OPEN-SOURCE SCRIPT

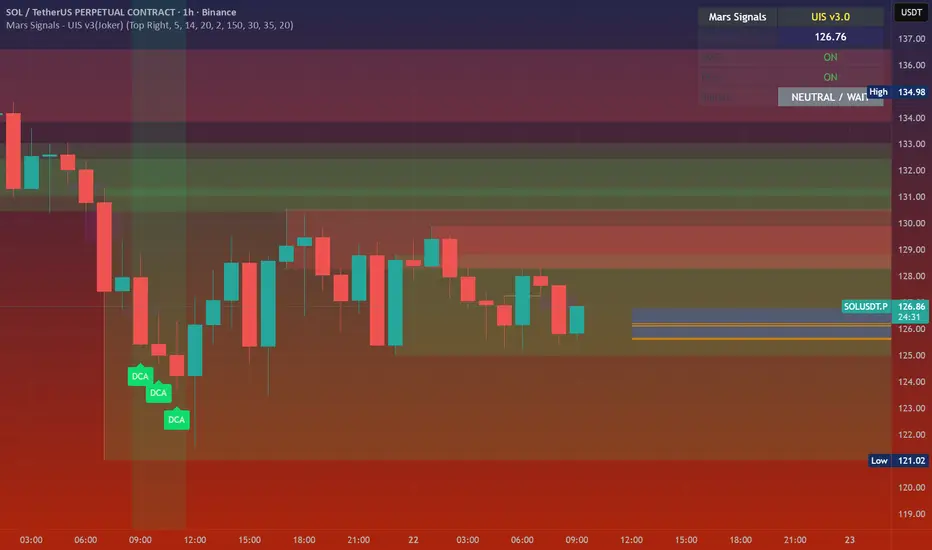

Mars Signals - Ultimate Institutional Suite v3.0(Joker)

Comprehensive Trading Manual

Mars Signals – Ultimate Institutional Suite v3.0 (Joker)

## Chapter 1 – Philosophy & System Architecture

This script is not a simple “buy/sell” indicator.

Mars Signals – UIS v3.0 (Joker) is designed as an institutional-style analytical assistant that layers several methodologies into a single, coherent framework.

The system is built on four core pillars:

1. Smart Money Concepts (SMC)

2. Smart DCA Strategy

3. Volume Profile (Visible Range Simulation)

4. Wyckoff Helper – Spring

All four pillars feed into a Confluence Engine (Scoring System).

The final output is presented in the Dashboard, with a clear, human-readable signal:

This allows the trader to see *how many* and *which* layers of the system support a bullish or bearish bias at any given time.

## Chapter 2 – Settings Overview

### 2.1 General & Dashboard Group

- Show Dashboard Panel (`show_dash`)

Turns the dashboard table in the corner of the chart ON/OFF.

- Show Signal Recommendation (`show_rec`)

- Dashboard Position (`dash_pos`)

Determines where the dashboard appears on the chart:

### 2.2 Smart Money (SMC) Group

- Enable SMC Strategy (`show_smc`)

Globally enables or disables the Order Block and FVG logic.

- Order Block Pivot Lookback (`ob_period`)

Main parameter for detecting key pivot highs/lows (swing points).

- Default value: 5

- Concept:

A bar is considered a pivot low if its low is lower than the lows of the previous 5 and the next 5 bars.

Similarly, a pivot high has a high higher than the previous 5 and the next 5 bars.

These pivots are used as anchors for Order Blocks.

- Increasing `ob_period`:

- Fewer levels.

- But levels tend to be more significant and reliable.

- In highly volatile markets (major news, war events, FOMC, etc.),

using values 7–10 is recommended to filter out weak levels.

- Show Fair Value Gaps (`show_fvg`)

Enables/disables the drawing of FVG zones (imbalances).

- Bullish OB Color (`c_ob_bull`)

- Color of Bullish Order Blocks (Demand Zones).

- Default: semi-transparent green (transparency ≈ 80).

- Bearish OB Color (`c_ob_bear`)

- Color of Bearish Order Blocks (Supply Zones).

- Default: semi-transparent red.

- Bullish FVG Color (`c_fvg_bull`)

- Color of Bullish FVG (upward imbalance), typically yellow.

- Bearish FVG Color (`c_fvg_bear`)

- Color of Bearish FVG (downward imbalance), typically purple.

### 2.3 Smart DCA Strategy Group

- Enable DCA Zones (`show_dca`)

Enables the Smart DCA logic and visual labels.

- RSI Length (`rsi_len`)

Lookback period for RSI (default: 14).

- Shorter → more sensitive, more noise.

- Longer → fewer signals, higher reliability.

- Bollinger Bands Length (`bb_len`)

Moving average period for Bollinger Bands (default: 20).

- BB Multiplier (`bb_mult`)

Standard deviation multiplier for Bollinger Bands (default: 2.0).

- For extremely volatile markets, values like 2.5–3.0 can be used so that only extreme deviations trigger a DCA signal.

### 2.4 Volume Profile (Visible Range Sim) Group

- Show Volume Profile (`show_vp`)

Enables the simulated Volume Profile bars on the right side of the chart.

- Volume Lookback Bars (`vp_lookback`)

Number of bars used to compute the Volume Profile (default: 150).

- Higher values → broader historical context, heavier computation.

- Row Count (`vp_rows`)

Number of vertical price segments (rows) to divide the total price range into (default: 30).

- Width (%) (`vp_width`)

Relative width of each volume bar as a percentage.

In the code, bar widths are scaled relative to the row with the maximum volume.

> Technical note: Volume Profile calculations are executed only on the last bar (`barstate.islast`) to keep the script performant even on higher timeframes.

### 2.5 Wyckoff Helper Group

- Show Wyckoff Events (`show_wyc`)

Enables detection and plotting of Wyckoff Spring events.

- Volume MA Length (`vol_ma_len`)

Length of the moving average on volume.

A bar is considered to have Ultra Volume if its volume is more than 2× the volume MA.

## Chapter 3 – Smart Money Strategy (Order Blocks & FVG)

### 3.1 What Is an Order Block?

An Order Block (OB) represents the footprint of large institutional orders:

- Bullish Order Block (Demand Zone)

The last selling region (bearish candle/cluster) before a strong upward move.

- Bearish Order Block (Supply Zone)

The last buying region (bullish candle/cluster) before a strong downward move.

Institutions and large players place heavy orders in these regions. Typical price behavior:

- Price moves away from the zone.

- Later returns to the same zone to fill unfilled orders.

- Then continues the larger trend.

In the script:

- If `pl` (pivot low) forms → a Bullish OB is created.

- If `ph` (pivot high) forms → a Bearish OB is created.

The box is drawn:

- From `bar_index[ob_period]` to `bar_index`.

- Between `low[ob_period]` and `high[ob_period]`.

- `extend=extend.right` extends the OB into the future, so it acts as a dynamic support/resistance zone.

- Only the last 4 OB boxes are kept to avoid clutter.

### 3.2 Order Block Color Guide

- Semi-transparent Green (`c_ob_bull`)

- Represents a Bullish Order Block (Demand Zone).

- Interpretation: a price region with a high probability of bullish reaction.

- Semi-transparent Red (`c_ob_bear`)

- Represents a Bearish Order Block (Supply Zone).

- Interpretation: a price region with a high probability of bearish reaction.

Overlap (Multiple OBs in the Same Area)

When two or more Order Blocks overlap:

- The shared area appears visually denser/stronger.

- This suggests higher order density.

- Such zones can be treated as high-priority levels for entries, exits, and stop-loss placement.

### 3.3 Demand/Supply Logic in the Scoring Engine

Pine Script®

- If current price is near the lowest lows of the last 20 bars, it is considered in a Demand Zone → positive impact on score.

- If current price is near the highest highs of the last 20 bars, it is considered in a Supply Zone → negative impact on score.

This logic complements Order Blocks and helps the Dashboard distinguish whether:

- Market is currently in a statistically cheap (long-friendly) area, or

- In a statistically expensive (short-friendly) area.

### 3.4 Fair Value Gaps (FVG)

#### Concept

When the market moves aggressively:

- Some price levels are skipped and never traded.

- A gap between wicks/shadows of consecutive candles appears.

- These regions are called Fair Value Gaps (FVGs) or Imbalances.

The market generally “dislikes” imbalance and often:

- Returns to these zones in the future.

- Fills the gap (rebalance).

- Then resumes its dominant direction.

#### Implementation in the Code

Bullish FVG (Yellow)

Pine Script®

Core condition:

`low > high[2]` → the current low is above the high of two bars ago; the space between them is an untraded gap.

Bearish FVG (Purple)

fvg_bear_cond = show_smc and show_fvg and high < low[2] and close[1] < low[2]

if fvg_bear_cond

box.new(bar_index[2], low[2], bar_index, high, ...)

Core condition:

`high < low[2]` → the current high is below the low of two bars ago; again a price gap exists.

#### FVG Color Guide

- Transparent Yellow (`c_fvg_bull`) – Bullish FVG

Often acts like a magnet for price:

- Price tends to retrace into this zone,

- Fill the imbalance,

- And then continue higher.

- Transparent Purple (`c_fvg_bear`) – Bearish FVG

Price tends to:

- Retrace upward into the purple area,

- Fill the imbalance,

- And then resume downward movement.

#### Trading with FVGs

- FVGs are *not* standalone entry signals.

They are best used as:

- Targets (take-profit zones), or

- Reaction areas where you expect a pause or reversal.

Examples:

- If you are long, a bearish FVG above is often an excellent take-profit zone.

- If you are short, a bullish FVG below is often a good cover/exit zone.

### 3.5 Core SMC Trading Templates

#### Reversal Long

1. Price trades down into a green Order Block (Demand Zone).

2. A bullish confirmation candle (Close > Open) forms inside or just above the OB.

3. If this zone is close to or aligned with a bullish FVG (yellow), the signal is reinforced.

4. Entry:

- At the close of the confirmation candle, or

- Using a limit order near the upper boundary of the OB.

5. Stop-loss:

- Slightly below the OB.

- If the OB is broken decisively and price consolidates below it, the zone loses validity.

6. Targets:

- The next FVG,

- Or the next red Order Block (Supply Zone) above.

#### Reversal Short

The mirror scenario:

- Price rallies into a red Order Block (Supply).

- A bearish confirmation candle forms (Close < Open).

- FVG/premium structure above can act as a confluence.

- Stop-loss goes above the OB.

- Targets: lower FVGs or subsequent green OBs below.

## Chapter 4 – Smart DCA Strategy (RSI + Bollinger Bands)

### 4.1 Smart DCA Concept

- Classic DCA = buying at fixed time intervals regardless of price.

- Smart DCA = scaling in only when:

- Price is statistically cheaper than usual, and

- The market is in a clear oversold condition.

Code logic:

Pine Script®

Conditions:

- DCA Buy – Smart Scale-In Zone

- RSI < 30 → oversold.

- Close < lower Bollinger Band → price has broken below its typical volatility envelope.

- DCA Sell – Overbought/Distribution Zone

- RSI > 70 → overbought.

- Close > upper Bollinger Band → price is extended far above the mean.

### 4.2 Visual Representation on the Chart

- Green “DCA” Label Below Candle

- Shape: `labelup`.

- Color: lime background, white text.

- Meaning: statistically attractive level for laddered spot entries or short exits.

- Red “SELL” Label Above Candle

- Warning that the market is in an extended, overbought condition.

- Suitable for profit-taking on longs or considering short entries (with proper confluence and risk management).

- Light Green Background (`bgcolor`)

- When `dca_buy` is true, the candle background turns very light green (high transparency).

- This helps visually identify DCA Zones across the chart at a glance.

### 4.3 Practical Use in Trading

#### Spot Trading

Used to build a better average entry price:

- Every time a DCA label appears, allocate a fixed portion of capital (e.g., 2–5%).

- Combining DCA signals with:

- Green OBs (Demand Zones), and/or

- The Volume Profile POC

makes the zone structurally more important.

#### Futures Trading

- Longs

- Use DCA Buy signals as low-risk zones for opening or adding to longs when:

- Price is inside a green OB, or

- The Dashboard already leans LONG.

- Shorts

- Use DCA Sell signals as:

- Exit zones for longs, or

- Areas to initiate shorts with stops above structural highs.

## Chapter 5 – Volume Profile (Visible Range Simulation)

### 5.1 Concept

Traditional volume (histogram under the chart) shows volume over time.

Volume Profile shows volume by price level:

- At which prices has the highest trading activity occurred?

- Where did buyers and sellers agree the most (High Volume Nodes – HVNs)?

- Where did price move quickly due to low participation (Low Volume Nodes – LVNs)?

### 5.2 Implementation in the Script

Executed only when `show_vp` is enabled and on the last bar:

1. The last `vp_lookback` bars (default 150) are processed.

2. The minimum low and maximum high over this window define the price range.

3. This price range is divided into `vp_rows` segments (e.g., 30 rows).

4. For each row:

- All bars are scanned.

- If the mid-price `(high[j] + low[j]) / 2` falls inside a row, that bar’s volume is added to the row total.

5. The row with the greatest volume is stored as `max_vol_idx` (the POC row).

6. For each row, a volume box is drawn on the right side of the chart.

### 5.3 Color Scheme

- Semi-transparent Orange

- The row with the maximum volume – the Point of Control (POC).

- Represents the strongest support/resistance level from a volume perspective.

- Semi-transparent Blue

- Other volume rows.

- The taller the bar → the higher the volume → the stronger the interest at that price band.

### 5.4 Trading Applications

- If price is above POC and retraces back into it:

→ POC often acts as support, suitable for long setups.

- If price is below POC and rallies into it:

→ POC often acts as resistance, suitable for short setups or profit-taking.

HVNs (Tall Blue Bars)

- Represent areas of equilibrium where the market has spent time and traded heavily.

- Price tends to consolidate here before choosing a direction.

LVNs (Short or Nearly Empty Bars)

- Represent low participation zones.

- Price often moves quickly through these areas – useful for targeting fast moves.

## Chapter 6 – Wyckoff Helper – Spring

### 6.1 Spring Concept

In the Wyckoff framework:

- A Spring is a false break of support.

- The market briefly trades below a well-defined support level, triggers stop losses,

then sharply reverses upward as institutional buyers absorb liquidity.

This movement:

### 6.2 Code Logic

Conditions for a Spring:

1. The current low is lower than the lowest low of the previous 50 bars

→ apparent break of a long-standing support.

2. The bar closes bullish (Close > Open)

→ the breakdown was rejected.

3. Volume is significantly elevated:

→ `volume > 2 × volume_MA` (Ultra Volume).

When all conditions are met and `show_wyc` is enabled:

- A pink diamond is plotted below the bar,

- With the label “Spring” – one of the strongest long signals in this system.

### 6.3 Trading Use

- After a valid Spring, markets frequently enter a meaningful bullish phase.

- The highest quality setups occur when:

- The Spring forms inside a green Order Block, and

- Near or on the Volume Profile POC.

Entries:

- At the close of the Spring bar, or

- On the first pullback into the mid-range of the Spring candle.

Stop-loss:

- Slightly below the Spring’s lowest point (wick low plus a small buffer).

## Chapter 7 – Confluence Engine & Dashboard

### 7.1 Scoring Logic

For each bar, the script:

1. Resets `score` to 0.

2. Adjusts the score based on different signals.

SMC Contribution

Pine Script®

- Being in Demand → `+1`

- Being in Supply → `-1`

DCA Contribution

Pine Script®

- DCA Buy → `+2` (strong, statistically driven long signal)

- DCA Sell → `-2`

Wyckoff Spring Contribution

Pine Script®

- Spring → `+2` (entry of strong money)

### 7.2 Mapping Score to Dashboard Signal

### 7.3 Dashboard Structure

The dashboard is a two-column table:

- Row 0

- Row 1

- Row 2

- Column 0: `"SMC:"`

- Column 1:

- Row 3

- Column 0: `"DCA:"`

- Column 1:

- Row 4

## Chapter 8 – Visual Legend (Colors, Shapes & Actions)

For quick reading inside TradingView, the visual elements are described line by line instead of a table.

Chart Element: Green Box

Color / Shape: Transparent green rectangle

Core Meaning: Bullish Order Block (Demand Zone)

Suggested Trader Response: Look for longs, Smart DCA adds, closing or reducing shorts.

Chart Element: Red Box

Color / Shape: Transparent red rectangle

Core Meaning: Bearish Order Block (Supply Zone)

Suggested Trader Response: Look for shorts, or take profit on existing longs.

Chart Element: Yellow Area

Color / Shape: Transparent yellow zone

Core Meaning: Bullish FVG / upside imbalance

Suggested Trader Response: Short take-profit zone or expected rebalance area.

Chart Element: Purple Area

Color / Shape: Transparent purple zone

Core Meaning: Bearish FVG / downside imbalance

Suggested Trader Response: Long take-profit zone or temporary supply region.

Chart Element: Green "DCA" Label

Color / Shape: Green label with white text, plotted below the candle

Core Meaning: Smart ladder-in buy zone, DCA buy opportunity

Suggested Trader Response: Spot DCA entry, partial short exit.

Chart Element: Red "SELL" Label

Color / Shape: Red label with white text, plotted above the candle

Core Meaning: Overbought / distribution zone

Suggested Trader Response: Take profit on longs, consider initiating shorts.

Chart Element: Light Green Background (bgcolor)

Color / Shape: Very transparent light-green background behind bars

Core Meaning: Active DCA Buy zone

Suggested Trader Response: Treat as a discount zone on the chart.

Chart Element: Orange Bar on Right

Color / Shape: Transparent orange horizontal bar in the volume profile

Core Meaning: POC – price with highest traded volume

Suggested Trader Response: Strong support or resistance; key reference level.

Chart Element: Blue Bars on Right

Color / Shape: Transparent blue horizontal bars in the volume profile

Core Meaning: Other volume levels, showing high-volume and low-volume nodes

Suggested Trader Response: Use to identify balance zones (HVN) and fast-move corridors (LVN).

Chart Element: Pink "Spring" Diamond

Color / Shape: Pink diamond with white text below the candle

Core Meaning: Wyckoff Spring – liquidity grab and potential major bullish reversal

Suggested Trader Response: One of the strongest long signals in the suite; look for high-quality long setups with tight risk.

Chart Element: STRONG LONG in Dashboard

Color / Shape: Green background, white text in the Signal row

Core Meaning: Multiple bullish layers in confluence

Suggested Trader Response: Consider initiating or increasing longs with strict risk management.

Chart Element: STRONG SHORT in Dashboard

Color / Shape: Red background, white text in the Signal row

Core Meaning: Multiple bearish layers in confluence

Suggested Trader Response: Consider initiating or increasing shorts with a logical, well-placed stop.

## Chapter 9 – Timeframe-Based Trading Playbook

### 9.1 Timeframe Selection

- Scalping

- Day Trading

- Swing Trading & Position Investing

### 9.2 Scenario A – Scalping Long

Example: 5-Minute Chart

1. Price is declining into a green OB (Bullish Demand).

2. A candle with a long lower wick and bullish close (Pin Bar / Rejection) forms inside the OB.

3. A Spring diamond appears below the same candle → very strong confluence.

4. The Dashboard shows at least WEAK LONG ↗, ideally STRONG LONG 🚀.

5. Entry:

6. Stop-loss:

7. Targets:

### 9.3 Scenario B – Day-Trading Short

Recommended Timeframes: 1H or 4H

1. The market completes a strong impulsive move upward.

2. Price enters a red Order Block (Supply).

3. In the same zone, a purple FVG appears or remains unfilled.

4. On a lower timeframe (e.g., 15M), RSI enters overbought territory and a DCA Sell signal appears.

5. The main timeframe Dashboard (1H) shows WEAK SHORT ↘ or STRONG SHORT 🩸.

Trade Plan

- Open a short near the upper boundary of the red OB.

- Place the stop above the OB or above the last swing high.

- Targets:

### 9.4 Scenario C – Swing / Investment with Smart DCA

Timeframes: Daily / Weekly

1. On the daily or weekly chart, each time a green “DCA” label appears:

2. Check whether this DCA zone aligns with the orange POC of the Volume Profile:

3. If the DCA signal sits inside a daily green OB, the probability of a medium-term bottom increases.

4. Always build the position laddered, never all-in at a single price.

Exits for investors:

### 9.5 Case Study 1 – BTCUSDT (15-Minute)

Plan

### 9.6 Case Study 2 – Meme Coin (PEPE – 4H)

Plan

## Chapter 10 – Risk Management, Psychology & Advanced Tuning

### 10.1 Risk Management

No signal, regardless of its strength, replaces risk control.

Recommendations:

- In futures, do not expose more than 1–3% of account equity to risk per trade.

- Adjust leverage to the volatility of the instrument (lower leverage for highly volatile altcoins).

- Place stop-losses in zones where the idea is clearly invalidated:

- Below/above the relevant Order Block or Spring, not randomly in the middle of the structure.

### 10.2 Market-Specific Parameter Tuning

- Calmer Markets (e.g., major FX pairs)

- Highly Volatile Markets (Crypto, news-driven assets)

### 10.3 Trading Psychology

- STRONG LONG 🚀 does not mean “risk-free”.

It means the probability of a successful long, given the model’s logic, is higher than average.

- Treat Mars Signals as a confirmation and context system, not a full replacement for your own decision-making.

- Example of disciplined thinking:

## Chapter 11 – Technical Notes & FAQ

### 11.1 Does the Script Repaint?

- Order Blocks and Springs are based on completed pivot structures and confirmed candles.

- Until a pivot is confirmed, an OB does not exist; after confirmation, behavior is stable under classic SMC assumptions.

- The script is designed to be structurally consistent rather than repainting signals arbitrarily.

### 11.2 Computational Load of Volume Profile

- On the last bar, the script processes up to `vp_lookback` bars × `vp_rows` rows.

- On very low timeframes with heavy zooming, this can become demanding.

- If you experience performance issues:

- Reduce `vp_lookback` or `vp_rows`, or

- Temporarily disable Volume Profile (`show_vp = false`).

### 11.3 Multi-Timeframe Behavior

- This version of the script is not internally multi-timeframe.

All logic (OB, DCA, Spring, Volume Profile) is computed on the active timeframe only.

- Practical workflow:

## Conclusion

Mars Signals – Ultimate Institutional Suite v3.0 (Joker) is a multi-layer trading framework that unifies:

into a single, coherent system driven by a transparent Confluence Scoring Engine.

The final output is presented in clear, actionable language:

The system is designed to support professional decision-making, not to replace it.

Used together with strict risk management and disciplined execution,

Mars Signals – UIS v3.0 (Joker) can serve as a central reference manual and operational guide

for your trading workflow, from scalping to swing and investment positioning.

Mars Signals – Ultimate Institutional Suite v3.0 (Joker)

## Chapter 1 – Philosophy & System Architecture

This script is not a simple “buy/sell” indicator.

Mars Signals – UIS v3.0 (Joker) is designed as an institutional-style analytical assistant that layers several methodologies into a single, coherent framework.

The system is built on four core pillars:

1. Smart Money Concepts (SMC)

- - Detection of Order Blocks (professional demand/supply zones).

- - Detection of Fair Value Gaps (FVGs) (price imbalances).

2. Smart DCA Strategy

- - Combination of RSI and Bollinger Bands

- - Identifies statistically discounted zones for scaling into spot positions or exiting shorts.

3. Volume Profile (Visible Range Simulation)

- - Distribution of volume by price, not by time.

- - Identification of POC (Point of Control) and high-/low-volume areas.

4. Wyckoff Helper – Spring

- - Detection of bear traps, liquidity grabs, and sharp bullish reversals.

All four pillars feed into a Confluence Engine (Scoring System).

The final output is presented in the Dashboard, with a clear, human-readable signal:

- - STRONG LONG 🚀

- - WEAK LONG ↗

- - NEUTRAL / WAIT

- - WEAK SHORT ↘

- - STRONG SHORT 🩸

This allows the trader to see *how many* and *which* layers of the system support a bullish or bearish bias at any given time.

## Chapter 2 – Settings Overview

### 2.1 General & Dashboard Group

- Show Dashboard Panel (`show_dash`)

Turns the dashboard table in the corner of the chart ON/OFF.

- Show Signal Recommendation (`show_rec`)

- - If enabled, the textual signal (STRONG LONG, WEAK SHORT, etc.) is displayed.

- - If disabled, you only see feature status (ON/OFF) and the current price.

- Dashboard Position (`dash_pos`)

Determines where the dashboard appears on the chart:

- - `Top Right`

- - `Bottom Right`

- - `Top Left`

### 2.2 Smart Money (SMC) Group

- Enable SMC Strategy (`show_smc`)

Globally enables or disables the Order Block and FVG logic.

- Order Block Pivot Lookback (`ob_period`)

Main parameter for detecting key pivot highs/lows (swing points).

- Default value: 5

- Concept:

A bar is considered a pivot low if its low is lower than the lows of the previous 5 and the next 5 bars.

Similarly, a pivot high has a high higher than the previous 5 and the next 5 bars.

These pivots are used as anchors for Order Blocks.

- Increasing `ob_period`:

- Fewer levels.

- But levels tend to be more significant and reliable.

- In highly volatile markets (major news, war events, FOMC, etc.),

using values 7–10 is recommended to filter out weak levels.

- Show Fair Value Gaps (`show_fvg`)

Enables/disables the drawing of FVG zones (imbalances).

- Bullish OB Color (`c_ob_bull`)

- Color of Bullish Order Blocks (Demand Zones).

- Default: semi-transparent green (transparency ≈ 80).

- Bearish OB Color (`c_ob_bear`)

- Color of Bearish Order Blocks (Supply Zones).

- Default: semi-transparent red.

- Bullish FVG Color (`c_fvg_bull`)

- Color of Bullish FVG (upward imbalance), typically yellow.

- Bearish FVG Color (`c_fvg_bear`)

- Color of Bearish FVG (downward imbalance), typically purple.

### 2.3 Smart DCA Strategy Group

- Enable DCA Zones (`show_dca`)

Enables the Smart DCA logic and visual labels.

- RSI Length (`rsi_len`)

Lookback period for RSI (default: 14).

- Shorter → more sensitive, more noise.

- Longer → fewer signals, higher reliability.

- Bollinger Bands Length (`bb_len`)

Moving average period for Bollinger Bands (default: 20).

- BB Multiplier (`bb_mult`)

Standard deviation multiplier for Bollinger Bands (default: 2.0).

- For extremely volatile markets, values like 2.5–3.0 can be used so that only extreme deviations trigger a DCA signal.

### 2.4 Volume Profile (Visible Range Sim) Group

- Show Volume Profile (`show_vp`)

Enables the simulated Volume Profile bars on the right side of the chart.

- Volume Lookback Bars (`vp_lookback`)

Number of bars used to compute the Volume Profile (default: 150).

- Higher values → broader historical context, heavier computation.

- Row Count (`vp_rows`)

Number of vertical price segments (rows) to divide the total price range into (default: 30).

- Width (%) (`vp_width`)

Relative width of each volume bar as a percentage.

In the code, bar widths are scaled relative to the row with the maximum volume.

> Technical note: Volume Profile calculations are executed only on the last bar (`barstate.islast`) to keep the script performant even on higher timeframes.

### 2.5 Wyckoff Helper Group

- Show Wyckoff Events (`show_wyc`)

Enables detection and plotting of Wyckoff Spring events.

- Volume MA Length (`vol_ma_len`)

Length of the moving average on volume.

A bar is considered to have Ultra Volume if its volume is more than 2× the volume MA.

## Chapter 3 – Smart Money Strategy (Order Blocks & FVG)

### 3.1 What Is an Order Block?

An Order Block (OB) represents the footprint of large institutional orders:

- Bullish Order Block (Demand Zone)

The last selling region (bearish candle/cluster) before a strong upward move.

- Bearish Order Block (Supply Zone)

The last buying region (bullish candle/cluster) before a strong downward move.

Institutions and large players place heavy orders in these regions. Typical price behavior:

- Price moves away from the zone.

- Later returns to the same zone to fill unfilled orders.

- Then continues the larger trend.

In the script:

- If `pl` (pivot low) forms → a Bullish OB is created.

- If `ph` (pivot high) forms → a Bearish OB is created.

The box is drawn:

- From `bar_index[ob_period]` to `bar_index`.

- Between `low[ob_period]` and `high[ob_period]`.

- `extend=extend.right` extends the OB into the future, so it acts as a dynamic support/resistance zone.

- Only the last 4 OB boxes are kept to avoid clutter.

### 3.2 Order Block Color Guide

- Semi-transparent Green (`c_ob_bull`)

- Represents a Bullish Order Block (Demand Zone).

- Interpretation: a price region with a high probability of bullish reaction.

- Semi-transparent Red (`c_ob_bear`)

- Represents a Bearish Order Block (Supply Zone).

- Interpretation: a price region with a high probability of bearish reaction.

Overlap (Multiple OBs in the Same Area)

When two or more Order Blocks overlap:

- The shared area appears visually denser/stronger.

- This suggests higher order density.

- Such zones can be treated as high-priority levels for entries, exits, and stop-loss placement.

### 3.3 Demand/Supply Logic in the Scoring Engine

is_in_demand = low <= ta.lowest(low, 20)[1]

is_in_supply = high >= ta.highest(high, 20)[1]

- If current price is near the lowest lows of the last 20 bars, it is considered in a Demand Zone → positive impact on score.

- If current price is near the highest highs of the last 20 bars, it is considered in a Supply Zone → negative impact on score.

This logic complements Order Blocks and helps the Dashboard distinguish whether:

- Market is currently in a statistically cheap (long-friendly) area, or

- In a statistically expensive (short-friendly) area.

### 3.4 Fair Value Gaps (FVG)

#### Concept

When the market moves aggressively:

- Some price levels are skipped and never traded.

- A gap between wicks/shadows of consecutive candles appears.

- These regions are called Fair Value Gaps (FVGs) or Imbalances.

The market generally “dislikes” imbalance and often:

- Returns to these zones in the future.

- Fills the gap (rebalance).

- Then resumes its dominant direction.

#### Implementation in the Code

Bullish FVG (Yellow)

fvg_bull_cond = show_smc and show_fvg and low > high[2] and close[1] > high[2]

if fvg_bull_cond

box.new(bar_index[2], high[2], bar_index, low, ...)

Core condition:

`low > high[2]` → the current low is above the high of two bars ago; the space between them is an untraded gap.

Bearish FVG (Purple)

fvg_bear_cond = show_smc and show_fvg and high < low[2] and close[1] < low[2]

if fvg_bear_cond

box.new(bar_index[2], low[2], bar_index, high, ...)

Core condition:

`high < low[2]` → the current high is below the low of two bars ago; again a price gap exists.

#### FVG Color Guide

- Transparent Yellow (`c_fvg_bull`) – Bullish FVG

Often acts like a magnet for price:

- Price tends to retrace into this zone,

- Fill the imbalance,

- And then continue higher.

- Transparent Purple (`c_fvg_bear`) – Bearish FVG

Price tends to:

- Retrace upward into the purple area,

- Fill the imbalance,

- And then resume downward movement.

#### Trading with FVGs

- FVGs are *not* standalone entry signals.

They are best used as:

- Targets (take-profit zones), or

- Reaction areas where you expect a pause or reversal.

Examples:

- If you are long, a bearish FVG above is often an excellent take-profit zone.

- If you are short, a bullish FVG below is often a good cover/exit zone.

### 3.5 Core SMC Trading Templates

#### Reversal Long

1. Price trades down into a green Order Block (Demand Zone).

2. A bullish confirmation candle (Close > Open) forms inside or just above the OB.

3. If this zone is close to or aligned with a bullish FVG (yellow), the signal is reinforced.

4. Entry:

- At the close of the confirmation candle, or

- Using a limit order near the upper boundary of the OB.

5. Stop-loss:

- Slightly below the OB.

- If the OB is broken decisively and price consolidates below it, the zone loses validity.

6. Targets:

- The next FVG,

- Or the next red Order Block (Supply Zone) above.

#### Reversal Short

The mirror scenario:

- Price rallies into a red Order Block (Supply).

- A bearish confirmation candle forms (Close < Open).

- FVG/premium structure above can act as a confluence.

- Stop-loss goes above the OB.

- Targets: lower FVGs or subsequent green OBs below.

## Chapter 4 – Smart DCA Strategy (RSI + Bollinger Bands)

### 4.1 Smart DCA Concept

- Classic DCA = buying at fixed time intervals regardless of price.

- Smart DCA = scaling in only when:

- Price is statistically cheaper than usual, and

- The market is in a clear oversold condition.

Code logic:

rsi_val = ta.rsi(close, rsi_len)

[bb_mid, bb_upper, bb_lower] = ta.bb(close, bb_len, bb_mult)

dca_buy = show_dca and rsi_val < 30 and close < bb_lower

dca_sell = show_dca and rsi_val > 70 and close > bb_upper

Conditions:

- DCA Buy – Smart Scale-In Zone

- RSI < 30 → oversold.

- Close < lower Bollinger Band → price has broken below its typical volatility envelope.

- DCA Sell – Overbought/Distribution Zone

- RSI > 70 → overbought.

- Close > upper Bollinger Band → price is extended far above the mean.

### 4.2 Visual Representation on the Chart

- Green “DCA” Label Below Candle

- Shape: `labelup`.

- Color: lime background, white text.

- Meaning: statistically attractive level for laddered spot entries or short exits.

- Red “SELL” Label Above Candle

- Warning that the market is in an extended, overbought condition.

- Suitable for profit-taking on longs or considering short entries (with proper confluence and risk management).

- Light Green Background (`bgcolor`)

- When `dca_buy` is true, the candle background turns very light green (high transparency).

- This helps visually identify DCA Zones across the chart at a glance.

### 4.3 Practical Use in Trading

#### Spot Trading

Used to build a better average entry price:

- Every time a DCA label appears, allocate a fixed portion of capital (e.g., 2–5%).

- Combining DCA signals with:

- Green OBs (Demand Zones), and/or

- The Volume Profile POC

makes the zone structurally more important.

#### Futures Trading

- Longs

- Use DCA Buy signals as low-risk zones for opening or adding to longs when:

- Price is inside a green OB, or

- The Dashboard already leans LONG.

- Shorts

- Use DCA Sell signals as:

- Exit zones for longs, or

- Areas to initiate shorts with stops above structural highs.

## Chapter 5 – Volume Profile (Visible Range Simulation)

### 5.1 Concept

Traditional volume (histogram under the chart) shows volume over time.

Volume Profile shows volume by price level:

- At which prices has the highest trading activity occurred?

- Where did buyers and sellers agree the most (High Volume Nodes – HVNs)?

- Where did price move quickly due to low participation (Low Volume Nodes – LVNs)?

### 5.2 Implementation in the Script

Executed only when `show_vp` is enabled and on the last bar:

1. The last `vp_lookback` bars (default 150) are processed.

2. The minimum low and maximum high over this window define the price range.

3. This price range is divided into `vp_rows` segments (e.g., 30 rows).

4. For each row:

- All bars are scanned.

- If the mid-price `(high[j] + low[j]) / 2` falls inside a row, that bar’s volume is added to the row total.

5. The row with the greatest volume is stored as `max_vol_idx` (the POC row).

6. For each row, a volume box is drawn on the right side of the chart.

### 5.3 Color Scheme

- Semi-transparent Orange

- The row with the maximum volume – the Point of Control (POC).

- Represents the strongest support/resistance level from a volume perspective.

- Semi-transparent Blue

- Other volume rows.

- The taller the bar → the higher the volume → the stronger the interest at that price band.

### 5.4 Trading Applications

- If price is above POC and retraces back into it:

→ POC often acts as support, suitable for long setups.

- If price is below POC and rallies into it:

→ POC often acts as resistance, suitable for short setups or profit-taking.

HVNs (Tall Blue Bars)

- Represent areas of equilibrium where the market has spent time and traded heavily.

- Price tends to consolidate here before choosing a direction.

LVNs (Short or Nearly Empty Bars)

- Represent low participation zones.

- Price often moves quickly through these areas – useful for targeting fast moves.

## Chapter 6 – Wyckoff Helper – Spring

### 6.1 Spring Concept

In the Wyckoff framework:

- A Spring is a false break of support.

- The market briefly trades below a well-defined support level, triggers stop losses,

then sharply reverses upward as institutional buyers absorb liquidity.

This movement:

- - Clears out weak hands (retail sellers).

- - Provides large players with liquidity to enter long positions.

- - Often initiates a new uptrend.

### 6.2 Code Logic

Conditions for a Spring:

1. The current low is lower than the lowest low of the previous 50 bars

→ apparent break of a long-standing support.

2. The bar closes bullish (Close > Open)

→ the breakdown was rejected.

3. Volume is significantly elevated:

→ `volume > 2 × volume_MA` (Ultra Volume).

When all conditions are met and `show_wyc` is enabled:

- A pink diamond is plotted below the bar,

- With the label “Spring” – one of the strongest long signals in this system.

### 6.3 Trading Use

- After a valid Spring, markets frequently enter a meaningful bullish phase.

- The highest quality setups occur when:

- The Spring forms inside a green Order Block, and

- Near or on the Volume Profile POC.

Entries:

- At the close of the Spring bar, or

- On the first pullback into the mid-range of the Spring candle.

Stop-loss:

- Slightly below the Spring’s lowest point (wick low plus a small buffer).

## Chapter 7 – Confluence Engine & Dashboard

### 7.1 Scoring Logic

For each bar, the script:

1. Resets `score` to 0.

2. Adjusts the score based on different signals.

SMC Contribution

if show_smc

if is_in_demand

score += 1

if is_in_supply

score -= 1

- Being in Demand → `+1`

- Being in Supply → `-1`

DCA Contribution

if show_dca

if dca_buy

score += 2

if dca_sell

score -= 2

- DCA Buy → `+2` (strong, statistically driven long signal)

- DCA Sell → `-2`

Wyckoff Spring Contribution

if show_wyc

if wyc_spring

score += 2

- Spring → `+2` (entry of strong money)

### 7.2 Mapping Score to Dashboard Signal

- - score ≥ 2 → STRONG LONG 🚀

- Multiple bullish conditions aligned.

- - score = 1 → WEAK LONG ↗

- Some bullish bias, but only one layer clearly positive.

- - score = 0 → NEUTRAL / WAIT

- Rough balance between buying and selling forces; staying flat is usually preferable.

- - score = -1 → WEAK SHORT ↘

- Mild bearish bias, suited for cautious or short-term plays.

- - score ≤ -2 → STRONG SHORT 🩸

- Convergence of several bearish signals.

### 7.3 Dashboard Structure

The dashboard is a two-column table:

- Row 0

- - Column 0: `"Mars Signals"` – black background, white text.

- - Column 1: `"UIS v3.0"` – black background, yellow text.

- Row 1

- - Column 0: `"Price:"` (light grey background).

- - Column 1: current closing price (`close`) with a semi-transparent blue background.

- Row 2

- Column 0: `"SMC:"`

- Column 1:

- - `"ON"` (green) if `show_smc = true`

- - `"OFF"` (grey) otherwise.

- Row 3

- Column 0: `"DCA:"`

- Column 1:

- - `"ON"` (green) if `show_dca = true`

- - `"OFF"` (grey) otherwise.

- Row 4

- - Column 0: `"Signal:"`

- - Column 1: signal text (`status_txt`) with background color `status_col`

- (green, red, teal, maroon, etc.)

- - If `show_rec = false`, these cells are cleared.

## Chapter 8 – Visual Legend (Colors, Shapes & Actions)

For quick reading inside TradingView, the visual elements are described line by line instead of a table.

Chart Element: Green Box

Color / Shape: Transparent green rectangle

Core Meaning: Bullish Order Block (Demand Zone)

Suggested Trader Response: Look for longs, Smart DCA adds, closing or reducing shorts.

Chart Element: Red Box

Color / Shape: Transparent red rectangle

Core Meaning: Bearish Order Block (Supply Zone)

Suggested Trader Response: Look for shorts, or take profit on existing longs.

Chart Element: Yellow Area

Color / Shape: Transparent yellow zone

Core Meaning: Bullish FVG / upside imbalance

Suggested Trader Response: Short take-profit zone or expected rebalance area.

Chart Element: Purple Area

Color / Shape: Transparent purple zone

Core Meaning: Bearish FVG / downside imbalance

Suggested Trader Response: Long take-profit zone or temporary supply region.

Chart Element: Green "DCA" Label

Color / Shape: Green label with white text, plotted below the candle

Core Meaning: Smart ladder-in buy zone, DCA buy opportunity

Suggested Trader Response: Spot DCA entry, partial short exit.

Chart Element: Red "SELL" Label

Color / Shape: Red label with white text, plotted above the candle

Core Meaning: Overbought / distribution zone

Suggested Trader Response: Take profit on longs, consider initiating shorts.

Chart Element: Light Green Background (bgcolor)

Color / Shape: Very transparent light-green background behind bars

Core Meaning: Active DCA Buy zone

Suggested Trader Response: Treat as a discount zone on the chart.

Chart Element: Orange Bar on Right

Color / Shape: Transparent orange horizontal bar in the volume profile

Core Meaning: POC – price with highest traded volume

Suggested Trader Response: Strong support or resistance; key reference level.

Chart Element: Blue Bars on Right

Color / Shape: Transparent blue horizontal bars in the volume profile

Core Meaning: Other volume levels, showing high-volume and low-volume nodes

Suggested Trader Response: Use to identify balance zones (HVN) and fast-move corridors (LVN).

Chart Element: Pink "Spring" Diamond

Color / Shape: Pink diamond with white text below the candle

Core Meaning: Wyckoff Spring – liquidity grab and potential major bullish reversal

Suggested Trader Response: One of the strongest long signals in the suite; look for high-quality long setups with tight risk.

Chart Element: STRONG LONG in Dashboard

Color / Shape: Green background, white text in the Signal row

Core Meaning: Multiple bullish layers in confluence

Suggested Trader Response: Consider initiating or increasing longs with strict risk management.

Chart Element: STRONG SHORT in Dashboard

Color / Shape: Red background, white text in the Signal row

Core Meaning: Multiple bearish layers in confluence

Suggested Trader Response: Consider initiating or increasing shorts with a logical, well-placed stop.

## Chapter 9 – Timeframe-Based Trading Playbook

### 9.1 Timeframe Selection

- Scalping

- - Timeframes: 1M, 5M, 15M

- - Objective: fast intraday moves (minutes to a few hours).

- - Recommendation: focus on SMC + Wyckoff.

- Smart DCA on very low timeframes may introduce excessive noise.

- Day Trading

- - Timeframes: 15M, 1H, 4H

- - Provides a good balance between signal quality and frequency.

- - Recommendation: use the full stack – SMC + DCA + Volume Profile + Wyckoff + Dashboard.

- Swing Trading & Position Investing

- - Timeframes: Daily, Weekly

- - Emphasis on Smart DCA + Volume Profile.

- - SMC and Wyckoff are used mainly to fine-tune swing entries within larger trends.

### 9.2 Scenario A – Scalping Long

Example: 5-Minute Chart

1. Price is declining into a green OB (Bullish Demand).

2. A candle with a long lower wick and bullish close (Pin Bar / Rejection) forms inside the OB.

3. A Spring diamond appears below the same candle → very strong confluence.

4. The Dashboard shows at least WEAK LONG ↗, ideally STRONG LONG 🚀.

5. Entry:

- - On the close of the confirmation candle, or

- - On the first pullback into the mid-range of that candle.

6. Stop-loss:

- - Slightly below the OB.

7. Targets:

- - Nearby bearish FVG above, and/or

- - The next red OB.

### 9.3 Scenario B – Day-Trading Short

Recommended Timeframes: 1H or 4H

1. The market completes a strong impulsive move upward.

2. Price enters a red Order Block (Supply).

3. In the same zone, a purple FVG appears or remains unfilled.

4. On a lower timeframe (e.g., 15M), RSI enters overbought territory and a DCA Sell signal appears.

5. The main timeframe Dashboard (1H) shows WEAK SHORT ↘ or STRONG SHORT 🩸.

Trade Plan

- Open a short near the upper boundary of the red OB.

- Place the stop above the OB or above the last swing high.

- Targets:

- - A yellow FVG lower on the chart, and/or

- - The next green OB (Demand) below.

### 9.4 Scenario C – Swing / Investment with Smart DCA

Timeframes: Daily / Weekly

1. On the daily or weekly chart, each time a green “DCA” label appears:

- - Allocate a fixed fraction of your capital (e.g., 3–5%) to that asset.

2. Check whether this DCA zone aligns with the orange POC of the Volume Profile:

- - If yes → the quality of the entry zone is significantly higher.

3. If the DCA signal sits inside a daily green OB, the probability of a medium-term bottom increases.

4. Always build the position laddered, never all-in at a single price.

Exits for investors:

- - Near weekly red OBs or large purple FVG zones.

- - Ideally via partial profit-taking rather than closing 100% at once.

### 9.5 Case Study 1 – BTCUSDT (15-Minute)

- - Context: Price has sold off down towards 65,000 USD.

- - A green OB had previously formed at that level.

- - Near the lower boundary of this OB, a partially filled yellow FVG is present.

- - As price returns to this region, a Spring appears.

- - The Dashboard shifts from NEUTRAL / WAIT to WEAK LONG ↗.

Plan

- - Enter a long near the OB low.

- - Place stop below the Spring low.

- - First target: a purple FVG around 66,200.

- - Second (optional) target: the first red OB above that level.

### 9.6 Case Study 2 – Meme Coin (PEPE – 4H)

- - After a strong pump, price enters a corrective phase.

- - On the 4H chart, RSI drops below 30; price breaks below the lower Bollinger Band → a DCA label prints.

- - The Volume Profile shows the POC at approximately the same level.

- - The Dashboard displays STRONG LONG 🚀.

Plan

- - Execute laddered buys in the combined DCA + POC zone.

- - Place a protective stop below the last significant swing low.

- - Target: an expected 20–30% upside move towards the next red OB or purple FVG.

## Chapter 10 – Risk Management, Psychology & Advanced Tuning

### 10.1 Risk Management

No signal, regardless of its strength, replaces risk control.

Recommendations:

- In futures, do not expose more than 1–3% of account equity to risk per trade.

- Adjust leverage to the volatility of the instrument (lower leverage for highly volatile altcoins).

- Place stop-losses in zones where the idea is clearly invalidated:

- Below/above the relevant Order Block or Spring, not randomly in the middle of the structure.

### 10.2 Market-Specific Parameter Tuning

- Calmer Markets (e.g., major FX pairs)

- - `ob_period`: 3–5.

- - `bb_mult`: 2.0 is usually sufficient.

- Highly Volatile Markets (Crypto, news-driven assets)

- - `ob_period`: 7–10 to highlight only the most robust OBs.

- - `bb_mult`: 2.5–3.0 so that only extreme deviations trigger DCA.

- - `vol_ma_len`: increase (e.g., to ~30) so that Spring triggers only on truly exceptional

### 10.3 Trading Psychology

- STRONG LONG 🚀 does not mean “risk-free”.

It means the probability of a successful long, given the model’s logic, is higher than average.

- Treat Mars Signals as a confirmation and context system, not a full replacement for your own decision-making.

- Example of disciplined thinking:

- - The Dashboard prints STRONG LONG,

- - But price is simultaneously testing a multi-month macro resistance or a major negative news event is imminent,

- - In such cases, trade smaller, widen stops appropriately, or skip the trade.

## Chapter 11 – Technical Notes & FAQ

### 11.1 Does the Script Repaint?

- Order Blocks and Springs are based on completed pivot structures and confirmed candles.

- Until a pivot is confirmed, an OB does not exist; after confirmation, behavior is stable under classic SMC assumptions.

- The script is designed to be structurally consistent rather than repainting signals arbitrarily.

### 11.2 Computational Load of Volume Profile

- On the last bar, the script processes up to `vp_lookback` bars × `vp_rows` rows.

- On very low timeframes with heavy zooming, this can become demanding.

- If you experience performance issues:

- Reduce `vp_lookback` or `vp_rows`, or

- Temporarily disable Volume Profile (`show_vp = false`).

### 11.3 Multi-Timeframe Behavior

- This version of the script is not internally multi-timeframe.

All logic (OB, DCA, Spring, Volume Profile) is computed on the active timeframe only.

- Practical workflow:

- - Analyze overall structure and key zones on higher timeframes (4H / Daily).

- - Use lower timeframes (15M / 1H) with the same tool for timing entries and exits.

## Conclusion

Mars Signals – Ultimate Institutional Suite v3.0 (Joker) is a multi-layer trading framework that unifies:

- - Price structure (Order Blocks & FVG),

- - Statistical behavior (Smart DCA via RSI + Bollinger),

- - Volume distribution by price (Volume Profile with POC, HVN, LVN),

- - Liquidity events (Wyckoff Spring),

into a single, coherent system driven by a transparent Confluence Scoring Engine.

The final output is presented in clear, actionable language:

> STRONG LONG / WEAK LONG / NEUTRAL / WEAK SHORT / STRONG SHORT

The system is designed to support professional decision-making, not to replace it.

Used together with strict risk management and disciplined execution,

Mars Signals – UIS v3.0 (Joker) can serve as a central reference manual and operational guide

for your trading workflow, from scalping to swing and investment positioning.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.