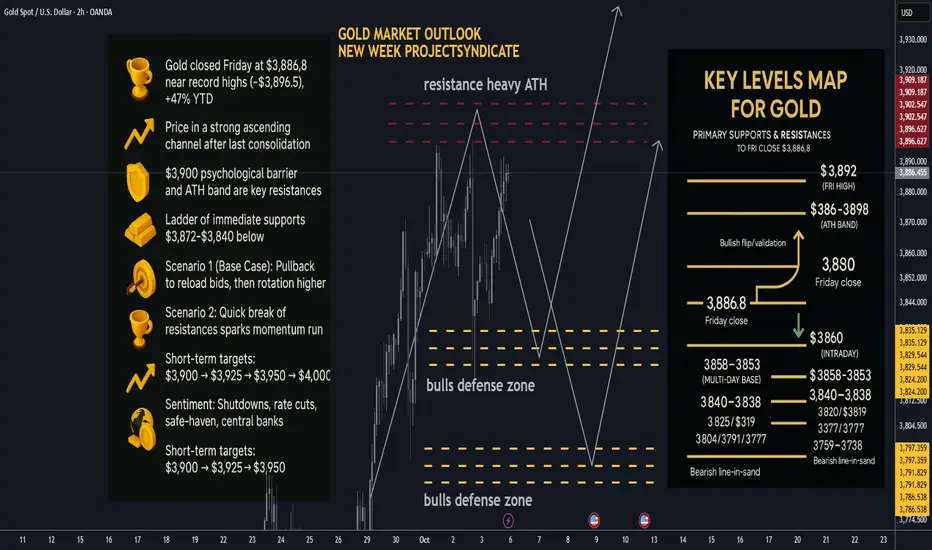

🏆 Friday’s Close & Recent ATH:

Gold (XAUUSD) closed Friday at $3,886.8, after printing a session high near $3,891.9. The latest all-time high is ~$3,896.5 (Thu), putting $3,900 squarely in play as the next psychological milestone. YTD performance remains extraordinary (≈+47% in 2025).

📈 Trend Structure:

Price continues to track a well-defined ascending channel on 1H/4H with a clean impulsive leg out of the last consolidation. Market character = higher highs / higher lows, persistent dip-buying, and strong trend adherence into quarter-turn levels (25/50 handles).

🔑 Key Resistance Levels:

The most critical resistance now sits at $3,900 (psychological + round-number supply). Beyond that, watch the ATH band $3,896–$3,898 and Friday’s spike high $3,892. Break/acceptance above opens $3,925–$3,950 as measured-move extensions, with $4,000 as a probable magnet on momentum follow-through.

🛡️ Support Zones:

Immediate supports step down as follows: $3,872–$3,860 (intraday pivot), $3,858–$3,853 (multi-day base), $3,840–$3,838 (Fri low). Deeper structural shelves: $3,825–$3,820, $3,804, $3,791, $3,777. A sustained break below $3,838–$3,825 would signal a more meaningful corrective phase.

⚖️ Likely Scenarios:

• Scenario 1 (Base Case) – Pullback then push: Controlled dip into $3,858–$3,838 to reload bids, then rotation higher toward $3,900+.

• Scenario 2 – Straight break: Quick clearance of $3,892/ATH $3,896–$3,898 → $3,900, unleashing a momentum run into $3,925–$3,950.

(Overbought signals persist, but structural demand keeps dips shallow.)

📊 Short-Term Targets:

On continuation: $3,892 → $3,900 → $3,925 → $3,950, with $4,000 as stretch if acceptance holds above $3,900. On retrace: $3,858 → $3,840 → $3,825.

💡 Market Sentiment Drivers:

• Shutdown-driven data delays & uncertainty are boosting safe-haven bids; Friday’s NFP was delayed, reinforcing cut expectations.

• Rate-cut odds remain elevated into October, keeping the opportunity cost of holding gold low (FedWatch/BofA commentary).

• Official-sector demand stays constructive (central banks resumed net +15t buying in August per WGC), underpinning dips.

• Macro/geopolitical risk + tariff chatter continue to provide a tailwind; 2025’s ~47% surge underscores the regime shift.

🔄 Retracement Outlook:

A tag of $3,858–$3,853 (multi-day pivot) or a stop-run to $3,840–$3,838 is a typical “healthy” pullback zone inside trend. Swift reclaim of $3,858/53 after a liquidity flush often precedes fresh ATHs.

🧭 Risk Levels to Watch:

Holding above $3,858–$3,838 keeps the bullish structure intact. Failure/acceptance below $3,825 shifts risk toward $3,804 → $3,791 → $3,777 and opens the door to $3,759–$3,738.

🚀 Overall Weekly Outlook:

Gold remains in a power-trend with $3,892/ATH $3,896–$3,898 → $3,900 as the immediate battleground. Expect orderly, buyable dips while those supports hold; topside roadmap favors $3,925–$3,950 with $4,000 viable on a decisive breakout/acceptance.

________________________________________

🗺️ Key Gold Levels Map — Primary Supports & Resistances (Updated to Fri Close $3,886.8):

Primary Resistances: 3892 (Fri high) → 3896–3898 (ATH band) → 3900 → 3925 → 3950 → 4000.

Primary Supports: 3872–3860 (intraday) → 3858–3853 (multi-day base) → 3840–3838 (Fri low) → 3825 / 3819 → 3804 / 3791 / 3777 → 3759–3738 (deeper control).

Bullish flip/validation: Sustained acceptance ≥3900 turns dips into buys toward 3925–3950.

Bearish line-in-sand: Daily close <3825 weakens the trend; <3791 confirms a broader corrective swing.

Gold (XAUUSD) closed Friday at $3,886.8, after printing a session high near $3,891.9. The latest all-time high is ~$3,896.5 (Thu), putting $3,900 squarely in play as the next psychological milestone. YTD performance remains extraordinary (≈+47% in 2025).

📈 Trend Structure:

Price continues to track a well-defined ascending channel on 1H/4H with a clean impulsive leg out of the last consolidation. Market character = higher highs / higher lows, persistent dip-buying, and strong trend adherence into quarter-turn levels (25/50 handles).

🔑 Key Resistance Levels:

The most critical resistance now sits at $3,900 (psychological + round-number supply). Beyond that, watch the ATH band $3,896–$3,898 and Friday’s spike high $3,892. Break/acceptance above opens $3,925–$3,950 as measured-move extensions, with $4,000 as a probable magnet on momentum follow-through.

🛡️ Support Zones:

Immediate supports step down as follows: $3,872–$3,860 (intraday pivot), $3,858–$3,853 (multi-day base), $3,840–$3,838 (Fri low). Deeper structural shelves: $3,825–$3,820, $3,804, $3,791, $3,777. A sustained break below $3,838–$3,825 would signal a more meaningful corrective phase.

⚖️ Likely Scenarios:

• Scenario 1 (Base Case) – Pullback then push: Controlled dip into $3,858–$3,838 to reload bids, then rotation higher toward $3,900+.

• Scenario 2 – Straight break: Quick clearance of $3,892/ATH $3,896–$3,898 → $3,900, unleashing a momentum run into $3,925–$3,950.

(Overbought signals persist, but structural demand keeps dips shallow.)

📊 Short-Term Targets:

On continuation: $3,892 → $3,900 → $3,925 → $3,950, with $4,000 as stretch if acceptance holds above $3,900. On retrace: $3,858 → $3,840 → $3,825.

💡 Market Sentiment Drivers:

• Shutdown-driven data delays & uncertainty are boosting safe-haven bids; Friday’s NFP was delayed, reinforcing cut expectations.

• Rate-cut odds remain elevated into October, keeping the opportunity cost of holding gold low (FedWatch/BofA commentary).

• Official-sector demand stays constructive (central banks resumed net +15t buying in August per WGC), underpinning dips.

• Macro/geopolitical risk + tariff chatter continue to provide a tailwind; 2025’s ~47% surge underscores the regime shift.

🔄 Retracement Outlook:

A tag of $3,858–$3,853 (multi-day pivot) or a stop-run to $3,840–$3,838 is a typical “healthy” pullback zone inside trend. Swift reclaim of $3,858/53 after a liquidity flush often precedes fresh ATHs.

🧭 Risk Levels to Watch:

Holding above $3,858–$3,838 keeps the bullish structure intact. Failure/acceptance below $3,825 shifts risk toward $3,804 → $3,791 → $3,777 and opens the door to $3,759–$3,738.

🚀 Overall Weekly Outlook:

Gold remains in a power-trend with $3,892/ATH $3,896–$3,898 → $3,900 as the immediate battleground. Expect orderly, buyable dips while those supports hold; topside roadmap favors $3,925–$3,950 with $4,000 viable on a decisive breakout/acceptance.

________________________________________

🗺️ Key Gold Levels Map — Primary Supports & Resistances (Updated to Fri Close $3,886.8):

Primary Resistances: 3892 (Fri high) → 3896–3898 (ATH band) → 3900 → 3925 → 3950 → 4000.

Primary Supports: 3872–3860 (intraday) → 3858–3853 (multi-day base) → 3840–3838 (Fri low) → 3825 / 3819 → 3804 / 3791 / 3777 → 3759–3738 (deeper control).

Bullish flip/validation: Sustained acceptance ≥3900 turns dips into buys toward 3925–3950.

Bearish line-in-sand: Daily close <3825 weakens the trend; <3791 confirms a broader corrective swing.

Nota

🎁Please hit the like button and🎁Leave a comment to support our team!

Nota

ProjectSyndicate Market Summary | Weekly update📊 WTD performance

🟡 GOLD (XAUUSD): ~$3,970 | +2.2% WTD (record high $4,059)

💶 EURUSD: ~1.157 | −1.3% WTD

💷 GBPUSD: ~1.331 | −0.6% WTD

💴 USDJPY: ~153.0 | +0.4% WTD

📈 SPX: 6,735 | +0.3% WTD

📈 NDX: 25,098 | +1.0% WTD

🗞 Highlights This Week (Gold & FX)

Gold set a new all-time high at $4,059 before consolidating near $3,970, supported by safe-haven flows and Fed-cut expectations. Central-bank demand and ongoing geopolitical tension remain strong pillars of support for gold.

The USD traded mixed — firmer versus the yen, softer versus European majors. Equities posted mild gains as rate-cut optimism outweighed economic concerns.

🟡 Gold Market Note – This Week

Gold continues its powerful rally, hovering just below the psychological $4,000 mark. Momentum remains bullish, with support around $3,900 and resistance near $4,100. Persistent Fed easing expectations, strong official-sector buying, and risk aversion all keep the metal in a favorable position heading into Q4.

📣 Street Forecasts for Gold – Q4 2025

J.P. Morgan: ~$3,675 average; sees potential above $4,000 by early 2026.

UBS: Targets ~$3,800 by year-end on softer USD outlook.

Citigroup: Maintains range of $3,800–$4,000 short-term.

Goldman Sachs: Sees structural upside; projects gold in the high-$3,000s by Q4 2025, trending toward $4,000 by mid-2026.

🧭 Market Drivers & Positioning Summary

Fed outlook: Dovish expectations support gold and cap USD gains.

Geopolitics: Continued uncertainty sustains haven demand.

Europe & UK: Political and economic mixed signals weigh on EUR and GBP.

Japan: Yen remains weak near 153 amid BoJ policy ambiguity.

Nota

📊 Friday Close: ~$3,990–$4,020📈 Trend: Strong uptrend — higher highs/lows, dip-buying persists.

🔝 Key Resistances: $4,000 → $4,030–$4,060 (ATH) → $4,075–$4,200

🛡 Supports: $3,980–$3,960 → $3,950–$3,930 → $3,900–$3,888

⚖️ Base Case: Buyable dips toward $3,950–$3,900 before ATH retest.

🚀 Momentum Break: Above $4,060 = $4,100–$4,200 targets.

💡 Drivers: Tariff headlines, softer Fed path, central bank demand.

🧭 Bullish above: $3,900 ✅ | Bearish below: $3,825 ⚠️

📍 Strategy: Accumulate dips >$3,900; target $4,075–$4,200 on breakout.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.