INVITE-ONLY SCRIPT

SOFEX High-End Indicators + Backtesting

Aggiornato

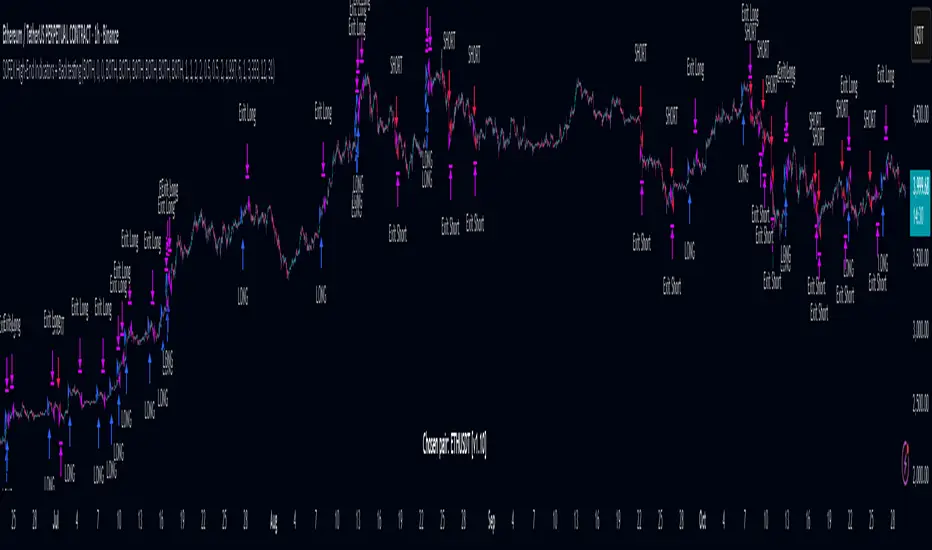

Introducing the first publicly available suite of indicators for Bitcoin and Ethereum by Sofex - the High-End Indicators & Backtesting System.

🔬Trading Philosophy

The High-End Indicators & Backtesting system offers both trend-following and mean-reversal algorithms to provide traders with a deep insight into the highly volatile cryptocurrency markets, known for their market noise and vulnerability to manipulation.

With these factors in mind, our indicators are designed to sidestep most potentially false signals. This is facilitated further by the "middle-ground" time frame (1 Hour) we use. Our focus is on the two largest cryptocurrencies: Bitcoin and Ethereum, which provide high liquidity, necessary for reliable trading.

Therefore, we recommend using our suite on these markets.

The backtesting version of the Sofex High-End Indicators includes mainly trend-following indicators. This is because our trading vision is that volatility in cryptocurrency markets is a tool that should be used carefully, and many times avoided. Furthermore, mean-reversal trading can lead to short-term profits, but we have found it less than ideal for long-term trading.

The script does not aim to make a lot of trades, or to always remain in a position and switch from long to short. Many times there is no direction and the market is in "random walk mode", and chasing trades is futile.

Based on our experience, it is preferable if traders remain neutral the majority of the time and only enter trades that can be exited in the foreseeable future. Trading just for the sake of it ultimately leads to loss in the long-run.

Expectations of performance should be realistic.

We also focus on a balanced take-profit to stop-loss ratio. In the default set-up of the script, that is a 2% : 2% (1:1) ratio. A relatively low stop loss and take profit build onto our idea that positions should be exited promptly. There are many options to edit these values, including enabling trailing take profit and stop loss. Traders can also completely turn off TP and SL levels, and rely on opposing signals to exit and enter new trades.

Extreme scenarios can happen on the cryptocurrency markets, and disabling stop-loss levels completely is not recommended. The position size should be monitored since all of it is at risk with no stop-loss.

We take pride in presenting this comprehensive suite of trading indicators, designed for both manual and automated use. Although automated use leads to increased efficiency, traders are free to incorporate any of our indicators into their own manual trading strategy.

⚙️Indicators

By default, all indicators are enabled for both Long and Short trades.

Extreme Trend Breakouts

The Extreme Trend Breakouts indicator seeks to follow breakouts of support and resistance levels, while also accounting for the unfortunate fact that false signals can be generated on these levels. The indicator combines trend-breakout strategies with various other volatility and direction measurements. It works best in the beginning of trends.

Underpinning this indicator are renowned Perry Kaufman's Adaptive Moving Averages (PKAMA) alongside our proprietary adaptive moving averages. These dynamic indicators adjust their parameters based on recent price movements, attempting to catch trends while maintaining consistent performance in the long run.

In addition, our modification of the TTM Squeeze indicator further enhances the Extreme Trend Breakouts indicator, making it more responsive, especially during the initial stages of trends and filtering of "flat" markets.

High-Volatility Trend Follower

The High-Volatility Trend Follower indicator is based around the logic of evading market conditions where volatility is low (choppy markets) and aggressively following confirmed trends. The indicator works best during strong trends, however, it has the downside of entering trades at trend tops or bottoms.

This indicator also leverages our proprietary adaptive moving averages to identify and follow high-volatility trends effectively. Furthermore, it uses the Average Directional Index, Aroon Oscillator, ATR and a modified version of VWAP, to categorize trends into weak or strong ones. The VWAP indicator is used to identify the monetary (volume) inflow into a given trend, further helping to avoid short-term manipulations.

Low-Volatility Reversal

The Low-Volatility Reversal aims at plugging the holes that trend-following indicators ignore. It specifically looks for choppy markets. Using proven concepts such as Relative Strength Index and volume measurements, among others, this indicator finds local tops and bottoms with good accuracy. It works best in choppy markets with low to medium volatility. It has a downside that all reversals have, losing trades at the end of choppy markets and in the beginning of big trends.

This indicator, like the others, employs PKAMA in conjunction with our proprietary adaptive moving averages, and an Average PSAR indicator to seek out "sideways" markets. Furthermore, Bollinger Bands with an adaptive basis line is used, with the idea of trading against the short-term trends by looking at big deviations in price movement. The above mentioned indicators attempt to catch local tops and bottoms in markets.

Adaptive Trend Convergence

The Adaptive Trend Convergence aims at following trends while avoiding entering positions at local bottoms and tops. It does so by comparing a number of adaptive moving averages and looking for convergence among them. Adaptive filtering techniques for avoiding choppy markets are also used.

This indicator utilizes our proprietary adaptive moving averages, and an Average Price Range indicator to identify trend convergence and divergence effectively, preventing false signals during volatile market phases. It also makes use of Bollinger Bands with an adaptive moving average basis line and price-action adjusted deviation. Contrasting to the Low-Volatility Reversal condition described above, the Bollinger Bands used here attempt to follow breakouts outside of the lower and upper bands.

Double-Filtered Channel Breakouts

The Double-Filtered Channel Breakouts indicator is made out of adaptive channel-identifying indicators. The indicator then follows trends that significantly diverge from the established channels. This aims at following extreme trends, where rapid, continuous movements in either direction occur. This indicator works best in very strong trends and follows them relentlessly. However, these strong trends can end in strong reversals, and the indicator can be stopped out on the last trade.

Our Double-Filtered Channel Breakouts indicator is built on a foundation of adaptive channel indicators. We've harnessed the power of Keltner Channels and Bollinger Band Channels, with a similar approach used in the Adaptive Trend Convergence indicator. The basis and upper/lower bands of the channels do not rely on fixed deviation parameters, rather on adaptive ones, based on price action and volatility. This combination seeks to identify and follows extreme trends.

Direction Tracker

The Direction Tracker indicator is made out of a central slower, adaptive moving average that clearly recognizes global, long-term trends. Combined with direction and range indicators, among others, this indicator excels at finding the long-term trend and ignoring temporary pullbacks in the opposite direction. It works best at the beginning and middle of long and strong trends. It can fail at the end of trends and on very strong historical resistance lines (where sharp reversals are common).

Our Direction Tracker indicator integrates an adaptive SuperTrend indicator into its core, alongside our proprietary adaptive moving averages, to accurately identify and track long-term trends while mitigating temporary pullbacks. Furthermore, it uses Average True Range, ADX and other volatility indicators to attempt to catch unusual moves on the market early-on.

📟Parameters Menu

To offer traders flexibility, our system comes with a comprehensive parameter menu:

Preset Selection: Choose between Bitcoin or Ethereum presets to tailor the indicators to your preferred cryptocurrency market.

Global Signal Direction: Set the global signal direction as Long, Short, or Both, depending on your trading strategy.

Global Sensitivity Parameter: Adjust the system's sensitivity to adapt to different trend-following conditions, particularly beneficial during higher-strength trends.

Source of Signals: Toggle individual indicators on or off according to your preference. By default, all indicators are enabled. Customize the indicators to trade Long, Short, or Both, aligning them with your desired market exposure.

Confirmation of Signals: Set the minimum number of confirmed signals on the same bar, ensuring signals are generated only when specific confirmation criteria are met. The default value is one, and it can be adjusted for both Long and Short signals.

Exit of Signals: You have options regarding Take-Profit (TP) and Stop-Loss (SL) levels. Enable TP/SL levels to exit trades at predetermined levels, or disable them to rely on direction changes for exits. Be aware that removing stop losses can introduce additional risk, and position sizing should be carefully monitored.

By enabling Trailing TP/SL, the system switches to a trailing approach, allowing you to:

- Place an initial customizable SL.

- Specify a level (%) for the Trailing SL to become active.

- When the activation level is reached, the system moves the trailing stop by a given Offset (%).

Additionally, you can enable exit at break-even, where the system places an exit order when the trail activation level is reached, accounting for fees and slippage.

Alert Messages: Define the fields for alert messages based on specific conditions. You can set up alerts to receive email, SMS, and in-app notifications. If you use webhooks for alerts, exercise caution, as these alerts can potentially execute trades without human supervision.

Backtesting: Default backtesting parameters are set to provide realistic backtesting performance:

- 0.04% Commission per trade (for both entries and exits)

- 3 ticks Slippage (highly dependent on exchange)

- Initial capital of $1000

- Order size of $1000

While the order size is equal to the initial capital, the script employs a 2% stop-loss order to limit losses and attempts to prevent risky trades from creating big losses. The order size is a set dollar value, so that the backtesting performance is linear, instead of using % of capital which may result in unrealistic backtesting performance.

Risk Disclaimer

Please be aware that backtesting results, while valuable for statistical overview, do not guarantee future performance in any way. Cryptocurrency markets are inherently volatile and risky. Always trade responsibly and do not risk more than you can afford to lose.

Note di rilascio

Version 1.1- Global sensitivity parameter now available for Long/Short separately.

- Backtesting menu inputs fix.

- ETHUSDT preset updated.

Note di rilascio

Version 1.2- Changes to global sensitivity parameters

Note di rilascio

Version 1.3- Added adaptive ATR filter to "Direction Tracker" Indicator.

- Added ATR filter to "Adaptive Trend Convergence" in the place of Average Price Range.

Note di rilascio

Version 1.5- Bug fixes for Low Volatility Reversal Indicator for SOLUSDT.

Note di rilascio

Version 1.6- Updated indicator parameters.

- Allowed

- Bug fixes.

Note di rilascio

Version 1.7- Updated indicator parameters for BINANCE:BTCUSDT.P.

Note di rilascio

Version 1.8- Removed SOLUSDT from presets.

Note di rilascio

Version 1.9- Small changes to Indicator "Low-Volatility Reversal" on ETHUSDT.

Script su invito

L'accesso a questo script è riservato agli utenti autorizzati dall'autore, solitamente dietro pagamento di una commissione. Puoi aggiungerlo ai preferiti, ma sarai in grado di utilizzarlo solo una volta ricevuto il via libera da parte dell'autore. Per ulteriori informazioni, contatta sofex o segui le istruzioni dell'autore riportate di seguito.

TradingView non suggerisce di pagare per uno script e di utilizzarlo a meno che non ci si fidi al 100% del suo autore e non si comprenda il suo funzionamento. In molti casi, è possibile trovare gratuitamente una buona alternativa open-source nei nostri Script della comunità.

Istruzioni dell'autore

″Visit https://sofex.io to request access to this script. (Only way to request access)

Vuoi usare questo script sui tuoi grafici?

Attenzione: leggi prima di richiedere l'accesso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.