OPEN-SOURCE SCRIPT

Aggiornato ATR+CCI Monetary Risk Tool - TP/SL

⚙️ ATR+CCI Monetary Risk Tool — Volatility-aware TP/SL & Position Sizing

Exact prices (no rounding), ATR-percentile dynamic stops, and risk-budget sizing for consistent execution.

🧠 What this indicator is

A risk-first planning tool. It doesn’t generate orders; it gives you clean, objective levels (Entry, SL, TP) and position size derived from your risk budget. It shows only the latest setup to keep charts readable, and a compact on-chart table summarizing the numbers you actually act on.

✨ What makes it different

🔧 How to use (quick start)

Add to chart and pick your timeframe and symbol.

In settings:

Read the labels (Entry/TP/SL) and the table (SL Distance, Position Size, Max USD Risk, ATR Percentile, effective SL Mult).

Combine with your entry trigger (price action, levels, momentum, etc.). This indicator handles risk & targets.

📐 How levels are computed

📊 What you’ll see on chart

🧪 Practical examples

🧭 Why traders should use it

🔧 Input guide (practical defaults)

💡 Best practices

⚠️ Notes & limitations

📎 Disclaimer

For educational purposes only. Not financial advice. Markets involve risk. Test thoroughly before trading live.

Exact prices (no rounding), ATR-percentile dynamic stops, and risk-budget sizing for consistent execution.

🧠 What this indicator is

A risk-first planning tool. It doesn’t generate orders; it gives you clean, objective levels (Entry, SL, TP) and position size derived from your risk budget. It shows only the latest setup to keep charts readable, and a compact on-chart table summarizing the numbers you actually act on.

✨ What makes it different

- Dynamic SL by regime (ATR percentile): Instead of a fixed multiple, the SL multiplier adapts to the current volatility percentile (low / medium / high). That helps avoid tight stops in noisy markets and over-wide stops in quiet markets.

- Risk budgeting, not guesswork: Size is computed from Account Balance × Max Risk % divided by SL distance × point value. You risk the same dollars across assets/timeframes.

- Precision that matches your instrument: Entry, TP, SL, and SL Distance are displayed as exact prices (no rounding), truncated to syminfo.mintick so they align with broker/exchange precision.

- Symbol-aware point value: Uses syminfo.pointvalue so you don’t maintain tick tables.

- Non-repaint option: Work from closed bars to keep the plan stable.

🔧 How to use (quick start)

Add to chart and pick your timeframe and symbol.

In settings:

Set Account Balance (USD) and Max Risk per Trade (%).

Choose R:R (1:1 … 1:5).

Pick ATR Period and CCI Period (defaults are sensible).

Keep Dynamic ATR ON to adapt SL by regime.

Keep Use closed-bar values ON to avoid repaint when planning.

Read the labels (Entry/TP/SL) and the table (SL Distance, Position Size, Max USD Risk, ATR Percentile, effective SL Mult).

Combine with your entry trigger (price action, levels, momentum, etc.). This indicator handles risk & targets.

📐 How levels are computed

- Bias: CCI ≥ 0 ⇒ long, otherwise short.

- ATR Percentile: Percent rank of ATR(atrPeriod) over a lookback window.

- Effective SL Mult:If percentile < Low threshold ⇒ use Low SL Mult (tighter).

If between thresholds ⇒ use Base SL Mult.

If percentile > High threshold ⇒ use High SL Mult (wider). - Stop-Loss: SL = Entry ± ATR × SL_Mult (minus for long, plus for short).

- Take-Profit: TP = Entry ± (Entry − SL) × R (R from the R:R dropdown).

- Position Size:USD Risk = Balance × Risk%

Contracts = USD Risk ÷ (|Entry − SL| × PointValue)

For futures, quantity is floored to whole contracts. - Exact prices: Entry/TP/SL and SL Distance are not rounded; they’re truncated to mintick so what you see matches valid price increments.

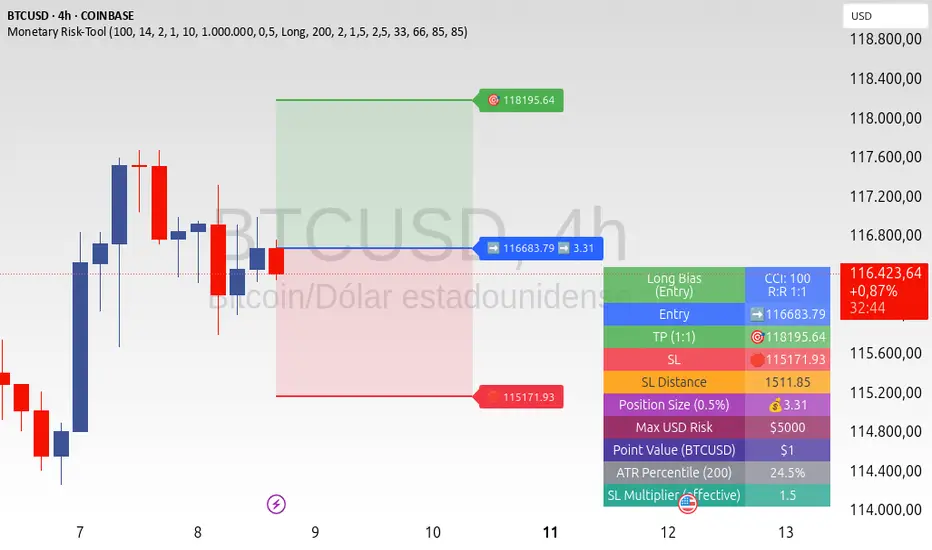

📊 What you’ll see on chart

- Latest Entry (blue), TP (green), SL (red) with labels (optional emojis: ➡️ 🎯 🛑).

- Info Table with:

- Bias, Entry, TP, SL (exact, truncated to mintick)

- SL Distance (exact, truncated)

- Position Size (contracts/units)

- Max USD Risk

- Point Value

- ATR Percentile and effective SL Mult

- Bias, Entry, TP, SL (exact, truncated to mintick)

🧪 Practical examples

- High-volatility session (e.g., XAUUSD, 1H): ATR percentile is high ⇒ wider SL, smaller size. Reduces churn from normal noise during macro events.

- Range-bound market (e.g., EURUSD, 4H): ATR percentile low ⇒ tighter SL, better R:R. Helps you avoid carrying unnecessary risk.

- Index swing planning (e.g., ES1!, Daily): Non-repaint levels + risk budgeting = consistent sizing across days/weeks, easier to review and journal.

🧭 Why traders should use it

- Consistency: Same dollar risk regardless of instrument or volatility regime.

- Clarity: One-trade view forces focus; you see the numbers that matter.

- Adaptivity: Stops calibrated to the market’s current behavior, not last month’s.

- Discipline: A visible checklist (SL distance, size, USD risk) before you hit buy/sell.

🔧 Input guide (practical defaults)

- CCI Period: 100 by default; use as a bias filter, not an entry signal.

- ATR Period: 14 by default; raise for smoother, lower for more reactive.

- ATR Percentile Lookback: 200 by default (stable regime detection).

- Percentile thresholds: 33/66 by default; widen the gap to change how often regimes switch.

- SL Mults: Start ~1.5 / 2.0 / 2.5 (low/base/high). Tune by asset.

- Risk % per trade: Common pro ranges are 0.25–1.0%; adjust to your risk tolerance.

- R:R: Start with 1:2 or 1:3 for balanced skew; adapt to strategy edge.

- Closed-bar values: Keep ON for planning/live; turn OFF only for exploration.

💡 Best practices

- Combine with your entry logic (structure, momentum, liquidity levels).

- Review ATR percentile and effective SL Mult across sessions so you understand regime shifts.

- For futures, remember size is floored to whole contracts—safer by design.

- Journal trades with the table snapshot to improve risk discipline over time.

⚠️ Notes & limitations

This is not a strategy; it does not place orders or alerts.

No slippage/commissions modeled here; build a strategy() version for backtests that mirror your broker/exchange.

Displayed non-price metrics use two decimals; prices and SL Distance are exact (truncated to mintick).

📎 Disclaimer

For educational purposes only. Not financial advice. Markets involve risk. Test thoroughly before trading live.

Note di rilascio

📢 Update: UnBiased Mode – Manual Direction🆕 New Feature:

You can now enable UnBiased Mode to ignore CCI and manually choose Long or Short.

• TP, SL, distance, and position size adjust to your chosen direction.

• Info table shows an [color=orange]orange warning header[/color] with your selected side.

💡 Why Use It:

Perfect for discretionary trading, quick simulations, or testing scenarios without CCI conditions.

📈 How to Use:

1. Enable UnBiased Mode in settings.

2. Select Long or Short.

3. All calculations and labels update instantly for your chosen bias.

Note di rilascio

Two new features added: 1️⃣ Custom Risk/Reward – Now you can type any numeric value for your R:R (e.g. 1 = 1:1, 2 = 2:1, 0.5 = 1:2).

2️⃣ Shaded Zones – The chart now shows a translucent area between [color=green]Entry ↔ TP[/color] and [color=red]Entry ↔ SL[/color] for quick visual reference.

How to use:

• Set your desired R:R number in the new input.

• Enable/disable dynamic ATR adaptation as needed.

• Enjoy a cleaner view of targets and stops with shaded risk/reward areas.

Perfect for traders who want fast, precise visual management of trades.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.