OPEN-SOURCE SCRIPT

MPI Burst Regime by CoryP1990 – Quant Toolkit

The Microstructure Pressure Index (MPI) Burst Regime indicator detects rare, clustered volume bursts (Percentile + Z-score), converts them into an MPI (% of bursts over a rolling window), then signals and shades short-term up-pressure regimes only when structural filters (VWMA slope, Close > VWMA / Bollinger Upper) align. Includes Anchored VWAP end-detector to spot regime neutralization.

Microstructure Pressure Index (MPI) — Burst → Cluster → Regime

Why this is different

Most volume tools flag single high-volume bars. MPI requires repeated bursts within a cluster window and then promotes them into a persistent regime (MPI%). This reduces noise and signals regime or campaign-style pressure rather than one-off spikes.

How it works

Burst gate: bar is a candidate if volume ≥ Xth percentile of recent history and/or Z-score ≥ threshold (user selectable).

Clustering: require ≥ minBursts within a clusWin window to avoid lone spikes.

MPI: percent of burst bars within lenMPI via SMA% or EMA%.

RegimeUp: MPI ≥ mpiTrig + cluster OK + structural filters (VWMA slope, Close > VW/BB) + optional session filter.

End detector: optional Session/Anchored VWAP + pin/flat/slope/volume collapse + IIP neutralization triggers regime end.

Recommended settings

Start: 5-minute charts.

Auto-tune: ON (recommended) - script adapts windows to timeframe.

If you want more sensitivity: lower mpiTrig or shorten lenMPI.

To be stricter/rarer: raise pctVol and zThr, increase minBursts.

Inputs

Auto-adapt - toggle timeframe auto-tuning.

MPI window, Percentrank lookback, Volume percentile, Z-score lookback, Z threshold, MPI trigger

Bollinger (len, mult), VWMA length

Structural filters: Close>VW, Close>UB, VWMA slope requirement

Clustering: minBursts, clusWin and SMA% / EMA% choice for MPI

Visualization: markers, shading, cooldown, confirm on close

VWAP: Session / Anchored (auto/manual) and end-detector thresholds

Alerts

Use the built-in alerts: MPI Burst Trigger (Up), MPI Regime Active (Up), MPI Regime END (VWAP), Single Burst Bar. The indicator supports “Confirm on close” gating to avoid intrabar noise.

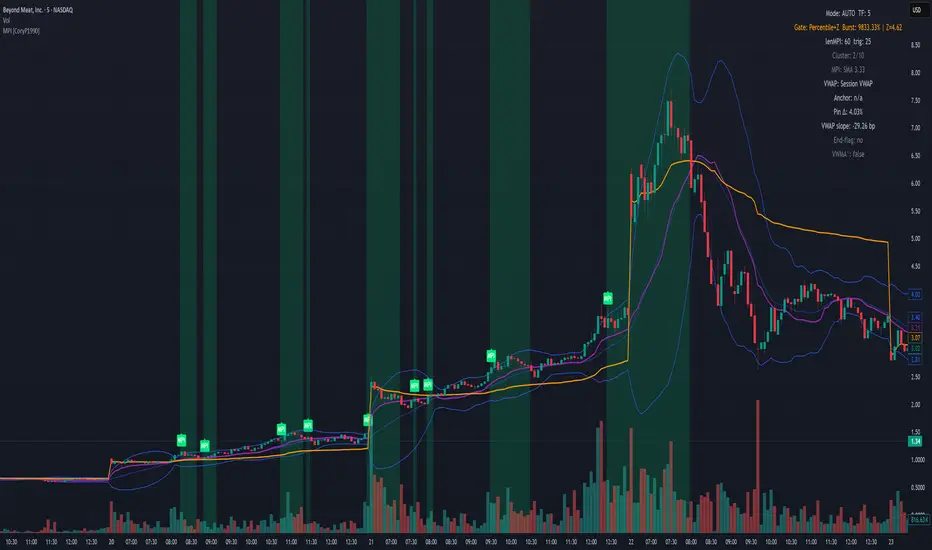

Example - (BYND, 5min)

On BYND, MPI flagged multiple clustered volume bursts hours before the vertical move and maintained a shaded up-regime as price rode the Bollinger upper band and VWMA sloped up. The regime reliably ended as VWMA flattened, volume collapsed and VWAP neutralized.

What you’re looking at (walkthrough):

Pre-run clustering: several green MPI markers appear before the large gap/rally... these are clustered percentile+Z bursts (not one-offs).

Regime persistence: once MPI% crosses the threshold and structural filters (VWMA slope, Close>VWMA) hold, the indicator shades the regime (lime). This shading persisted through the main thrust.

Price structure confirmation: price tracks the BB upper band during the push - classic accumulation → expansion behavior.

Regime END: after the top, VWMA slopes down, volume collapses and VWAP conditions trend toward neutralization - end detector flags the regime end.

Settings used in this demo (recommended start):

Chart: 5-min (demo)

Auto-Tune: ON (recommended)

lenMPI = 60, lenRank = 300, pctVol = 98, zLen = 300, zThr = 1.96, mpiTrig = 25

minBursts = 3, clusWin = 10, mpiMode = SMA%

confirmOnClose = true, session only = true for the screenshot

Why this matters:

Most volume tools flag single prints. MPI requires repeated bursts within a window and converts that density into an MPI% regime. That reduces false positives and surfaces regime or campaign-style pressure you can act upon or study.

Part of the Quant Toolkit — transparent, open-source indicators for modern quantitative analysis. Built by CoryP1990.

Microstructure Pressure Index (MPI) — Burst → Cluster → Regime

Why this is different

Most volume tools flag single high-volume bars. MPI requires repeated bursts within a cluster window and then promotes them into a persistent regime (MPI%). This reduces noise and signals regime or campaign-style pressure rather than one-off spikes.

How it works

Burst gate: bar is a candidate if volume ≥ Xth percentile of recent history and/or Z-score ≥ threshold (user selectable).

Clustering: require ≥ minBursts within a clusWin window to avoid lone spikes.

MPI: percent of burst bars within lenMPI via SMA% or EMA%.

RegimeUp: MPI ≥ mpiTrig + cluster OK + structural filters (VWMA slope, Close > VW/BB) + optional session filter.

End detector: optional Session/Anchored VWAP + pin/flat/slope/volume collapse + IIP neutralization triggers regime end.

Recommended settings

Start: 5-minute charts.

Auto-tune: ON (recommended) - script adapts windows to timeframe.

If you want more sensitivity: lower mpiTrig or shorten lenMPI.

To be stricter/rarer: raise pctVol and zThr, increase minBursts.

Inputs

Auto-adapt - toggle timeframe auto-tuning.

MPI window, Percentrank lookback, Volume percentile, Z-score lookback, Z threshold, MPI trigger

Bollinger (len, mult), VWMA length

Structural filters: Close>VW, Close>UB, VWMA slope requirement

Clustering: minBursts, clusWin and SMA% / EMA% choice for MPI

Visualization: markers, shading, cooldown, confirm on close

VWAP: Session / Anchored (auto/manual) and end-detector thresholds

Alerts

Use the built-in alerts: MPI Burst Trigger (Up), MPI Regime Active (Up), MPI Regime END (VWAP), Single Burst Bar. The indicator supports “Confirm on close” gating to avoid intrabar noise.

Example - (BYND, 5min)

On BYND, MPI flagged multiple clustered volume bursts hours before the vertical move and maintained a shaded up-regime as price rode the Bollinger upper band and VWMA sloped up. The regime reliably ended as VWMA flattened, volume collapsed and VWAP neutralized.

What you’re looking at (walkthrough):

Pre-run clustering: several green MPI markers appear before the large gap/rally... these are clustered percentile+Z bursts (not one-offs).

Regime persistence: once MPI% crosses the threshold and structural filters (VWMA slope, Close>VWMA) hold, the indicator shades the regime (lime). This shading persisted through the main thrust.

Price structure confirmation: price tracks the BB upper band during the push - classic accumulation → expansion behavior.

Regime END: after the top, VWMA slopes down, volume collapses and VWAP conditions trend toward neutralization - end detector flags the regime end.

Settings used in this demo (recommended start):

Chart: 5-min (demo)

Auto-Tune: ON (recommended)

lenMPI = 60, lenRank = 300, pctVol = 98, zLen = 300, zThr = 1.96, mpiTrig = 25

minBursts = 3, clusWin = 10, mpiMode = SMA%

confirmOnClose = true, session only = true for the screenshot

Why this matters:

Most volume tools flag single prints. MPI requires repeated bursts within a window and converts that density into an MPI% regime. That reduces false positives and surfaces regime or campaign-style pressure you can act upon or study.

Part of the Quant Toolkit — transparent, open-source indicators for modern quantitative analysis. Built by CoryP1990.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Quant finance researcher focused on options, volatility modeling, and derivative pricing. Building tools that turn complex market behavior into clear, data-driven insights. Explore analytics and modeling at OptionsAnalysisSuite.com

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Quant finance researcher focused on options, volatility modeling, and derivative pricing. Building tools that turn complex market behavior into clear, data-driven insights. Explore analytics and modeling at OptionsAnalysisSuite.com

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.