#XAUUSD  XAUUSD

XAUUSD

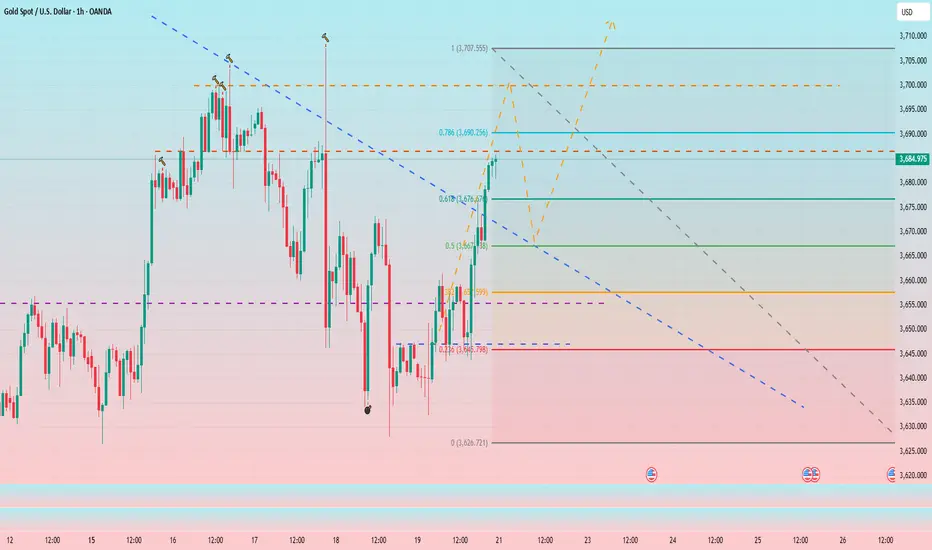

I had to go out for something on Friday, so I left everyone with a bearish trading strategy. As the gold price rose on Friday night, the limit order I set at 3685 before leaving was activated. At present, friends who have referred to the trading strategy should be holding short positions like me. Let’s briefly analyze the possible market trends on Monday and how to arrange the short positions in hand.

First, let’s review Friday’s trend. Driven by news and large-scale buying intervention from major ETF funds, gold in the US market broke the trend and began to rise. The 15-minute chart formed a classic W-shaped pattern, forming a double bottom near 3645. It then rebounded, breaking through the short-term resistance around 3660-3665, and ultimately rising to around 3685.

The daily chart shows that Friday saw a large bullish candlestick close, with gold prices once again stabilizing above the MA5 moving average. This suggests a renewed bullish rally, and gold prices may continue to rise on Monday.

At the same time, you can observe silver, which is also a precious metal. The upward trend of silver has not been broken, so the bulls still exist in the short term, which indirectly reflects the possibility of gold rising on Monday. But one thing worth noting is that when gold hit a new historical high earlier, silver also hit a new high. This time, silver broke through again, but gold did not follow suit and break new highs. This involves issues such as exchange rate conversion. Therefore, sometimes the US dollar and silver can be used as a reference for us, but we should not trust them too much.

Overall, my judgment on gold on Monday is that it may continue to rise at the opening and touch around 3700 before encountering resistance and falling back, falling to near the turning point and then rebounding. Therefore, friends who hold short positions do not need to worry too much. Friends with sufficient funds can consider adding short positions around 3700 and adjust the TP of all short positions in their hands to 3670-3660. For those with smaller accounts or who can't effectively manage their trades, consider hedging to protect your account and unwind the hedge after the pullback. On the contrary, if gold falls directly, we can still look towards 3670-3660.

I had to go out for something on Friday, so I left everyone with a bearish trading strategy. As the gold price rose on Friday night, the limit order I set at 3685 before leaving was activated. At present, friends who have referred to the trading strategy should be holding short positions like me. Let’s briefly analyze the possible market trends on Monday and how to arrange the short positions in hand.

First, let’s review Friday’s trend. Driven by news and large-scale buying intervention from major ETF funds, gold in the US market broke the trend and began to rise. The 15-minute chart formed a classic W-shaped pattern, forming a double bottom near 3645. It then rebounded, breaking through the short-term resistance around 3660-3665, and ultimately rising to around 3685.

The daily chart shows that Friday saw a large bullish candlestick close, with gold prices once again stabilizing above the MA5 moving average. This suggests a renewed bullish rally, and gold prices may continue to rise on Monday.

At the same time, you can observe silver, which is also a precious metal. The upward trend of silver has not been broken, so the bulls still exist in the short term, which indirectly reflects the possibility of gold rising on Monday. But one thing worth noting is that when gold hit a new historical high earlier, silver also hit a new high. This time, silver broke through again, but gold did not follow suit and break new highs. This involves issues such as exchange rate conversion. Therefore, sometimes the US dollar and silver can be used as a reference for us, but we should not trust them too much.

Overall, my judgment on gold on Monday is that it may continue to rise at the opening and touch around 3700 before encountering resistance and falling back, falling to near the turning point and then rebounding. Therefore, friends who hold short positions do not need to worry too much. Friends with sufficient funds can consider adding short positions around 3700 and adjust the TP of all short positions in their hands to 3670-3660. For those with smaller accounts or who can't effectively manage their trades, consider hedging to protect your account and unwind the hedge after the pullback. On the contrary, if gold falls directly, we can still look towards 3670-3660.

Trade attivo

#XAUUSD Good morning, last night I gave a market forecast for Monday. It is likely to continue to rise, and then fall back after hitting the resistance near 3700. At present, our judgment is very accurate.

However, judging by the hourly chart, gold has only retreated to around 3685 before halting its decline, which could easily cause panic among short-term traders. Although gold closed with a large bullish candlestick on the daily chart, the 5 and 10 moving averages did not turn upward as they had in the past. This recent rally in gold is primarily driven by news and the involvement of major funds such as ETFs. At the same time, technical indicators are all overbought, and there is a need for a correction in the short term.

Therefore, I believe gold will inevitably experience a short-term pullback. The current middle track of the Bollinger Band and the MA5 MA10 moving average are at 3675-3660. Friends who hold short positions can consider closing their positions when the price retreats to this range.

Trade chiuso: obiettivo raggiunto

#XAUUSD Because gold was affected by market sentiment and broke through the previous high of 3707 again, the short position in hand reached SL and left the market regretfully. In the short term, gold prices are dominated by bulls and continue to rise to around 3720. The current market is relatively extreme and there is no good reference point for the time being. Therefore, under such market conditions, it is difficult to easily participate in the game. Therefore, I believe we should not rush into the market now and patiently observe gold's performance.

If gold prices rise and then retreat, we may find a good entry point to follow the trend and go long on gold; of course, if gold continues to rise and is able to form an M-top trend in the short term, we will then participate in short trading moderately according to market conditions.

✅ CFA® Charterholder | 90% Win Rate | 300%-500% Profit ✅

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

✅ CFA® Charterholder | 90% Win Rate | 300%-500% Profit ✅

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.