OPEN-SOURCE SCRIPT

Aggiornato Volume Profile [ActiveQuants]

The Volume Profile indicator visualizes the distribution of trading volume across price levels over a user-defined historical period. It identifies key liquidity zones, including the Point of Control (POC) (price level with the highest volume) and the Value Area (price range containing a specified percentage of total volume). This tool is ideal for traders analyzing support/resistance levels, market sentiment, and potential price reversals.

█ CORE METHODOLOGY

█ KEY FEATURES

- Customizable Lookback & Resolution

- Configurable Profile Width & Horizontal Offset

- Value Area & POC Highlighting

- Flexible Display Options

- Gradient Coloring

- Real-Time Adjustments

█ USAGE EXAMPLES

Example 1: Basic Volume Profile with Value Area

Settings:

Image Context:

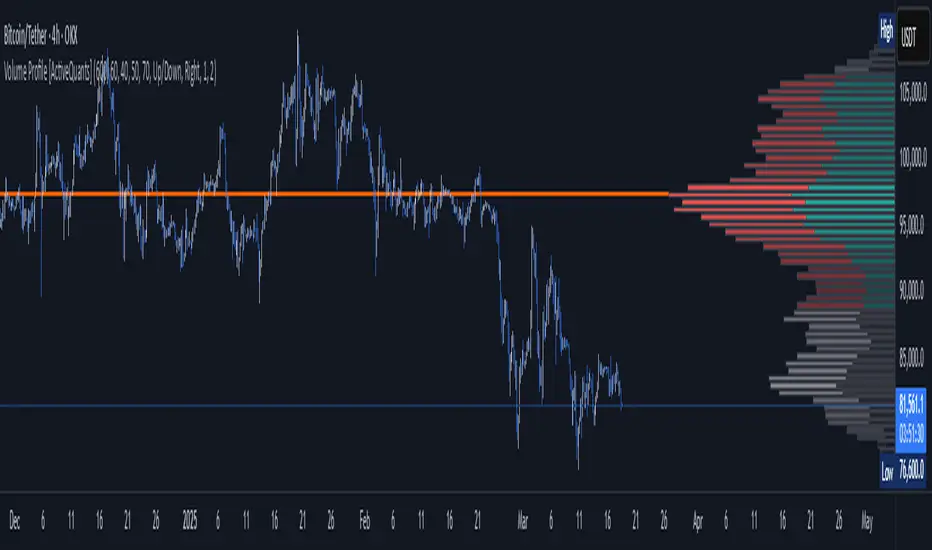

The profile appears on the right side of the chart. The POC (orange line) marks the highest volume row. Value Area rows (green/red) extend above/below the POC, containing 70% of total volume.

Example 2: Total Volume with Gradient Colors

Settings:

Image Context:

Rows display total volume in a single color with gradient transparency. Darker rows indicate higher volume concentration.

Example 3: Left-Aligned Profile with Narrow Value Area

Settings:

Image Context:

The profile shifts to the left, with a tighter Value Area (50%).

█ USER INPUTS

Calculation Settings

Appearance

█ CONCLUSION

The Volume Profile indicator provides a dynamic, customizable view of market liquidity. By highlighting the POC and Value Area, traders can identify high-probability reversal zones, gauge market sentiment, and align entries/exits with key volume levels.

█ IMPORTANT NOTES

⚠ Lookback Period: Shorter lookbacks prioritize recent activity but may omit critical levels.

⚠ Horizontal Offset Limitation: Avoid excessively high offsets (e.g., close to ±300). TradingView restricts plotting indicators more than 500 bars into the future, which may truncate or hide the profile.

⚠ Risk Management: While the indicator highlights areas of concentrated volume, always use it in combination with other technical analysis tools and proper risk management techniques.

█ RISK DISCLAIMER

Trading involves substantial risk. The Volume Profile highlights historical liquidity but does not predict future price movements. Always use stop-loss orders and confirm signals with additional analysis. Past performance is not indicative of future results.

📊 Happy trading! 🚀

█ CORE METHODOLOGY

- Vertical Price Rows: Divides the price range of the selected lookback period into equal-height rows.

- Volume Aggregation: Accumulates bullish/bearish or total volume within each price row.

- POC: The row with the highest total volume.

- Value Area: Expands from the POC until cumulative volume meets the user-defined threshold (e.g., 70%).

- Dynamic Visualization: Rows are plotted as horizontal boxes with widths proportional to their volume.

█ KEY FEATURES

- Customizable Lookback & Resolution

- Adjust the historical period (Lookback) and granularity (Number of Rows) for precise analysis.

- Configurable Profile Width & Horizontal Offset

- Control the relative horizontal length of the profile rows, and set the distance from the current bar to the POC row’s anchor.

Important: Do not set the horizontal offset too high. Indicators cannot be plotted more than 500 bars into the future.

- Value Area & POC Highlighting

- Set the percentage of total volume required to form the Value Area, ensuring that key volume levels are clearly identified.

- Value Area rows are colored distinctly, while the POC is marked with a bold line.

- Flexible Display Options

- Show bullish/bearish volume splits or total volume.

- Place the profile on the right or left of the chart.

- Gradient Coloring

- Rows fade in color intensity based on their relative volume strength.

- Real-Time Adjustments

- Modify horizontal offset, profile width, and appearance without reloading.

█ USAGE EXAMPLES

Example 1: Basic Volume Profile with Value Area

Settings:

- Lookback: 500 bars

- Number of Rows: 100

- Value Area: 70%

- Display Type: Up/Down

- Placement: Right

Image Context:

The profile appears on the right side of the chart. The POC (orange line) marks the highest volume row. Value Area rows (green/red) extend above/below the POC, containing 70% of total volume.

Example 2: Total Volume with Gradient Colors

Settings:

- Lookback: 800 bars

- Number of Rows: 100

- Profile Width: 60

- Horizontal Offset: 20

- Display Type: Total

- Gradient Colors: Enabled

Image Context:

Rows display total volume in a single color with gradient transparency. Darker rows indicate higher volume concentration.

Example 3: Left-Aligned Profile with Narrow Value Area

Settings:

- Lookback: 600 bars

- Number of Rows: 100

- Profile Width: 45

- Horizontal Offset: 500

- Value Area: 50%

- Profile Placement: Left

Image Context:

The profile shifts to the left, with a tighter Value Area (50%).

█ USER INPUTS

Calculation Settings

- Lookback: Historical bars analyzed (default: 500).

- Number of Rows: Vertical resolution of the profile (default: 100).

- Profile Width: Horizontal length of rows (default: 50).

- Horizontal Offset: Distance from the current bar to the POC (default: 50).

- Value Area (%): Cumulative volume threshold for the Value Area (default: 70%).

- Volume Display: Toggle between Up/Down (bullish/bearish) or Total volume.

- Profile Placement: Align profile to the Right or Left of the chart.

Appearance

- Rows Border: Customize border width/color.

- Gradient Colors: Enable fading color effects.

- Value Area Colors: Set distinct colors for bullish and bearish Value Area rows.

- POC Line: Adjust color, width, and visibility.

█ CONCLUSION

The Volume Profile indicator provides a dynamic, customizable view of market liquidity. By highlighting the POC and Value Area, traders can identify high-probability reversal zones, gauge market sentiment, and align entries/exits with key volume levels.

█ IMPORTANT NOTES

⚠ Lookback Period: Shorter lookbacks prioritize recent activity but may omit critical levels.

⚠ Horizontal Offset Limitation: Avoid excessively high offsets (e.g., close to ±300). TradingView restricts plotting indicators more than 500 bars into the future, which may truncate or hide the profile.

⚠ Risk Management: While the indicator highlights areas of concentrated volume, always use it in combination with other technical analysis tools and proper risk management techniques.

█ RISK DISCLAIMER

Trading involves substantial risk. The Volume Profile highlights historical liquidity but does not predict future price movements. Always use stop-loss orders and confirm signals with additional analysis. Past performance is not indicative of future results.

📊 Happy trading! 🚀

Note di rilascio

Updates:

Updated row volume calculation method

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.