OPEN-SOURCE SCRIPT

LANZ Strategy 4.0 [Backtest]

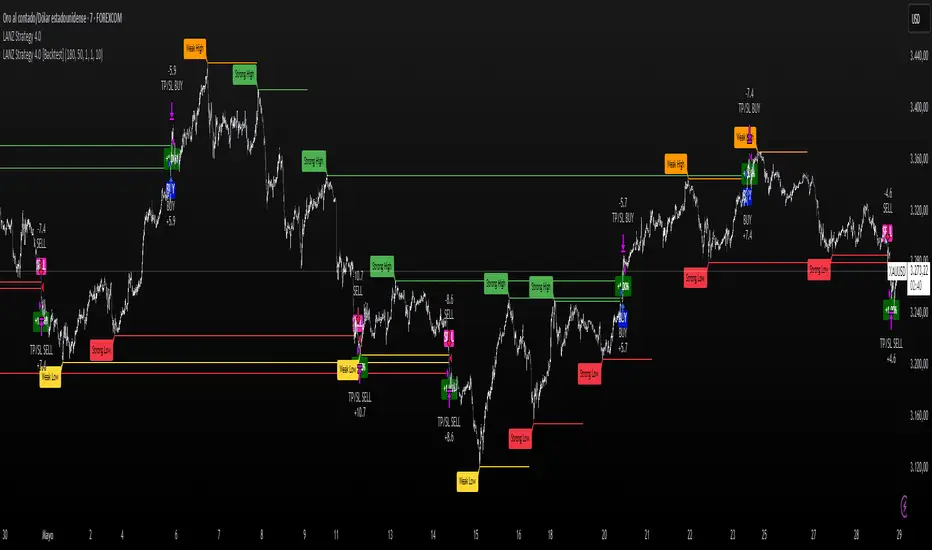

🔷 LANZ Strategy 4.0 — Strategy Execution Based on Confirmed Structure + Risk-Based SL/TP

LANZ Strategy 4.0 [Backtest] is the official backtesting engine for the LANZ Strategy 4.0 trading logic. It simulates real-time executions based on breakout of Strong/Weak Highs or Lows, using a consistent structural system with SL/TP dynamically calculated per trade. With integrated risk management and lot size logic, this script allows traders to validate LANZ Strategy 4.0 performance with real strategy metrics.

🧠 Core Components:

📊 Visual Features:

⚙️ How It Works:

📝 Notes:

📌 Credits:

Backtest engine developed by LANZ based on the official rules of LANZ Strategy 4.0. This script ensures visual and logical consistency between live charting and backtesting simulations.

LANZ Strategy 4.0 [Backtest] is the official backtesting engine for the LANZ Strategy 4.0 trading logic. It simulates real-time executions based on breakout of Strong/Weak Highs or Lows, using a consistent structural system with SL/TP dynamically calculated per trade. With integrated risk management and lot size logic, this script allows traders to validate LANZ Strategy 4.0 performance with real strategy metrics.

🧠 Core Components:

- Confirmed Breakout Entries: Trades are executed only when price breaks the most recent structural level (Strong High or Strong Low), detected using swing pivots.

- Dynamic SL and TP Logic: SL is placed below/above the breakout point with a customizable buffer. TP is defined using a fixed Risk-Reward (RR) ratio.

- Capital-Based Risk Management: Lot size is calculated based on account equity, SL distance, and pip value (e.g. $10 per pip on XAUUSD).

- Clean and Controlled Executions: Only one trade is active at a time. No new entries are allowed until the current position is closed.

📊 Visual Features:

- Automatic plotting of Entry, SL, and TP levels.

- Full control of swing sensitivity (swingLength) and SL buffer.

- SL and TP lines extend visually for clarity of trade risk and reward zones.

⚙️ How It Works:

- Detects pivots and classifies trend direction.

- Waits for breakout above Strong High (BUY) or below Strong Low (SELL).

- Calculates dynamic SL and TP based on buffer and RR.

- Computes trade size automatically based on risk per trade %.

- Executes entry and manages exits via strategy engine.

📝 Notes:

- Ideal for evaluating the LANZ Strategy 4.0 logic over historical data.

- Must be paired with the original indicator (LANZ Strategy 4.0) for live trading.

- Best used on assets with clear structural behavior (gold, indices, FX).

📌 Credits:

Backtest engine developed by LANZ based on the official rules of LANZ Strategy 4.0. This script ensures visual and logical consistency between live charting and backtesting simulations.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.