OPEN-SOURCE SCRIPT

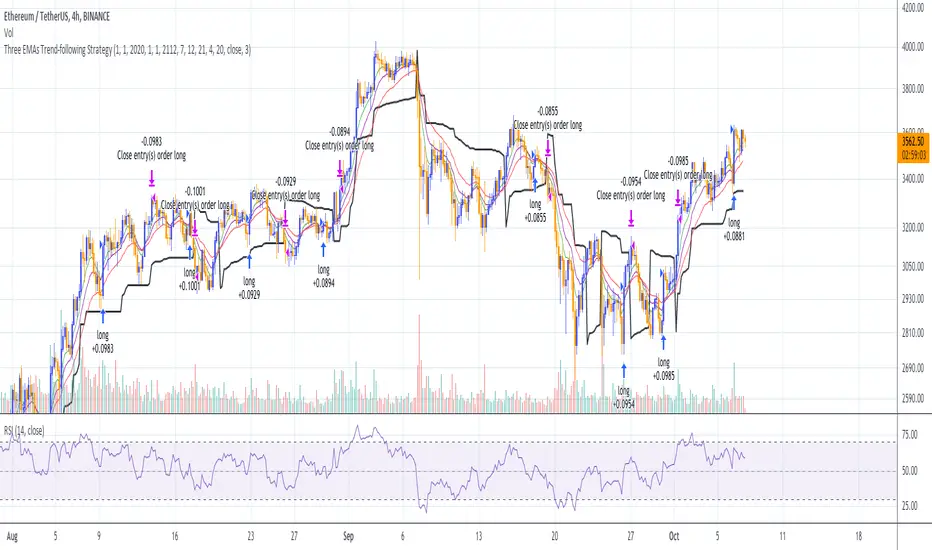

Three EMAs Trend-following Strategy (by Coinrule)

Trend-following strategies are great because they give you the peace of mind that you're trading in line with the market.

However, by definition, you're always following. That means you're always a bit later than your want to be. The main challenges such strategies face are:

This EMA Trend-following strategy attempts to address such challenges while allowing for a dynamic stop loss.

ENTRY

The trading system requires three crossovers on the same candle to confirm that a new trend is beginning:

The first benefit of using all three crossovers is to reduce false signals. The second benefit is that you know that a strong trend is likely to develop relatively soon, with the help of the fast setup of the three EMAs.

EXIT

The strategy comes with a fixed take profit and a volatility stop, which acts as a trailing stop to adapt to the trend's strength. That helps you get out of the way as soon as market conditions change. Depending on your long term confidence in the asset, you can edit the fixed take profit to be more conservative or aggressive.

The position is closed when:

The best time frame for this strategy based on our backtest is the 4-hr. Shorter timeframes can also work well, although they exhibit larger volatility in their returns. In general, this approach suits medium timeframes. A trading fee of 0.1% is taken into account. The fee is aligned to the base fee applied on Binance, which is the largest cryptocurrency exchange.

You can execute this strategy on your favourite exchange at coinrule.com

However, by definition, you're always following. That means you're always a bit later than your want to be. The main challenges such strategies face are:

- Confirming that there is a trend

- Following the trend, hopefully, early enough to catch the majority of the move

- Hopping off the trade when it seems to have run its course

This EMA Trend-following strategy attempts to address such challenges while allowing for a dynamic stop loss.

ENTRY

The trading system requires three crossovers on the same candle to confirm that a new trend is beginning:

- Price crossing over EMA 7

- Price crossing over EMA 14

- Price crossing over EMA 21

The first benefit of using all three crossovers is to reduce false signals. The second benefit is that you know that a strong trend is likely to develop relatively soon, with the help of the fast setup of the three EMAs.

EXIT

The strategy comes with a fixed take profit and a volatility stop, which acts as a trailing stop to adapt to the trend's strength. That helps you get out of the way as soon as market conditions change. Depending on your long term confidence in the asset, you can edit the fixed take profit to be more conservative or aggressive.

The position is closed when:

- The price increases by 4%

- The price crosses below the volatility stop.

The best time frame for this strategy based on our backtest is the 4-hr. Shorter timeframes can also work well, although they exhibit larger volatility in their returns. In general, this approach suits medium timeframes. A trading fee of 0.1% is taken into account. The fee is aligned to the base fee applied on Binance, which is the largest cryptocurrency exchange.

You can execute this strategy on your favourite exchange at coinrule.com

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.