OPEN-SOURCE SCRIPT

Aggiornato Adaptive Fisherized ROC

Introduction

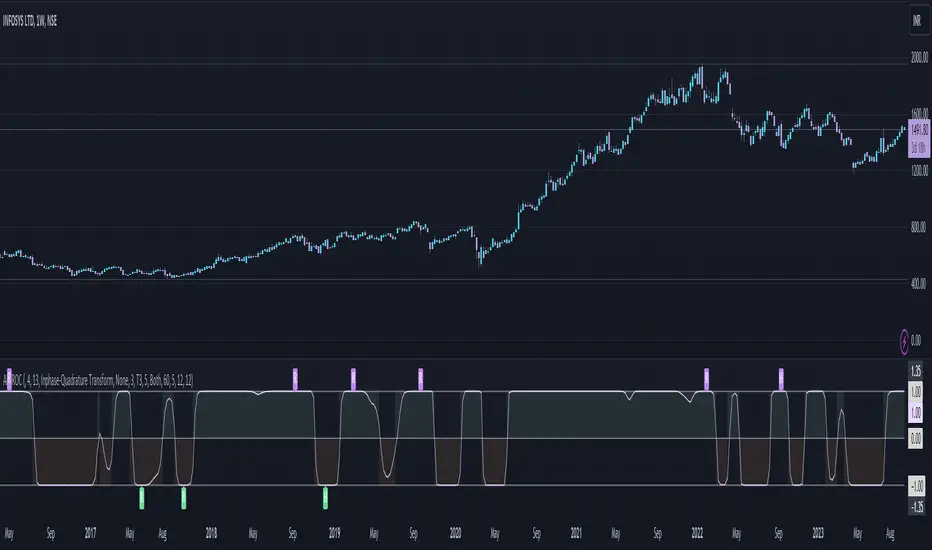

Hello community, here I applied the Inverse Fisher Transform, Ehlers dominant cycle determination and smoothing methods on a simple Rate of Change (ROC) indicator

You have a lot of options to adjust the indicator.

Usage

The rate of change is most often used to measure the change in a security's price over time.

That's why it is a momentum indicator.

When it is positive, prices are accelerating upward; when negative, downward.

It is useable on every timeframe and could be a potential filter for you your trading system.

IMO it could help you to confirm entries or find exits (e.g. you have a long open, roc goes negative, you exit).

If you use a trend-following strategy, you could maybe look out for red zones in an in uptrend or green zones in a downtrend to confirm your entry on a pullback.

Signals

ROC above 0 => confirms bullish trend

ROC below 0 => confirms bearish trend

ROC hovers near 0 => price is consolidating

Enjoy! 🚀

Hello community, here I applied the Inverse Fisher Transform, Ehlers dominant cycle determination and smoothing methods on a simple Rate of Change (ROC) indicator

You have a lot of options to adjust the indicator.

Usage

The rate of change is most often used to measure the change in a security's price over time.

That's why it is a momentum indicator.

When it is positive, prices are accelerating upward; when negative, downward.

It is useable on every timeframe and could be a potential filter for you your trading system.

IMO it could help you to confirm entries or find exits (e.g. you have a long open, roc goes negative, you exit).

If you use a trend-following strategy, you could maybe look out for red zones in an in uptrend or green zones in a downtrend to confirm your entry on a pullback.

Signals

ROC above 0 => confirms bullish trend

ROC below 0 => confirms bearish trend

ROC hovers near 0 => price is consolidating

Enjoy! 🚀

Note di rilascio

Updated default valuesFixed hilber transform calculation bug

Note di rilascio

Updated default valuesAdded min length check

Fixed Inphase-Quadrature Transform calculation

Fixed adaptive mode selection bug

Note di rilascio

Decreased lag of Hann Window smoothing by applying it to the price instead of the indicator itself.Increased linewidth and decreased transparency on background colors

Note di rilascio

Updated plotNote di rilascio

Just to update the chartNote di rilascio

- Added divergence detection

- Removed wrong Kalman filter

- Reworked smoothing system -> Now you can apply the smoothing methods on the source price (which is close[1]) or on the indicator itself depending on what your goal is with the smoothing.

Note di rilascio

Applied the IFT after the smoothing to stick to the scale of -1 to 1Note di rilascio

Removed 34 as max length of Homodyne DiscriminatorNote di rilascio

Fixed that T3 Normal wasn't selectale.Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.