OPEN-SOURCE SCRIPT

Aggiornato LANZ Strategy 7.0

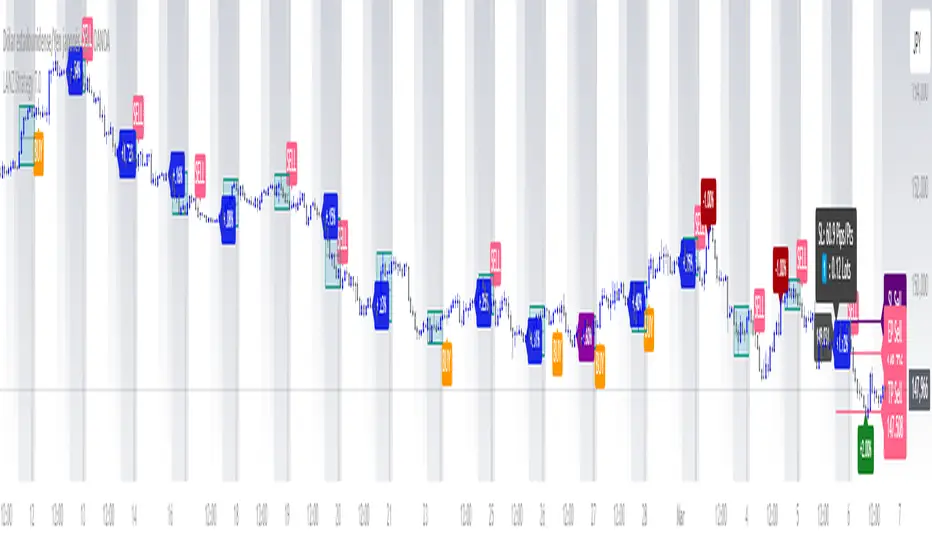

🔷 LANZ Strategy 7.0 — Multi-Session Breakout Logic with Midnight-Cross Support, Dynamic SL/TP, Multi-Account Lot Sizing & Real-Time Visual Tracking

LANZ Strategy 7.0 is a robust, visually-driven trading indicator designed to capture high-probability breakouts from a customizable market session.

It includes full support for sessions that cross midnight, dynamic calculation of Entry Price (EP), Stop Loss (SL) and Take Profit (TP) levels, and a multi-account lot sizing panel for precise risk management.

The system is built to only trigger one trade per day and manages the full trade lifecycle with automated visual cleanup and detailed alerts.

📌 This is an indicator, not a strategy — it does not place trades automatically, but provides exact entry setups, SL/TP levels, risk-based lot size guidance, and real-time alerts for execution.

🧠 Core Logic & Features

🚀 Entry Signal (BUY/SELL)

⚙️ Dynamic Stop Loss & Take Profit

⏳ Session & Midnight-Cross Support

💰 Multi-Account Risk-Based Lot Sizing

🖼️ Real-Time Visual Tracking

🔔 Alerts for Every Key Event

🧭 Execution Flow

💡 Ideal For:

👨💻 Credits:

LANZ Strategy 7.0 is a robust, visually-driven trading indicator designed to capture high-probability breakouts from a customizable market session.

It includes full support for sessions that cross midnight, dynamic calculation of Entry Price (EP), Stop Loss (SL) and Take Profit (TP) levels, and a multi-account lot sizing panel for precise risk management.

The system is built to only trigger one trade per day and manages the full trade lifecycle with automated visual cleanup and detailed alerts.

📌 This is an indicator, not a strategy — it does not place trades automatically, but provides exact entry setups, SL/TP levels, risk-based lot size guidance, and real-time alerts for execution.

🧠 Core Logic & Features

🚀 Entry Signal (BUY/SELL)

- The trading day begins with a Decision Session (yellow box) where the high/low range is recorded.

- Once the Operative Session starts (blue zone), the first touch of the session’s high triggers a BUY setup, and the first touch of the session’s low triggers a SELL setup.

- Only one valid trade can be triggered per day — the system locks after the first signal.

⚙️ Dynamic Stop Loss & Take Profit

- SL levels are derived from the Decision Session high/low using customizable Fibonacci multipliers (independent for BUY and SELL).

- TP is dynamically calculated from the EP–SL distance using a user-defined Risk:Reward ratio (R:R).

- All EP, SL, and TP levels are drawn as independent lines with customizable colors, label text size, and style.

⏳ Session & Midnight-Cross Support

- Works with any custom Decision/Operative session hours, including sessions that start one day and end the next.

- Properly tracks time zones using New York session time for consistency.

- Includes Cutoff Time: after this limit, no new entries are allowed, and all visuals are auto-cleared if no trade was triggered.

💰 Multi-Account Risk-Based Lot Sizing

- Supports up to 5 independent accounts.

- Each account can have:

- Own capital

- Own risk percentage per trade

- Lot size is auto-calculated based on:

- SL distance (in pips or points)

- Pip value (auto-detected for Forex or manually set for indices/commodities)

- Results are displayed in a clean lot size info panel.

🖼️ Real-Time Visual Tracking

- Dynamic updates to all levels during the Decision Session.

- EP, SL, TP lines update if the session high/low changes before the Operative Session starts.

- Trade result labels:

- SL hit → “–1.00%” in red

- TP hit → “+X.XX%” in green

- Manual close at Operative End → shows actual % result in blue or purple.

🔔 Alerts for Every Key Event

- Session start notification

- EP entry triggered

- SL or TP hit

- Manual close at session end

- Missed entry due to cutoff

🧭 Execution Flow

- Decision Session (Yellow) — Capture high/low range.

- Operative Session (Blue) — First touch of high = BUY setup; first touch of low = SELL setup.

- Plot EP, SL, TP lines + calculate lot sizes for all active accounts.

- Track trade until SL, TP, or Operative End.

- If no entry triggered by Cutoff Time → clean all visuals and notify.

💡 Ideal For:

- Traders who operate breakout logic on specific sessions (NY, London, Asian, or custom).

- Those managing multiple accounts with strict risk per trade.

- Anyone trading assets with sessions crossing midnight.

👨💻 Credits:

- Developer: LANZ

- Logic Design: LANZ

- Built For: Multi-timeframe session breakouts with high precision.

- Purpose: One-shot trade per day, risk consistency, and total visual clarity.

Note di rilascio

LANZ Strategy 7.0 — Multi-Method Entry Framework (7.1, 7.2, 7.3)🚀 LANZ Strategy 7.0 introduces a complete evolution of the intraday session-based system. This indicator lets you test and visualize three distinct entry philosophies within the same framework, while managing EP, SL, TP and lot size dynamically.

🔑 Core Features

- Session box detection (decision + operative) with midnight support

- Configurable Fibonacci-based SL and dynamic RR TP

- Multi-account lot size calculation (risk % per account)

- Visual labels and alerts for EP, SL, TP and results

- Clean automatic removal of lines and labels if no entry is triggered before cutoff

🧠 Entry Methods

- 7.1 First Touch → Direction is set on the first touch of the session High/Low (with tiebreak if both touched).

- 7.2 Candle Closing → Direction only confirmed when a candle closes above/below the session High/Low. EP is set at that close.

- 7.3 Directional Lock → At operative start, direction is locked depending on the last decision candle close vs 50%. Execution waits for the touch.

🎯 How to Use

Recommended timeframe: 15m or 1h (adjust session inputs accordingly).

Select your preferred entry method via input menu.

Visualize EP/SL/TP levels in real time and receive alerts when triggered.

Use multi-account panel to calculate exact lot sizes per risk.

⚠️ Note: This is an indicator, not an automated strategy. It does not execute trades, only provides structured signals and visual management tools.

Note di rilascio

🔷 LANZ Strategy 7.0 — Major Update (v7.4 Method Added)This update transforms LANZ Strategy 7.0 into a more flexible and powerful tool for intraday and overnight sessions.

🆕 What’s New?

- Added Method 7.4 (Reversal Lock): opposite to 7.3, if the box closes above 50% it looks for SELL, if it closes below 50% it looks for BUY.

- Midnight Session Support 🌙: robust handling of Asian or overnight ranges (e.g., 18:00–04:00 NY).

- Dynamic EP/SL/TP System:

- EP adapts depending on method (First Touch, Closing, Lock, or Reversal).

- SL automatically normalizes to stay outside the box.

- TP updates live based on distance (RR multiplier).

- Multi-account Risk Panel 💰: lot size calculation displayed directly in the EP-SL label (up to 5 accounts).

- Improved Alerts 🔔: real-time feedback with messages for session start, entry, SL, TP, manual close, and missed trades.

- Manual Close Result: session ends with the exact % achieved, visually labeled and stored.

This makes LANZ Strategy 7.0 an all-in-one visual framework for structured entries, adaptable across sessions and methods.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.