Gold Outlook After FOMC – Building a Bullish Structure

The latest FOMC meeting offered no new measures to support the economy, as Chair Powell suggested conditions remain stable and interest rates were left unchanged. Markets therefore stayed muted, with expectations now shifting towards September for potential policy moves.

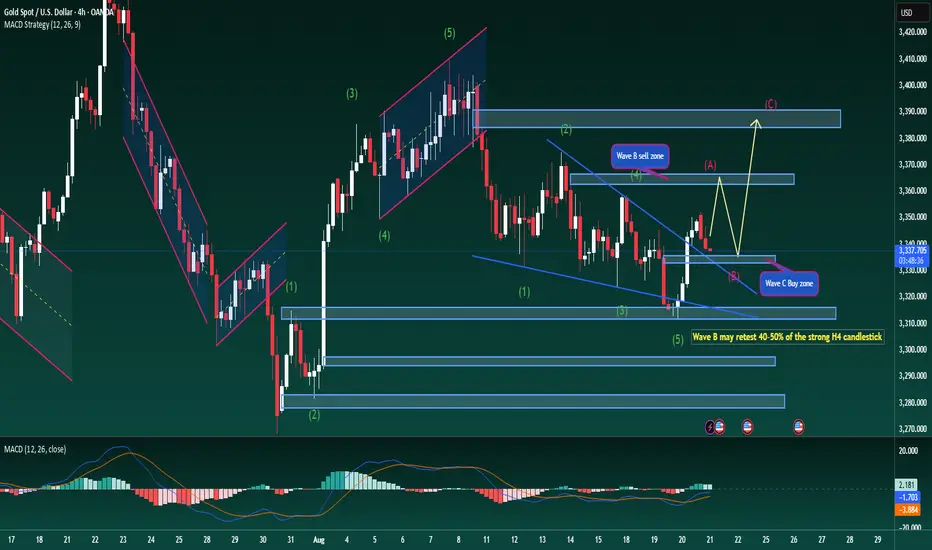

On the technical side, gold has completed wave A after reacting to the daily trendline, and I expect the market is now forming an ABC corrective structure to complete a medium-term Elliott cycle. The recent rally also broke through the descending trendline on H4, confirming that bullish momentum may prove more sustainable.

At present, price is undergoing a mild pullback from the Asian session, with the potential to retrace 40–50% of the recent H4 candle. This move would also retest the broken descending trendline — if confirmed, it would establish a stronger bullish Dow structure and open the path for a longer wave cycle, at least until wave C plays out fully.

The H4 chart supports this scenario, as MACD averages are trending upward and volume is showing steady growth.

Buy zone: Around 3334, in line with the broader trend for medium- to long-term positions.

Sell zone: Around 3365, where wave C could complete and a new cycle may begin.

Gold is gradually showing a clearer technical structure. Patience and discipline with entries should help traders capture this move effectively.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #ElliottWave #Fibonacci #MACD #Forex #FOMC #Trading

The latest FOMC meeting offered no new measures to support the economy, as Chair Powell suggested conditions remain stable and interest rates were left unchanged. Markets therefore stayed muted, with expectations now shifting towards September for potential policy moves.

On the technical side, gold has completed wave A after reacting to the daily trendline, and I expect the market is now forming an ABC corrective structure to complete a medium-term Elliott cycle. The recent rally also broke through the descending trendline on H4, confirming that bullish momentum may prove more sustainable.

At present, price is undergoing a mild pullback from the Asian session, with the potential to retrace 40–50% of the recent H4 candle. This move would also retest the broken descending trendline — if confirmed, it would establish a stronger bullish Dow structure and open the path for a longer wave cycle, at least until wave C plays out fully.

The H4 chart supports this scenario, as MACD averages are trending upward and volume is showing steady growth.

Buy zone: Around 3334, in line with the broader trend for medium- to long-term positions.

Sell zone: Around 3365, where wave C could complete and a new cycle may begin.

Gold is gradually showing a clearer technical structure. Patience and discipline with entries should help traders capture this move effectively.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #ElliottWave #Fibonacci #MACD #Forex #FOMC #Trading

Trade attivo

Gold Outlook – Wave C Taking ShapeGold is moving in line with the expected structure. Wave B has played out as anticipated, and although liquidity absorbed the last H4 candle, the broader technical picture remains intact. According to Elliott Wave theory, the next move is Wave C, which marks the final stage of this corrective cycle.

A confirmed H4 close above 3340 would provide a strong signal that the bullish continuation is underway. Long positions can be maintained, with the market likely to extend higher as this wave develops.

Staying patient and disciplined with positions will allow traders to capture the momentum while following the trend.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jqCSSdKGm7YyMGZl

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.