OPEN-SOURCE SCRIPT

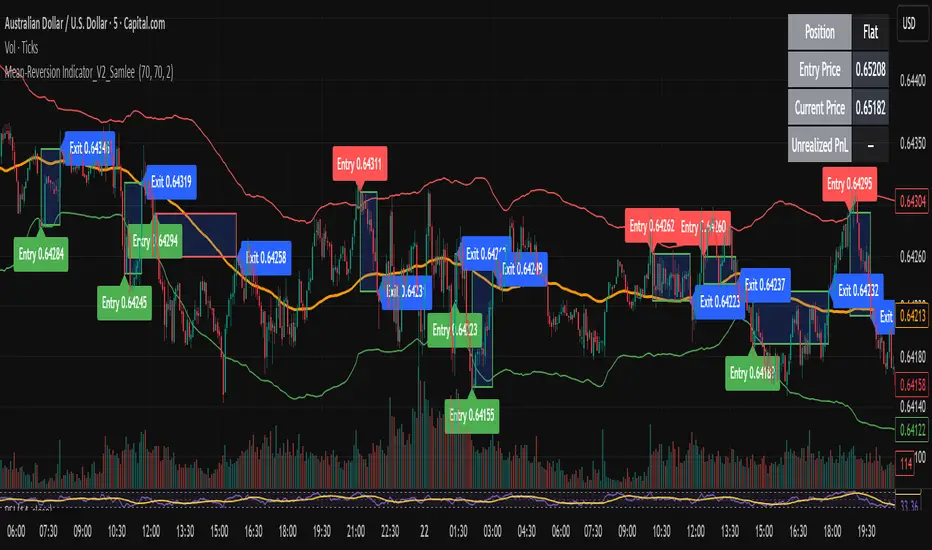

Mean-Reversion Indicator_V2_Samlee

Overview

This is the second version of my mean reversion indicator. It combines a moving average with adaptive standard deviation bands to detect when the price deviates significantly from its mean. The script provides automatic entry/exit signals, real-time PnL tracking, and shaded trade zones to make mean reversion trading more intuitive.

Core Logic

Mean benchmark: Simple Moving Average (MA).

Volatility bands: Standard deviation of the spread (close − MA) defines upper and lower bands.

Trading rules:

Price breaks below the lower band → Enter Long

Price breaks above the upper band → Enter Short

Price reverts to MA → Exit position

What’s different vs. classic Bollinger/Keltner

Bandwidth is based on the standard deviation of the price–MA spread, not raw closing prices.

Entry signals use previous-bar confirmation to reduce intrabar noise.

Exit rule is a mean-touch condition, rather than fixed profit/loss targets.

Enhanced visualization:

A shaded box dynamically shows the distance between entry and current/exit price, making it easy to see profit/loss zones over the holding period.

Instant PnL labels display current position side (Long/Short/Flat) and live profit/loss in both pips and %.

Entry and exit points are clearly marked on the chart with labels and exact prices.

These visualization tools go beyond what most indicators provide, giving traders a clearer, more practical view of trade evolution.

Key Features

Automatic detection of position status (Long / Short / Flat).

Chart labels for entries (“Entry”) and exits (“Exit”).

Real-time floating PnL calculation in both pips and %.

Info panel (top-right) showing entry price, current price, position side, and PnL.

Dynamic shading between entry and current/exit price to visualize profit/loss zones.

Usage Notes & Risk

Mean reversion may underperform in strong trending markets; parameters (len_ma, len_std, mult) should be validated per instrument and timeframe.

Works best on relatively stable, mean-reverting pairs (e.g., AUDNZD).

Risk management is essential: use independent stop-loss rules (e.g., limit risk to 1–2% of equity per trade).

This script is provided for educational purposes only and is not financial advice.

This is the second version of my mean reversion indicator. It combines a moving average with adaptive standard deviation bands to detect when the price deviates significantly from its mean. The script provides automatic entry/exit signals, real-time PnL tracking, and shaded trade zones to make mean reversion trading more intuitive.

Core Logic

Mean benchmark: Simple Moving Average (MA).

Volatility bands: Standard deviation of the spread (close − MA) defines upper and lower bands.

Trading rules:

Price breaks below the lower band → Enter Long

Price breaks above the upper band → Enter Short

Price reverts to MA → Exit position

What’s different vs. classic Bollinger/Keltner

Bandwidth is based on the standard deviation of the price–MA spread, not raw closing prices.

Entry signals use previous-bar confirmation to reduce intrabar noise.

Exit rule is a mean-touch condition, rather than fixed profit/loss targets.

Enhanced visualization:

A shaded box dynamically shows the distance between entry and current/exit price, making it easy to see profit/loss zones over the holding period.

Instant PnL labels display current position side (Long/Short/Flat) and live profit/loss in both pips and %.

Entry and exit points are clearly marked on the chart with labels and exact prices.

These visualization tools go beyond what most indicators provide, giving traders a clearer, more practical view of trade evolution.

Key Features

Automatic detection of position status (Long / Short / Flat).

Chart labels for entries (“Entry”) and exits (“Exit”).

Real-time floating PnL calculation in both pips and %.

Info panel (top-right) showing entry price, current price, position side, and PnL.

Dynamic shading between entry and current/exit price to visualize profit/loss zones.

Usage Notes & Risk

Mean reversion may underperform in strong trending markets; parameters (len_ma, len_std, mult) should be validated per instrument and timeframe.

Works best on relatively stable, mean-reverting pairs (e.g., AUDNZD).

Risk management is essential: use independent stop-loss rules (e.g., limit risk to 1–2% of equity per trade).

This script is provided for educational purposes only and is not financial advice.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.