Core Drivers

Bullish for Gold

Expectations of a Fed Rate Cut: Weak US economic data (narrowing trade deficit, stagnant services sector) strengthens the probability of a September rate cut, putting pressure on the US dollar and boosting gold.

Risk aversion: The escalation of Trump's tariff policy and the uncertainty of the Federal Reserve's personnel changes have increased market volatility, and gold is favored as a safe-haven asset.

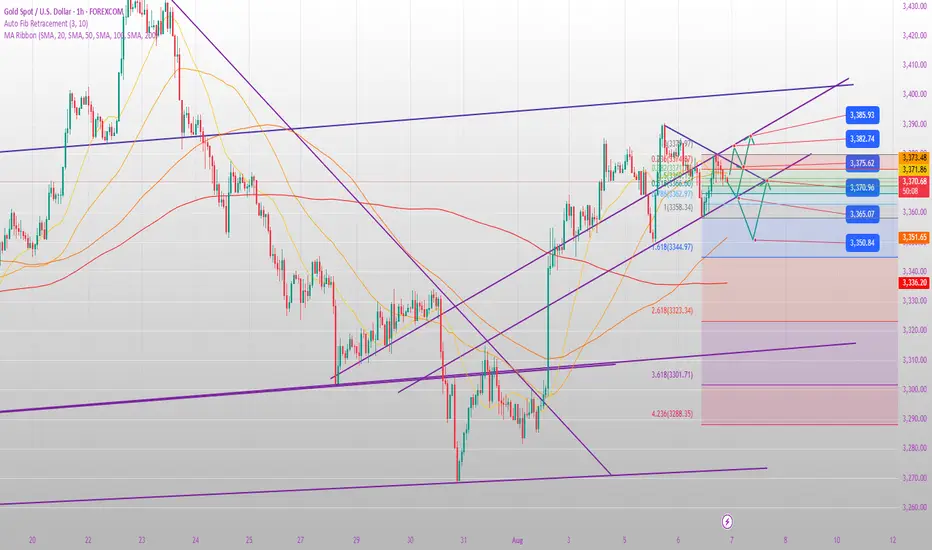

The technical side is strong: the daily line has four consecutive positive lines, and after the big positive K at the bottom, it oscillates to digest the short momentum, and the lower track support of the convergence triangle is effective (3350-3355).

Potential Bearish Factors

Inflation Data Risk: May weaken expectations of a rate cut, triggering a gold price correction.

Russia-Ukraine ceasefire agreement: If reached, it will weaken safe-haven demand and dampen gold's upward momentum.

Technical Pullback Risk: The previous two rounds of gains have both experienced five-wave pullbacks. Be wary of downside risks after a break of 3350.

Key Technical Levels

Support:

3355-3360 (lower band of the daily convergence triangle + 5-day moving average + middle band of the 4-hour moving average).

3350 (bull-bear watershed). If it breaks, the market will fluctuate and shift to a bearish bias, with a target of 3320-3300.

Resistance:

3375 (hourly middle line; a break above this level could lead to short-term strength).

3390 (previous high; a break above this opens up upside potential to the upper triangle line at 3406).

Today's Trading Strategy

1. Long Scenario (60% probability)

Entry Condition: Gold price holds support at 3355-3360 and closes above 3375 on the hourly chart.

Target: 3390 → 3406 (upper band of the converging triangle).

Stop Loss: Below 3350 (confirmation of a breakout).

2. Short Scenario (40% probability)

Entry Condition: Gold price falls below 3350 and closes below it on the hourly chart.

Target: 3320 (previous support low) → 3300 (psychological barrier). Stop loss: above 3360 (false breakout and covering).

Trading Recommendations

Conservative: Wait until the US market opens, confirming a breakout above 3350 or 3390 before entering the market.

Aggressive:

Take a light position to buy near 3365, with a stop-loss at 3350 and a target of 3375 → 3390.

If 3375 fails to break through before the US market opens, reverse into a short position targeting 3355.

Risk Warning

Event Risk: Speech by Federal Reserve officials or sudden changes in geopolitical dynamics could trigger sharp short-term fluctuations.

Position management: Currently at the end of the triangle, it is advisable to operate with a light position before breaking through to avoid two-way losses.

Conclusion: Gold is likely to fluctuate upward in the short term, but be wary of the risk of a pullback after a breakout of 3350. The recommended range is 3350-3390.

Trade attivo

In-depth Analysis of Gold Trends and Precise Trading Strategies:

Current Market Core Logic

The bullish trend remains unchanged, but the risk of stagflation at high levels is increasing.

The daily stochastic indicators (KD/RSI) have formed a golden cross, and the MACD momentum is mild, indicating that bulls still have the upper hand. However, the price is approaching the upper Bollinger band (3415), so be wary of a technical pullback.

Key Watersheds:

A break above 3390 → confirms the continuation of the bullish trend, opening up potential for 3415 or even higher.

A break below 3350 → may trigger profit-taking by bulls, leading to a deeper correction (target 3320-3300).

The H4 cycle is consolidating, with a breakout imminent.

The Bollinger Bands are closing (3390-3350), and the K-line is fluctuating with broken bullish and bearish candlestick patterns, indicating that the market is awaiting a directional decision.

The Asian and European sessions are likely to experience range-bound fluctuations, while the US session may see a breakout driven by data or news.

Today's Practical Trading Strategy:

Scenario 1: Range-bound (3350-3390)

Long at Lows: Buy lightly at 3365-3370, stop loss below 3355, target 3385-3390.

Short at Highs: Sell lightly at 3390-3395, stop loss above 3400, target 3365-3355.

(Note: Buy low and sell high within the range and enter and exit quickly to avoid losses after a breakout.)

Scenario 2: Upward Breakout of 3390

Buy: Follow up long orders on a pullback to 3380-3385, with a stop loss at 3370 and a target of 3415.

Ultimate resistance at 3415: If it is reached, try a short position (stop loss at 3425), anticipating a daily peak and decline.

Scenario 3: Downward movement below 3350

Short selling: Short on a rebound to 3355-3360, stop loss at 3370, target at 3330-3320.

Trend reversal confirmation: If the daily chart closes below 3350, the medium-term outlook will shift to bearish.

Trade chiuso: obiettivo raggiunto

August 8th Gold Trend Analysis and Strategy:

Core Drivers

Expectations of Easing Support Gold Prices

The market anticipates a 25 basis point rate cut by the Federal Reserve in September with a probability exceeding 90%, potentially leading to two rate cuts this year. This lowers the cost of holding gold, an interest-free asset, and strengthens the medium- to long-term bullish outlook.

A modest rebound in the US dollar index (stabilizing after a one-week low) and rising US stocks will limit gold's gains in the short term, but risk aversion (due to trade uncertainty) provides hedging support.

Key Technical Signals

Daily Chart:

The market is nearing the end of a converging triangle, with upper support moving down to 3406 and lower support moving up to 3360.

Thursday's close firmly above the 5-day moving average, with the MACD trend showing a mild bullish bias. A break above 3400 would open up upside potential.

4-Hour Chart:

Middle support at 3371-3372 resonates with the daily 5-day moving average. A breakout above the downward trend line in the Asian session and a pullback confirm this, indicating a short-term bullish bias. The 4-hour MACD top divergence needs to be repaired. If the price retraces but does not break below 3370, the bullish outlook remains.

Day Trading Strategy

1. Long Opportunity

Entry Zone: 3370-3373 (618 retracement of overnight rally + 4-hour middle band support).

Target:

First target: 3397-3400 (Asian session high + psychological barrier).

After a breakout, target 3406 (upper band of the triangle), with further breakouts targeting 3420.

Stop Loss: Below 3365 (a break below would destroy the short-term upward trend).

2. Be cautious when shorting.

Conditions: If the gold price surges to around 3406 and then experiences pressure and a rapid decline, a small position can be considered for a short position.

Target: 3380-3375.

Stop Loss: Above 3412.

Key Risk Warning: US Dollar Trend: A sharp rebound in the US Dollar Index (e.g., above 104.5) could suppress gold prices. Fed Commentary: If Fed officials send hawkish signals (e.g., downplaying interest rate cuts), gold prices could pull back.

Triangle Breakout: A break below 3360 could trigger a potential drop to support levels of 3340-3330; a break above 3406 would confirm a new uptrend.

Trading Recommendations

Main Strategy: Invest primarily in low-level long positions, relying on support at 3370-3372, with a stop-loss at 3365 and a target of 3400-3406.

Alternative plan: short-term short selling under pressure at 3406, enter and exit quickly.

Breakthrough follow-up: If it stabilizes at 3400 after the European session, you can chase it to 3420; otherwise, if it falls below 3360, wait and see.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.