https://www.tradingview.com/x/EulgM5NH/

News:

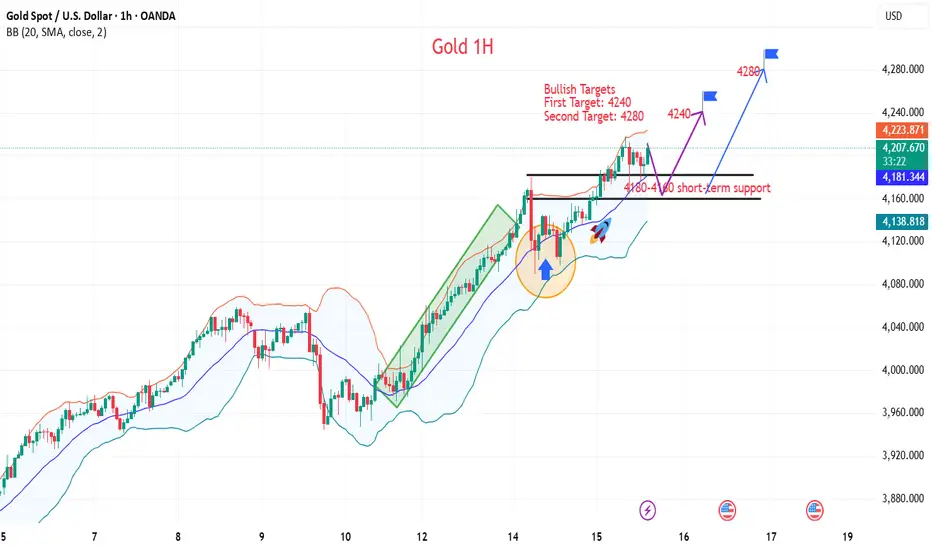

Spot gold prices continued their upward trend in early Asian trading on Wednesday (October 15th), surging by over $20 to $4,165.89 per ounce as of 7:42 AM. Renewed concerns about the international trade situation are providing upward momentum for gold prices.

International trade concerns, the US government shutdown, geopolitical tensions, and shifting monetary policies are expected to fuel further price increases.

Conclusion: In the short term, the international trade situation may become a key variable. If signals of reconciliation are released, gold prices may fall back; but if friction escalates, the $4,280 mark will be easily surpassed.

Specifically:

On the downside, a pullback towards $4,100 could attract buying, potentially finding support in the $4,060-4,055 range. However, a break below this support level could trigger a technical sell-off, pushing gold prices towards the psychologically important $4,000 level – a level that coincides with the rising trendline support and the 50-period simple moving average (4018.08) on the 4-hour chart. Therefore, a confirmed break below this key area could be the first sign of bullish momentum exhaustion and pave the way for a deeper correction.

On the upside, a sustained hold above $4,200 could trigger a retest of the intraday high, pushing bulls towards $4,250 and, subsequently, the $4,300-4,280 range.

Trading strategy:

Buy: 4180-4170, SL: 4160, TP: 4240-4280

Short positions will be reminded in time according to the trend

News:

Spot gold prices continued their upward trend in early Asian trading on Wednesday (October 15th), surging by over $20 to $4,165.89 per ounce as of 7:42 AM. Renewed concerns about the international trade situation are providing upward momentum for gold prices.

International trade concerns, the US government shutdown, geopolitical tensions, and shifting monetary policies are expected to fuel further price increases.

Conclusion: In the short term, the international trade situation may become a key variable. If signals of reconciliation are released, gold prices may fall back; but if friction escalates, the $4,280 mark will be easily surpassed.

Specifically:

On the downside, a pullback towards $4,100 could attract buying, potentially finding support in the $4,060-4,055 range. However, a break below this support level could trigger a technical sell-off, pushing gold prices towards the psychologically important $4,000 level – a level that coincides with the rising trendline support and the 50-period simple moving average (4018.08) on the 4-hour chart. Therefore, a confirmed break below this key area could be the first sign of bullish momentum exhaustion and pave the way for a deeper correction.

On the upside, a sustained hold above $4,200 could trigger a retest of the intraday high, pushing bulls towards $4,250 and, subsequently, the $4,300-4,280 range.

Trading strategy:

Buy: 4180-4170, SL: 4160, TP: 4240-4280

Short positions will be reminded in time according to the trend

Trade attivo

The strong rise of gold has not changed, and there are still many callbacks. You can try to go high with strong resistance, but you can only enter and exit quickly;I'm Theodore, welcome to join my channel, where you can get the latest trading signals and strategy layout.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

I'm Theodore, welcome to join my channel, where you can get the latest trading signals and strategy layout.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.