OPEN-SOURCE SCRIPT

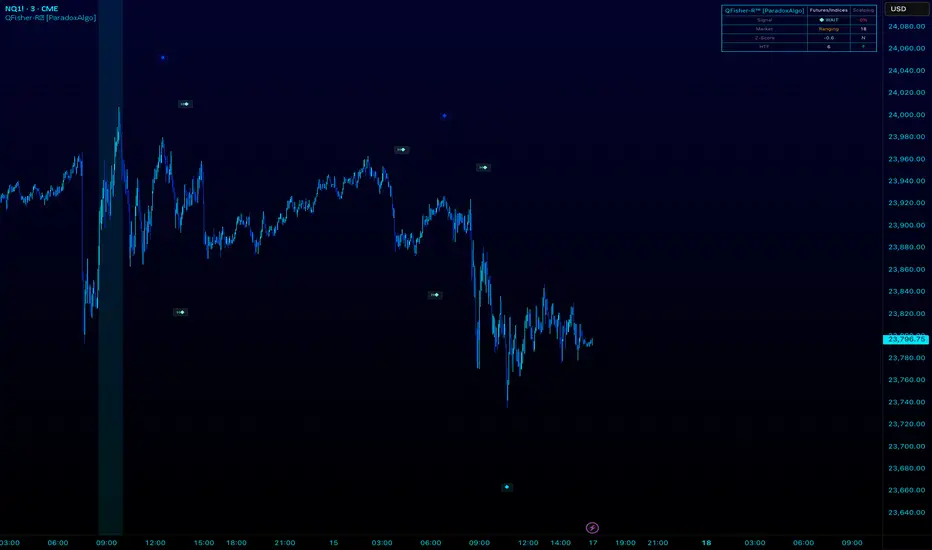

QFisher-R™ [ParadoxAlgo]

QFISHER-R™ (Regime-Aware Fisher Transform)

A research/education tool that helps visualize potential momentum exhaustion and probable inflection zones using a quantitative, non-repainting Fisher framework with regime filters and multi-timeframe (MTF) confirmation.

What it does

Converts normalized price movement into a stabilized Fisher domain to highlight potential turning points.

Uses adaptive smoothing, robust (MAD/quantile) thresholds, and optional MTF alignment to contextualize extremes.

Provides a Reversal Probability Score (0–100) to summarize signal confluence (extreme, slope, cross, divergence, regime, and MTF checks).

Key features

Non-repainting logic (bar-close confirmation; security() with no lookahead).

Dynamic exhaustion bands (data-driven thresholds vs fixed ±2).

Adaptive smoothing (efficiency-ratio based).

Optional divergence tags on structurally valid pivots.

MTF confirmation (same logic computed on a higher timeframe).

Compact visuals with subtle plotting to reduce chart clutter.

Inputs (high level)

Source (e.g., HLC3 / Close / HA).

Core lookback, fast/slow range blend, and ER length.

Band sensitivity (robust thresholding).

MTF timeframe(s) and agreement requirement.

Toggle divergence & intrabar previews (default off).

Signals & Alerts

Turn Candidate (Up/Down) when multiple conditions align.

Trade-Grade Turn when score ≥ threshold and MTF agrees.

Divergence Confirmed when structural criteria are met.

Alerts are generated on confirmed bar close by default. Optional “preview” mode is available for experimentation.

How to use

Start on your preferred timeframe; optionally enable an HTF (e.g., 4×) for confirmation.

Look for RPS clusters near the exhaustion bands, slope inflections, and (optionally) divergences.

Combine with your own risk management, liquidity, and trend context.

Paper test first and calibrate thresholds to your instrument and timeframe.

Notes & limitations

This is not a buy/sell signal generator and does not predict future returns.

Readings can remain extreme during strong trends; use HTF context and your own filters.

Parameters are intentionally conservative by default; adjust carefully.

Compliance / Disclaimer

Educational & research tool only. Not financial advice. No recommendation to buy/sell any security or derivative.

Past performance, backtests, or examples (if any) are not indicative of future results.

Trading involves risk; you are responsible for your own decisions and risk management.

Built upon the Fisher Transform concept (Ehlers); all modifications, smoothing, regime logic, scoring, and visualization are original work by Paradox Algo.

A research/education tool that helps visualize potential momentum exhaustion and probable inflection zones using a quantitative, non-repainting Fisher framework with regime filters and multi-timeframe (MTF) confirmation.

What it does

Converts normalized price movement into a stabilized Fisher domain to highlight potential turning points.

Uses adaptive smoothing, robust (MAD/quantile) thresholds, and optional MTF alignment to contextualize extremes.

Provides a Reversal Probability Score (0–100) to summarize signal confluence (extreme, slope, cross, divergence, regime, and MTF checks).

Key features

Non-repainting logic (bar-close confirmation; security() with no lookahead).

Dynamic exhaustion bands (data-driven thresholds vs fixed ±2).

Adaptive smoothing (efficiency-ratio based).

Optional divergence tags on structurally valid pivots.

MTF confirmation (same logic computed on a higher timeframe).

Compact visuals with subtle plotting to reduce chart clutter.

Inputs (high level)

Source (e.g., HLC3 / Close / HA).

Core lookback, fast/slow range blend, and ER length.

Band sensitivity (robust thresholding).

MTF timeframe(s) and agreement requirement.

Toggle divergence & intrabar previews (default off).

Signals & Alerts

Turn Candidate (Up/Down) when multiple conditions align.

Trade-Grade Turn when score ≥ threshold and MTF agrees.

Divergence Confirmed when structural criteria are met.

Alerts are generated on confirmed bar close by default. Optional “preview” mode is available for experimentation.

How to use

Start on your preferred timeframe; optionally enable an HTF (e.g., 4×) for confirmation.

Look for RPS clusters near the exhaustion bands, slope inflections, and (optionally) divergences.

Combine with your own risk management, liquidity, and trend context.

Paper test first and calibrate thresholds to your instrument and timeframe.

Notes & limitations

This is not a buy/sell signal generator and does not predict future returns.

Readings can remain extreme during strong trends; use HTF context and your own filters.

Parameters are intentionally conservative by default; adjust carefully.

Compliance / Disclaimer

Educational & research tool only. Not financial advice. No recommendation to buy/sell any security or derivative.

Past performance, backtests, or examples (if any) are not indicative of future results.

Trading involves risk; you are responsible for your own decisions and risk management.

Built upon the Fisher Transform concept (Ehlers); all modifications, smoothing, regime logic, scoring, and visualization are original work by Paradox Algo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.