OPEN-SOURCE SCRIPT

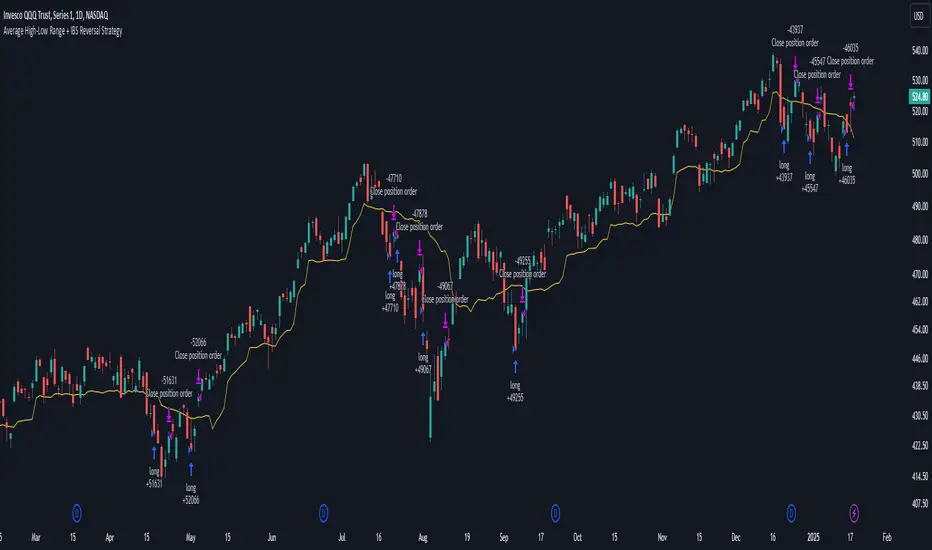

Average High-Low Range + IBS Reversal Strategy

█ STRATEGY DESCRIPTION

The "Average High-Low Range + IBS Reversal Strategy" is a mean-reversion strategy designed to identify potential buying opportunities when the price deviates significantly from its average high-low range and the Internal Bar Strength (IBS) indicates oversold conditions. It enters a long position when specific conditions are met and exits when the price shows strength by exceeding the previous bar's high. This strategy is suitable for use on various timeframes.

█ WHAT IS THE AVERAGE HIGH-LOW RANGE?

The Average High-Low Range is calculated as the Simple Moving Average (SMA) of the difference between the high and low prices over a specified period. It helps identify periods of increased volatility and potential reversal points.

█ WHAT IS INTERNAL BAR STRENGTH (IBS)?

Internal Bar Strength (IBS) is a measure of where the closing price is relative to the high and low of the bar. It is calculated as:

Pine Script®

A low IBS value (e.g., below 0.2) indicates that the close is near the low of the bar, suggesting oversold conditions.

█ SIGNAL GENERATION

1. LONG ENTRY

A Buy Signal is triggered when:

2. EXIT CONDITION

█ ADDITIONAL SETTINGS

█ PERFORMANCE OVERVIEW

The "Average High-Low Range + IBS Reversal Strategy" is a mean-reversion strategy designed to identify potential buying opportunities when the price deviates significantly from its average high-low range and the Internal Bar Strength (IBS) indicates oversold conditions. It enters a long position when specific conditions are met and exits when the price shows strength by exceeding the previous bar's high. This strategy is suitable for use on various timeframes.

█ WHAT IS THE AVERAGE HIGH-LOW RANGE?

The Average High-Low Range is calculated as the Simple Moving Average (SMA) of the difference between the high and low prices over a specified period. It helps identify periods of increased volatility and potential reversal points.

█ WHAT IS INTERNAL BAR STRENGTH (IBS)?

Internal Bar Strength (IBS) is a measure of where the closing price is relative to the high and low of the bar. It is calculated as:

IBS = (Close - Low) / (High - Low)

A low IBS value (e.g., below 0.2) indicates that the close is near the low of the bar, suggesting oversold conditions.

█ SIGNAL GENERATION

1. LONG ENTRY

A Buy Signal is triggered when:

- The close price has been below the buy threshold (calculated as `upper - (2.5 * hl_avg)`) for a specified number of consecutive bars (`bars_below_threshold`).

- The IBS value is below the specified buy threshold (`ibs_buy_treshold`).

- The signal occurs within the specified time window (between `Start Time` and `End Time`).

2. EXIT CONDITION

- A Sell Signal is generated when the current closing price exceeds the high of the previous bar (`close > high[1]`). This indicates that the price has shown strength, potentially confirming the reversal and prompting the strategy to exit the position.

█ ADDITIONAL SETTINGS

- Length: The lookback period for calculating the average high-low range. Default is 20.

- Bars Below Threshold: The number of consecutive bars the price must remain below the buy threshold to trigger a Buy Signal. Default is 2.

- IBS Buy Threshold: The IBS value below which a Buy Signal is triggered. Default is 0.2.

- Start Time and End Time: The time window during which the strategy is allowed to execute trades.

█ PERFORMANCE OVERVIEW

- This strategy is designed for mean-reverting markets and performs best when the price frequently deviates from its average high-low range.

- It is sensitive to oversold conditions, as indicated by the IBS, which helps to identify potential reversals.

- Backtesting results should be analyzed to optimize the Length, Bars Below Threshold, and IBS Buy Threshold parameters for specific instruments.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.