OPEN-SOURCE SCRIPT

Aggiornato Linear Mean Reversion Strategy

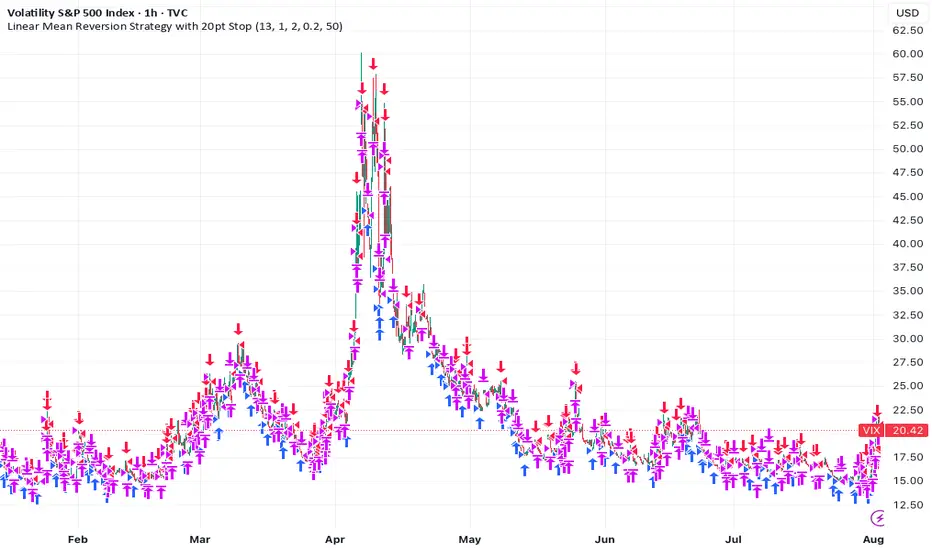

📘 Strategy Introduction: Linear Mean Reversion with Fixed Stop

This strategy implements a simple yet powerful mean reversion model that assumes price tends to oscillate around a dynamic average over time. It identifies statistically significant deviations from the moving average using a z-score, and enters trades expecting a return to the mean.

🧠 Core Logic:

A z-score is calculated by comparing the current price to its moving average, normalized by standard deviation, over a user-defined half-life window.

Trades are entered when the z-score crosses a threshold (e.g., ±1), signaling overbought or oversold conditions.

The strategy exits positions either when price reverts back near the mean (z-score close to 0), or if a fixed stop loss of 100 points is hit, whichever comes first.

⚙️ Key Features:

Dynamic mean and volatility estimation using moving average and standard deviation

Configurable z-score thresholds for entry and exit

Position size scaling based on z-score magnitude

Fixed stop loss to control risk and avoid prolonged drawdowns

🧪 Use Case:

Ideal for range-bound markets or assets that exhibit stationary behavior around a mean, this strategy is especially useful on assets with mean-reverting characteristics like currency pairs, ETFs, or large-cap stocks. It is best suited for traders looking for short-term reversions rather than long-term trends.

This strategy implements a simple yet powerful mean reversion model that assumes price tends to oscillate around a dynamic average over time. It identifies statistically significant deviations from the moving average using a z-score, and enters trades expecting a return to the mean.

🧠 Core Logic:

A z-score is calculated by comparing the current price to its moving average, normalized by standard deviation, over a user-defined half-life window.

Trades are entered when the z-score crosses a threshold (e.g., ±1), signaling overbought or oversold conditions.

The strategy exits positions either when price reverts back near the mean (z-score close to 0), or if a fixed stop loss of 100 points is hit, whichever comes first.

⚙️ Key Features:

Dynamic mean and volatility estimation using moving average and standard deviation

Configurable z-score thresholds for entry and exit

Position size scaling based on z-score magnitude

Fixed stop loss to control risk and avoid prolonged drawdowns

🧪 Use Case:

Ideal for range-bound markets or assets that exhibit stationary behavior around a mean, this strategy is especially useful on assets with mean-reverting characteristics like currency pairs, ETFs, or large-cap stocks. It is best suited for traders looking for short-term reversions rather than long-term trends.

Note di rilascio

The idea is simple: if an instrument’s price is truly mean-reverting, we can expect it to return to its long-term average. Most assets, however, behave more like random walks and show little tendency to revert. The VIX—an index of S&P 500 volatility—is a notable exception, exhibiting clear mean-reversion.

For this strategy, I’ve assumed a trading cost of 0.1%, which seems reasonable given the typical bid-ask spread on the VIX is about 0.18 points.

A z-score is calculated by comparing the current price to its moving average, normalized by standard deviation, over a user-defined half-life window.

Trades are entered when the z-score crosses a threshold (e.g., ±1), signaling overbought or oversold conditions.

The strategy exits positions either when price reverts back near the mean (z-score close to 0), or if a fixed stop loss is hit, whichever comes first.

Designed for a 1 H window, where the VIX’s mean reversion and assumed costs tend to align well.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.