price changes.

You know the term “riding the wave”? That’s it! You need waves to surf, right? If there’s no wave, you’re stuck.

Speculating works the same: it’s a bit daring, and you have to be ready to lose.

When you see a chance, you dive in fast or cut your losses quickly if things go wrong.

For example, back in the day, I got hyped up when Elon Musk tweeted about SHIBA coin. I jumped in, my money shot up 10 times in a short time, and I sold fast. Good thing, because the price crashed right after! If I hadn’t moved quickly, my account would’ve been wiped out.

Speculating is all about quick moves—”buy the rumors, sell the news”, and cashing in on the hype. It’s not about long-term value; it’s about grabbing profits fast. But it’s way riskier, and you can lose everything if you’re not sharp. Knowing when to stop is super important.

So, What’s the Key Difference?

Investing is all about patience.

Speculating is about being quick and flexible.

Someone asked me: “If I trade short-term but do research, is that investing?” Awesome question! But even with research, short-term trading is usually called speculating.

Why?

Because it’s focused on fast profits and higher risks, unlike the steady, long-term foundation of investing.

If you trade short-term with a solid plan, that’s cooler—pros call it systematic trading, way better than just guessing. But in general, short-term moves are still seen as speculating, not investing, because they don’t have that long-term vision.

Investing without a plan? That’s just gambling. (Investing + No plan = Gambling)

Speculating with a strategy? You’re thinking like a smart entrepreneur. (Speculating + Strategy = Entrepreneur)

Whether investing or speculating is better depends on you—your style and your game plan!

That said, choosing between investing and speculatingsometimes depends on each person's position. I’ll share more details in my next video.

If you agree with my opinion, drop a comment here!

I’m Anfibo , just sharing what I know about finance.

What’s Investing? (4 Keywords: Long-term, steady, knowledge, patience)

Investing is like a marathon—it’s about the long game, focusing on things that grow in value over time. You’re aiming for steady, lasting profits, not a quick buck.

When you invest, you do your research. You really understand what you’re putting your money into.

You use knowledge—like studying a company’s finances (FA), looking at market trends (TA), or knowing the rules of the game (FM, RM).

You stay cool-headed, not getting swept up by hype or greed.

Investing isn’t about betting everything on one big win. It’s about protecting your money first, then letting profits grow slowly.

Think of it like planting a tree: you care for it, water it, and wait patiently for the fruit.

For example, let’s say you research a solid real estate deal. You believe a piece of land will grow in value over 3–5 years because it’s in a great spot with new roads being built. You buy it, hold on, and later sell it for a profit. Or you keep it, build a house, or rent it out for monthly cash while owning something valuable.

Investing like this isn’t fazed by short-term ups and downs—it’s all about the long-term payoff.

What’s Speculating? (4 Keywords: Short-term, fast, risky, flexible)

Speculating is like surfing—you jump in to catch a quick wave and make money fast by riding short-term price changes.

You know the term “riding the wave”? That’s it! You need waves to surf, right? If there’s no wave, you’re stuck.

Speculating works the same: it’s a bit daring, and you have to be ready to lose.

When you see a chance, you dive in fast or cut your losses quickly if things go wrong.

For example, back in the day, I got hyped up when Elon Musk tweeted about SHIBA coin. I jumped in, my money shot up 10 times in a short time, and I sold fast. Good thing, because the price crashed right after! If I hadn’t moved quickly, my account would’ve been wiped out.

Speculating is all about quick moves—”buy the rumors, sell the news”, and cashing in on the hype. It’s not about long-term value; it’s about grabbing profits fast. But it’s way riskier, and you can lose everything if you’re not sharp. Knowing when to stop is super important.

So, What’s the Key Difference?

Investing is all about patience.

Speculating is about being quick and flexible.

Someone asked me: “If I trade short-term but do research, is that investing?” Awesome question! But even with research, short-term trading is usually called speculating.

Why?

Because it’s focused on fast profits and higher risks, unlike the steady, long-term foundation of investing.

If you trade short-term with a solid plan, that’s cooler—pros call it systematic trading, way better than just guessing. But in general, short-term moves are still seen as speculating, not investing, because they don’t have that long-term vision.

Investing without a plan? That’s just gambling. (Investing + No plan = Gambling)

Speculating with a strategy? You’re thinking like a smart entrepreneur. (Speculating + Strategy = Entrepreneur)

Whether investing or speculating is better depends on you—your style and your game plan!

That said, choosing between investing and speculatingsometimes depends on each person's position. I’ll share more details in my next video.

If you agree with my opinion, drop a comment here!

I’m Anfibo , just sharing what I know about finance.

⚜️ 8–10 high-quality signals every day for Forex | Gold | Bitcoin

⚜️ Fast updates, accurate alerts – never miss a market opportunity

⚜️ Trading is not just about numbers, it’s also about finesse

Join my community: t.me/+2ZEpvPQLaigxNTk1

⚜️ Fast updates, accurate alerts – never miss a market opportunity

⚜️ Trading is not just about numbers, it’s also about finesse

Join my community: t.me/+2ZEpvPQLaigxNTk1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

⚜️ 8–10 high-quality signals every day for Forex | Gold | Bitcoin

⚜️ Fast updates, accurate alerts – never miss a market opportunity

⚜️ Trading is not just about numbers, it’s also about finesse

Join my community: t.me/+2ZEpvPQLaigxNTk1

⚜️ Fast updates, accurate alerts – never miss a market opportunity

⚜️ Trading is not just about numbers, it’s also about finesse

Join my community: t.me/+2ZEpvPQLaigxNTk1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.