OPEN-SOURCE SCRIPT

Consolidation Range with Signals (Zeiierman)

█ Overview

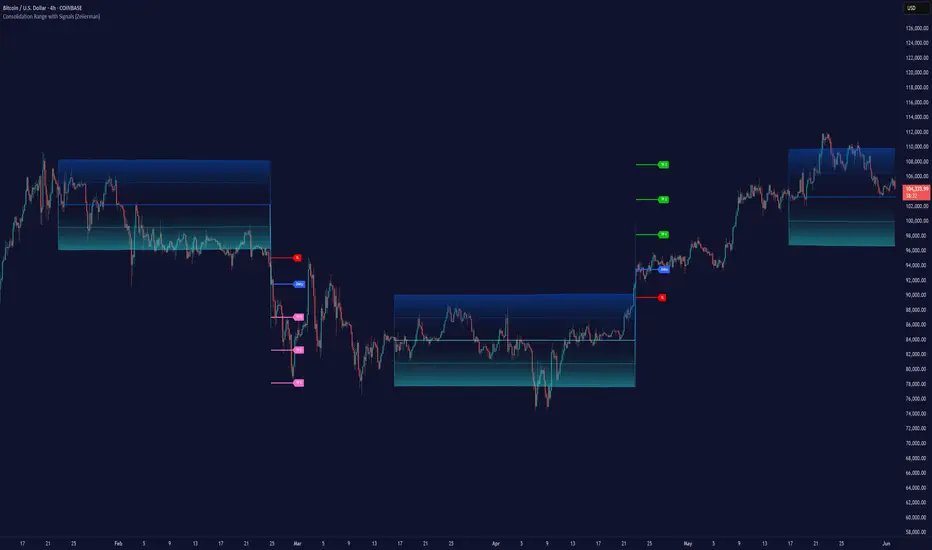

Consolidation Range with Signals (Zeiierman) is a precision tool for identifying and trading market consolidation zones, where price contracts into tight ranges before significant movement. It provides dynamic range detection using either ADX-based trend strength or volatility compression metrics, and offers built-in take profit and stop loss signals based on breakout dynamics.

Whether you trade breakouts, range reversals, or trend continuation setups, this indicator visualizes the balance between supply and demand with clearly defined mid-bands, breakout zones, and momentum-sensitive TP/SL placements.

█ How It Works

█ How to Use

⚪ Breakout Traders

Use the SL/TP signals when the price breaks above or below the range bands, especially after extended sideways movement. You can customize how far TP1, TP2, and TP3 sit from the entry using your own risk/reward profile.

⚪ Mean Reversion Traders

Use the bands to locate high-probability reversion zones. These serve as reference zones for scalping or fade entries within stable consolidation phases.

█ Settings

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Consolidation Range with Signals (Zeiierman) is a precision tool for identifying and trading market consolidation zones, where price contracts into tight ranges before significant movement. It provides dynamic range detection using either ADX-based trend strength or volatility compression metrics, and offers built-in take profit and stop loss signals based on breakout dynamics.

Whether you trade breakouts, range reversals, or trend continuation setups, this indicator visualizes the balance between supply and demand with clearly defined mid-bands, breakout zones, and momentum-sensitive TP/SL placements.

█ How It Works

⚪ Multi-Method Range Detection

ADX Mode

Uses the Average Directional Index (ADX) to detect low-trend-strength environments. When ADX is below your selected threshold, price is considered to be in consolidation.

Volatility Mode

This mode detects consolidation by identifying periods of volatility compression. It evaluates whether the following metrics are simultaneously below their respective historical rolling averages:

- Standard Deviation

- Variance

- Average True Range (ATR)

⚪ Dynamic Range Band System

Once a range is confirmed, the system builds a dynamic band structure using a volatility-based filter and price-jump logic:

- Middle Line (Trend Filter): Reacts to price imbalance using adaptive jump logic.

- Upper & Lower Bands: Calculated by expanding from the middle line using a configurable multiplier.

This creates a clean, visual box that reflects current consolidation conditions and adapts as price fluctuates within or escapes the zone.

⚪ SL/TP Signal Engine

On detection of a breakout from the range, the indicator generates up to 3 Take Profit levels and one Stop Loss, based on the breakout direction:

- All TP/SL levels are calculated using the filtered base range and multipliers.

- Cooldown logic ensures signals are not spammed bar-to-bar.

- Entries are visualized with colored lines and labeled levels.

This feature is ideal for traders who want automated risk and reward reference points for range breakout plays.

█ How to Use

⚪ Breakout Traders

Use the SL/TP signals when the price breaks above or below the range bands, especially after extended sideways movement. You can customize how far TP1, TP2, and TP3 sit from the entry using your own risk/reward profile.

⚪ Mean Reversion Traders

Use the bands to locate high-probability reversion zones. These serve as reference zones for scalping or fade entries within stable consolidation phases.

█ Settings

- Range Detection Method – Choose between ADX or Volatility compression to define range criteria.

- Range Period – Determines how many bars are used to compute trend/volatility.

- Range Multiplier – Scales the width of the consolidation zone.

- SL/TP System – Optional levels that project TP1/TP2/TP3 and SL from the base price using multipliers.

- Cooldown – Prevents repeated SL/TP signals from triggering too frequently.

- ADX Threshold & Smoothing – Adjusts sensitivity of trend strength detection.

- StdDev / Variance / ATR Multipliers – Fine-tune compression detection logic.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.